Daily question: How much does Scotland pay in tax and how much does it spend?

- Published

As the people of Scotland weigh up how to vote in the independence referendum, they are asking questions on a range of topics.

In this series, we are looking at those major questions and by using statistics, analysis and expert views shining a light on some of the possible answers.

Here we look at taxes and find out how much Scotland pays and how much it spends.

Do you have a referendum question? Let us know by....

Emailing newsonlinescotland@bbc.co.uk.

We can also be found on Twitter @bbcscotlandnews, external

And on Facebook, external.

BBC news website users, including Alan McNulty, Bob Farquharson, Sya Simpson, Scott Morrison, Ian Metcalfe, Robert Donald, Angus Armstrong and Nigel Laws, have asked a variety of questions about tax.

How much does Scotland pay in taxes and how much does it spend?

This is a question which has dominated Scottish political debate for decades, fuelling resentment on both sides of the border.

And the truth is complicated by two factors, oil and debt.

Scotland's tax conundrum

In 2012-13

£53bn

Tax revenue generated by Scotland

-

9.1% of UK tax revenue came from Scotland

-

8.3% of the UK population live in Scotland

-

£10,000 tax per head in Scotland

-

£9,200 tax per head, rest of UK

Or to put it another way, for every person in Scotland last year, the exchequer received £800 more than the UK average.

And that gap is not new. The Scottish government has produced experimental statistics, external suggesting that Scottish tax receipts have been higher than the UK average in every one of the past 33 years.

Of course all of these statistics rely on certain assumptions and one in particular makes a big difference.

The figures for 2012/13 assume that 84.2% of taxes from UK oil and gas accrued to Scotland, a geographic share calculated by experts from the University of Aberdeen, external based on the existing North Sea fisheries boundary.

Allocate the oil on a population basis (8.3% rather than 84.2%) and Scotland's tax receipts for 2012/13 were £48.1bn (rather than £53.1bn), equivalent to 8.2% of the UK total tax take.

Strip out the oil altogether and they were £47.6bn, also around 8.2% of the UK total.

Scotland, remember, has 8.3% of the UK population.

And what about spending?

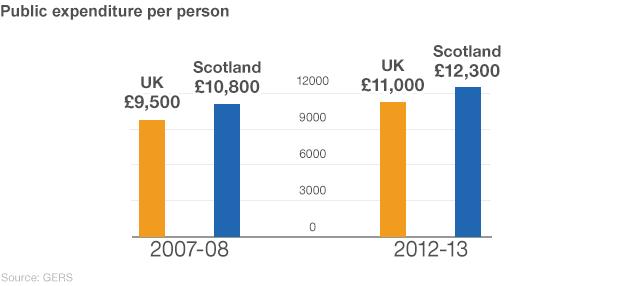

But of course taxation is only part of the story. When it comes to spending, Scotland is above average.

In 2012/13 total public spending in Scotland, external was estimated to be £65.2bn, or 9.3% of total UK spending, with a population of 8.3%.

This figure takes into account a share of spending by UK government departments, including benefits payments, as well as a population-based slice of interest payments on the UK national debt.

So, even by the most generous measure, Scotland raised £53.1bn in 2012/13 and spent £65.2bn, leaving the country £12.1bn short.

In the same period, the UK had a shortfall of £117.4bn.

According to the Treasury, public spending in Scotland is higher than anywhere else in the UK apart from Northern Ireland. Explanations have included Scotland's relative sparseness and its poor health.

But if Scotland is spending beyond its means - and clearly it is - then so too is the UK.

Both are running a deficit, the difference between the money a country raises in taxes and the amount it spends and invests.

The latest comprehensive snapshot concluded that Scotland was running a larger deficit as a percentage of economic output than the UK average.

Deficits compared

Net fiscal balance

-

Scotland (including geog. share of oil revenue, 2012-13) £12.1bn

-

UK (including 100% of oil revenue, 2012-13) £114.8bn

-

Scotland (2011-12) £8.6bn

-

UK (2011-12) £117.4bn

We can see that Scotland's deficit increased sharply between 2011/12 and 2012/13, up by £3.5bn. Excluding oil revenue, Scotland's deficit would have been considerably higher in 2012/13 at £17.6bn, or 14% of GDP.

But this has been unusual. In recent years, Scotland has actually been running a smaller deficit as a percentage of GDP than the UK average.

Why is this?

Again, it comes down to oil. The year 2012/13 was a particularly unflattering one for the Scottish economy because of what might be called an "oil shock", a dramatic fall in tax revenue from the UK continental shelf.

This was blamed on the North Sea industry's worst leak for 20 years which cut production in Total's Elgin-Franklin field, along with particularly high levels of investment eating into profits and therefore taxes.

Such a spectacular change underlines the difficulty in predicting with any certainty future revenues from oil and gas.

Campaigners for independence say Scotland's underlying economy is strong and oil is a bonus. Supporters of the union say an independent Scotland would be dangerously reliant on one volatile resource.

Either way, reducing borrowing without hiking taxes or cutting services will remain a big challenge, whether Scotland votes "Yes" or "No" in the referendum.