Scottish Budget: The reaction in quotes

- Published

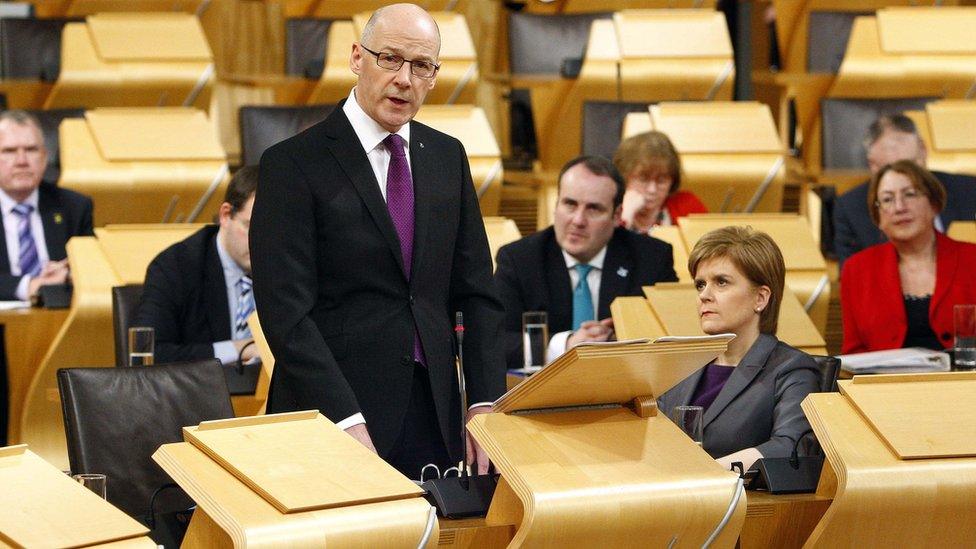

The Scottish Finance Secretary John Swinney has presented his plan for the budget.

This is only the second budget in which the Scottish Finance Secretary has been able to decide tax rates.

Murdo Fraser, Scottish Conservative finance spokesman

"The finance secretary has chosen to set the Scottish rate of income tax at the same level as elsewhere in the UK.

"We applaud this decision - we do not believe that hard-pressed families in Scotland should pay higher taxes than those elsewhere in Britain."

Jackie Baillie, Scottish Labour public services and wealth creation spokeswoman

"This is the most important budget since devolution, delivered by a party who promised to stand up for Scotland against Tory austerity.

"But it doesn't deliver fairer taxes, a long term plan for Scotland or an anti-austerity alternative. Local services like our schools, roads and care of the elderly will face massive cuts."

Willie Rennie, Scottish Liberal Democrat leader

"The deputy first minister has spent his entire political life campaigning for more tax powers. And what does he do when he gets them? The answer is nothing, no change, same rate and the same as in England.

"John Swinney cannot tell Scotland that he is rejecting austerity when he is not raising a penny more even though he has the new tax powers to do something about it.

Patrick Harvie, finance spokesperson for the Scottish Greens

"The decision to keep the Scottish rate of income tax the same as the UK makes sense as this devolved power does not allow a more progressive approach."

Councillor David O'Neill, Cosla president

"A cut of 3.5% is catastrophic for jobs and services within Scottish local government - because the harsh reality is that it actually translates to real job cuts that hit real families, in real communities throughout Scotland. Everyone will be hurt by this."

Andy Willox, Scottish policy convenor of the Federation of Small Businesses

"FSB has pushed hard for the reform of the out of date Scottish business rates system. Mr Swinney must be applauded for grasping this thistle and promising to deliver a tax more appropriate for the 21st century.

"Communities and businesses need help to get back on their feet. This welcome support must see local firms getting their fair share."

Ian McDougall, of Business for Scotland

"The UK has for some time lagged behind our European partners in terms of productivity levels and we are delighted that the Scottish government will continue to invest heavily in the main areas that can increase productivity, namely digital infrastructure, transport and a continued investment in the innovation sector."

Mary Alexander, deputy Scottish secretary of Unite

"The debate on the future of local government should dominate the forthcoming election campaign because we can't wait until after May to see how hard and fast the axe is going to fall.

"We have two options to try and sustain jobs and services - centralisation or local democracy. John Swinney has indicated that over the lifetime of the next parliament his party would lean towards the former so we need to know what the impact will be.

Alex McLuckie, regional officer of GMB Scotland

"GMB Scotland find this budget predictable. It is the same recipe as previous budgets which have seen local government take the brunt of the cuts to budgets. Yet again services to the less fortunate within society will be under real threat. Despite the statement from the Scottish government about health, education and social work being protected every area will be affected by this budget.

David Lonsdale, director of the Scottish Retail Consortium

"We are delighted that the Scottish government has listened to the retail industry and the growing chorus from across business and commercial life in Scotland who have spoken up in favour of fundamental reform of business rates, and we very much welcome the promised review of business rates."

"The hike in the large firms rates supplement is concerning, and it now appears that larger firms operating in Scotland will be paying more in business rates than firms operating in comparable premises down south."

Ian McCall, tax partner at Deloitte in Scotland

"The Scottish government may have decided to remain with the status quo for its Scottish rate of income tax, but there are still important changes which both individuals and businesses need to prepare for ahead of next April.

"As Her Majesty's Revenue and Customs (HMRC) looks to define those liable to pay the SRIT, individuals should be proactive in making sure that HMRC has up-to-date information about their circumstances - it's possible that it doesn't have your most recent address, for example. This can be done through the HMRC website or by phoning the Revenue; employers cannot do this on behalf of their employees.

John Blackwood, chief executive of the Scottish Association of Landlords

"Landlords will be disappointed and frustrated by the decision by the finance secretary this afternoon to copy the policy of the Conservative party at Westminster and punish those who choose to invest in the private rented sector.

"Reducing investment will only lead to less being spent on improving housing stock across Scotland and create a space for rogue landlords and letting agents who operate outside of the high standards that the overwhelming majority of the sector are rightly held to."

Adam Lang, head of communications and policy at Shelter Scotland

"We welcome the additional investment of £90m for affordable housing in this budget bringing next year's budget to £690m.

"The increase in the Land and Building Transaction Tax for second homes is also welcome news, as is the continued commitment to fund mitigation of the Bedroom Tax."

Ashley Campbell, policy and practice officer at Chartered Institute of Housing Scotland

"We welcome the Scottish government's commitment to increase the budget for affordable housing by £90m in 2016-17. For the benefits of this increased investment to be fully realised, this will need to be matched with action to address issues around land supply, infrastructure and construction skills.

"We welcome proposals to increase land and buildings transaction tax for second homes and buy-to-let properties but would like to see more details of where the additional revenue raised will be invested. Our preference would be for these funds to be re-invested towards increasing housing supply."

Stephanie Niven, associate director for employment solutions at Grant Thornton

"While it's welcome news that the finance secretary has clarified what the Scottish rate of income tax will be for now, there is still a great deal of uncertainty amongst business leaders and their employees around what changes they must make in relation to this matter.

Vonnie Sandlan, president of NUS Scotland

"It's clear that students are in desperate need of fairer funding, and this budget could go further in addressing that, with no proposals to improve the student support system and cash cuts for universities.

"It's really good to see a recognition of the importance of our colleges, and continued protection of their budget, but college students are still left with uncertainty of whether they'll have enough money to live on."

Lloyd Austin, head of conservation policy at RSPB Scotland

"The draft budget does not propose any significant cuts to environmental spend which is some comfort. However, the budget for agri-environment measures remains static and insufficient to halt the loss of biodiversity. In addition funding for SNH is cut by £5m and for SEPA by £2.5m. This continued salami slicing threatens the ability of the agencies to deliver.

- Published16 December 2015

- Published16 December 2015

- Published13 December 2015