Interest rates: Force banks to offer mortgage help, says Labour

- Published

- comments

Rachel Reeves says lenders must offer a full range of support

The government should force banks to help homeowners struggling with mortgage payments, Labour has said.

Shadow chancellor Rachel Reeves said borrowers should be allowed to switch to interest-only payments for a temporary period to ease the crisis.

Many lenders are already offering this but Labour says it needs to be enforced across the board.

However, Ms Reeves said major financial support for mortgages was not a good idea as this could fuel price rises.

She told the BBC Radio 4's Today programme "a big fiscal injection of cash into the economy, especially an untargeted injection, would not be the right approach".

Labour's announcement came ahead of interest rates rising by more than expected, from 4.5% to 5%, as the Bank of England seeks to tame soaring prices.

It means mortgage-holders are facing further rises in payments.

Raising interest rates makes it more expensive to borrow money and theoretically encourages people to borrow less and spend less, meaning price rises should ease.

Ms Reeves said Labour's plan "to ease the Tory mortgage penalty offers practical help now, while our commitment to fiscal responsibility and growth will secure our economy for the future".

Chancellor Jeremy Hunt is meeting bank chiefs again on Friday to see what additional help they can give. He has already urged lenders to offer the measures which Labour wants to make mandatory.

He is coming under pressure for the government to step in with Covid-style financial help for households.

But he has rejected calls by Tory backbenchers Sir Jake Berry and Jonathan Gullis to bring back a tax break that would cut monthly payments.

He told MPs: "Those kind of schemes, which involve injecting large amounts of cash into the economy, would be inflationary."

The government has also rejected a Liberal Democrat plan for grants of up to £300 a month for homeowners on "the lowest incomes" whose mortgage payments rise by more than 10% of their income.

The party says its scheme would last for one year, funded by increasing taxes on bank profits.

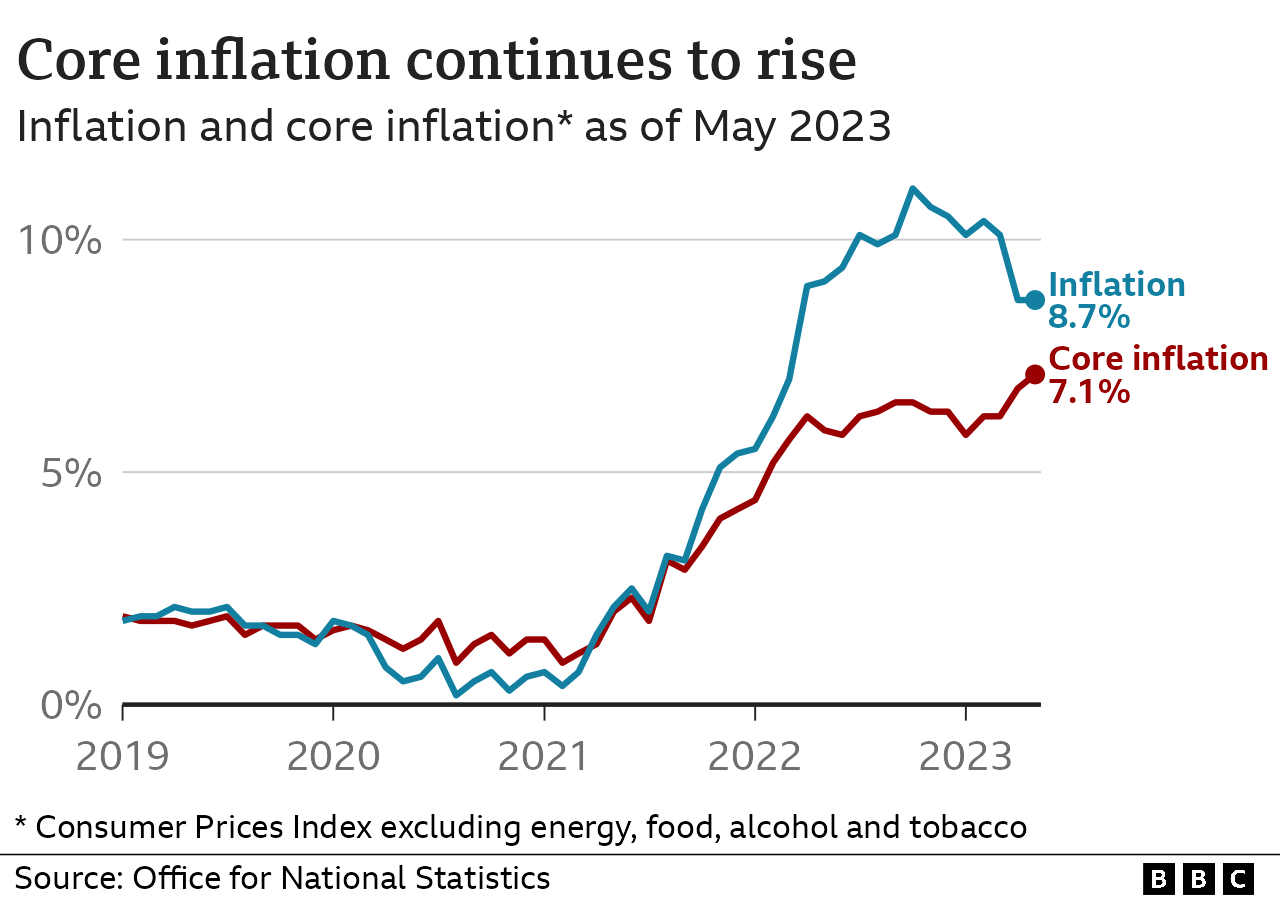

Downing Street insists Rishi Sunak is on course to meet his target of halving inflation - the rate prices are rising - this year, even though the rate remains stubbornly high at 8.7%.

Speaking at an event on Thursday, the prime minister is expected to say he feels a "deep moral responsibility" to lower inflation, adding: "I'm completely confident that if we hold our nerve, we can do so."

However, Foreign Secretary James Cleverly admitted "not all the levers of control are in the government's hands", with the independent Bank of England responsible for setting interest rates, one of the main tools to tackle inflation.

Instead, Mr Cleverly told the BBC the government was doing things like being cautious on offering big public sector pay increases and being conscious that increased government borrowing could fuel inflationary pressures.

Labour's plan includes guaranteeing that relief measures such as temporary interest-only payments and extending the time period for paying back mortgages are available.

The party is also calling for a six-month grace period for homeowners threatened with repossession as well as guarantees that credit scores will not be affected by asking for help.

Labour says the government should order regulator the Financial Conduct Authority to require lenders to offer all these options.

The Centre for Policy Studies, a Conservative-linked think tank, said there could be "big unintended consequences" from the proposals.

"Labour's plan mostly 'requires' lenders to do a variety of things they will already be doing voluntarily," said Tom Clougherty, the think tank's research director.

"To the extent that it forces banks to offer greater cross-subsidies to particular customers, it is bound to raise costs for other borrowers - or prevent necessary adjustments in the mortgage market," he added.

"A legislated, one-size-fits-all approach is bound to cause as many problems as it solves."

In a statement, UK Finance, which represents the banking and finance industry, said: "Over the last year, lenders have helped nearly 200,000 borrowers who cannot meet their full mortgage payments by providing tailored forbearance.

"This could be a period of reduced payments, a period of zero payments or a temporary switch to interest-only.

"Contacting your lender to find out the options available won't impact your credit score, but missing payments will."

Related topics

- Published22 June 2023

- Published21 June 2023

- Published9 January 2024

- Published18 June 2023