Hunter becomes the hunted

- Published

- comments

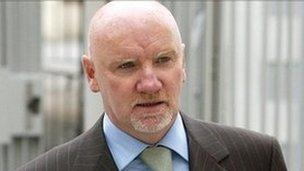

Sir Tom Hunter invested more than £7m in USC last year

It's been a tough few years for Scotland's entrepreneurial poster boy, Sir Tom Hunter, as his investments in retail and property have come under intense pressure.

Those were not good sectors to be in, and it didn't help that he was one of those closest to the spree-lending Peter Cummings at Bank of Scotland Corporate.

Housebuilder Crest Nicholson and care home builder McCarthy and Stone already burned a large hole in Hunter's West Coast Capital, as did Wyevale garden centres.

In the retail part of his empire, the USC fashion chain has caused him more pain than most, being pitched into administration at the end of 2008 - and immediately being bought out of it in a pre-pack deal that left Sir Tom with 43 stores.

Now, he's sold an 80% stake in the chain to Mike Ashley at Sports Direct, also owner of Newcastle United football club. That's along with a similar stake in Cruise, the upmarket fashion chain Hunter bought out of administration at the end of last year.

Extraordinary turbulence

Sir Tom's receiving £7m in cash for the 80% stake, having invested more than that in USC last year alone.

And with £20m to be invested in USC and Cruise, he's saying that the deal will provide stability for the chains at a time of "extraordinary turbulence on the High Street".

So unlike his sale of the Office chain last year, the Sports Direct deal does not look like one Sir Tom's done from a position of strength.

His loss is also philanthropy's loss, as he had hoped to give away a billion pounds - much of it for African development - in concert with former US President Bill Clinton.

Although West Coast Capital returned to profit last year, it did so after colossal losses through write-downs in the early stages of the recession.

Sir Tom has said he still wants to donate a billion, but it might take rather longer than he had planned before that money is available.