Rishi Sunak: The time has come to cut tax

- Published

- comments

The PM says taxes can only be cut when inflation is under control and "that promise has now been met"

Prime Minister Rishi Sunak has said the government is now able to cut taxes, after the pace of price rises eased.

Mr Sunak said his target of halving inflation had been met so taxes would be reduced in "a responsible way".

He refused to comment on "speculation" about changes to individual taxes and said there would be more details in Wednesday's Autumn Statement.

But the PM said the government could now move to "the next phase" of its plan to grow the economy.

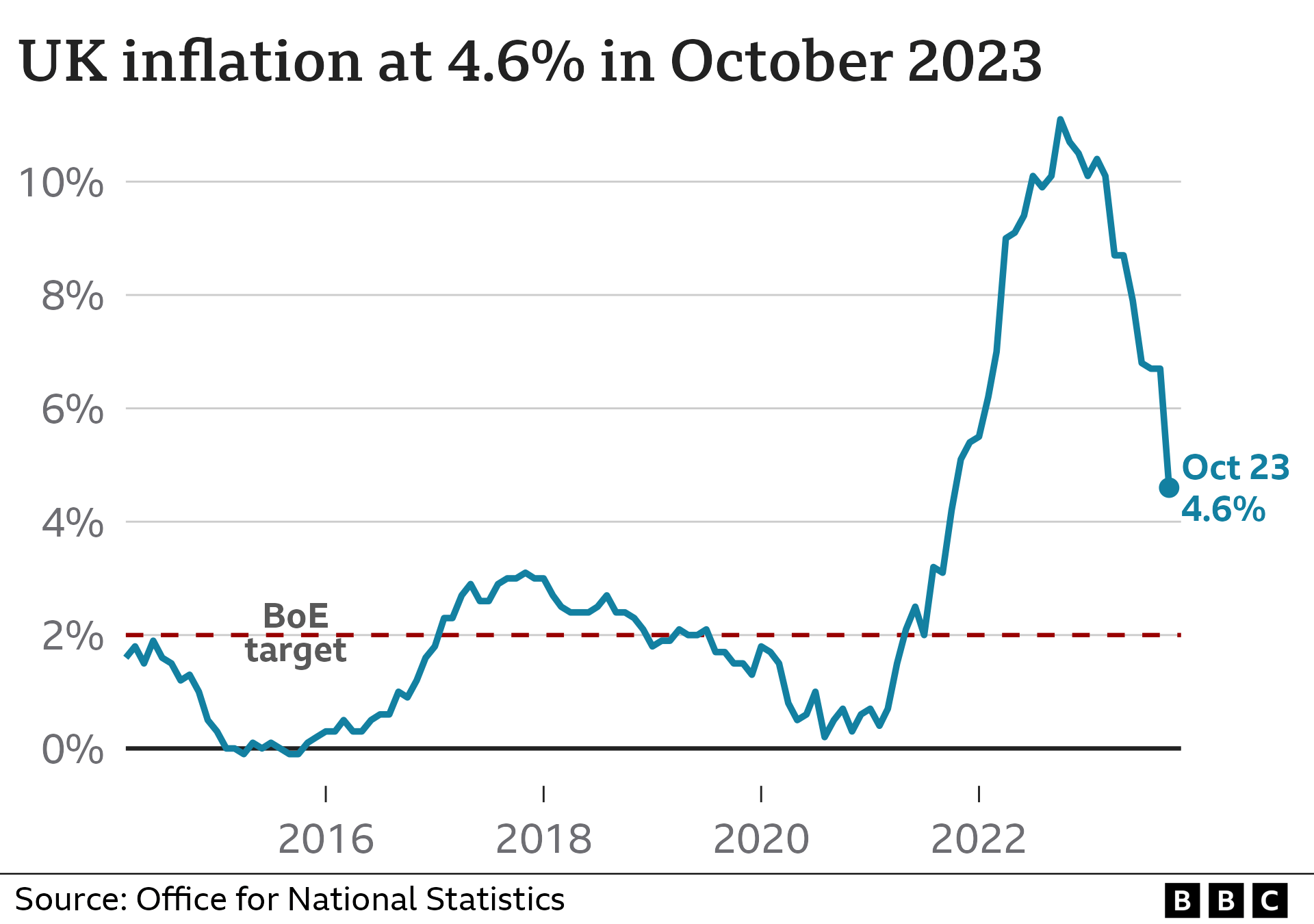

Last week the government said it had met its pledge to halve inflation - the rate prices are rising - after the figure fell sharply to 4.6% in October.

The decrease was largely due to lower global energy prices, so there is a limit to how much credit ministers can take.

However, Mr Sunak said the government had taken "difficult decisions", including avoiding inflationary pay rises in response to strikes, to deliver on its pledge.

"That's why we can now can move on to the next phase of our economic plan and turn our attention to cutting taxes," he said.

"We will do so seriously, we will do so responsibly, but that time is now here."

Tax levels in the UK are at their highest since records began 70 years ago, according to the Institute for Fiscal Studies think tank.

With the Conservatives trailing in the polls, the government has been under pressure from many of its own MPs to cut taxes ahead of a general election, which is expected next year.

In a speech at a London college, Mr Sunak acknowledged "we can't do everything all at once".

"It will take discipline and we need to prioritise," he said. "But over time, we can and we will cut taxes."

His comments all but confirmed tax cuts are coming in Wednesday's Autumn Statement, when the chancellor sets out the government's tax and spending plans for the year ahead.

The prime minister would not confirm where exactly tax cuts would be made.

Welfare changes

However, Mr Sunak said he wanted to focus on "rewarding hard work", which would suggest national insurance as the likeliest candidate.

He also stressed the need to avoid doing anything which could fuel inflation.

In a reference to his predecessor Liz Truss, who beat him in the Conservative leadership election in the summer of 2022, he pledged not to make "the same economic mistake as last year's mini-budget" and warned against "unfunded tax cuts".

On benefits, he said he wanted to "reform" the welfare system so "work always pays".

This could mean increasing benefit payments by October's inflation figure of 4.6%, rather than September's higher figure of 6.7% as is convention.

Mr Sunak said he would not "pre-empt" any announcements on Wednesday, but added that the welfare system should be "compassionate, fair and sustainable".

In his speech, the prime minister promised to do more to help people into work, as well as to "clamp down on welfare fraudsters".

The government has already announced that claimants who are deemed fit to work and refuse to seek employment would lose access to their benefits for a period.

While Chancellor Jeremy Hunt had considered cutting inheritance tax, sources said the focus of the Autumn Statement would be to promote growth - on which inheritance tax has minimal impact. Mr Hunt is likely to return to the issue for his Budget in the spring.

There is also expected to be a focus on business taxes as cutting them is seen as key to helping the economy to grow.

On support for businesses, the prime minister said he wanted to help companies to "invest, innovate and grow through lower taxes and simpler regulation".

In his speech Mr Sunak set out "five long-term decisions" for the economy - reducing debt, cutting tax, building sustainable energy, backing British businesses and delivering world-class education.

Labour's shadow chancellor of the Duchy of Lancaster Pat McFadden said: "The Tories have failed to deliver on so many pledges from the past. Why should people believe they will deliver on pledges for the future?"

"After thirteen years of Conservative governments, working people have been left worse off and the Conservative economic record lies in tatters," he added.

The Liberal Democrats accused the government of "de-prioritising the NHS" and failing to understand "the link between a better health service and a stronger economy".

The party has argued higher-than-expected tax receipts should go towards a "rescue package" for the NHS.

Less than two months ago, Chancellor Jeremy Hunt had warned tax cuts this autumn would be "virtually impossible".

However, inflation has come down faster than some in government feared it might and tax receipts have also been higher than expected.

This is partly a result of many people being dragged into higher tax brackets as a result of inflation and the freeze on personal tax thresholds - and means the government could have as much as £25bn to use for tax cuts.

Government sources expect those thresholds to remain frozen despite Conservative MPs' complaints about this "fiscal drag".

Related topics

- Published20 November 2023

- Published20 November 2023

- Published20 November 2023

- Published22 November 2023