Scottish budget: No change in Scottish income tax rate

- Published

- comments

The finance secretary John Swinney has ruled out an increase in Scottish income tax when Holyrood gets new financial powers next year.

Mr Swinney made the announcement as he unveiled his draft budget to MSPs in the Scottish Parliament.

He also announced a tax rise on many second homes and buy-to-let properties through a Land and Buildings Transaction Tax levy.

And Mr Swinney confirmed that the council tax freeze would continue.

The finance secretary warned that the Scottish budget was set to continue to reduce in real terms until the end of the decade, as he said it had done since 2010.

Opposition parties claimed that Mr Swinney was "following where the Conservatives lead" and that his budget would result in "massive cuts" to local services such as schools, roads and care of the elderly.

And local authority body Cosla warned that funding going to Scotland's 32 councils had been cut by 3.5% - meaning they would lose out on £350m between them.

Holyrood will be given limited powers over income tax rates next April under the 2012 Scotland Act, which was passed under the previous UK coalition government.

It will see the Treasury deduct from the Scottish block grant a sum equivalent to the product of 10p worth of income tax north of the border.

Mr Swinney then had the option of setting a Scottish Rate of Income Tax (SRIT) which could either be lower, higher or the same as the 10p that has been deducted.

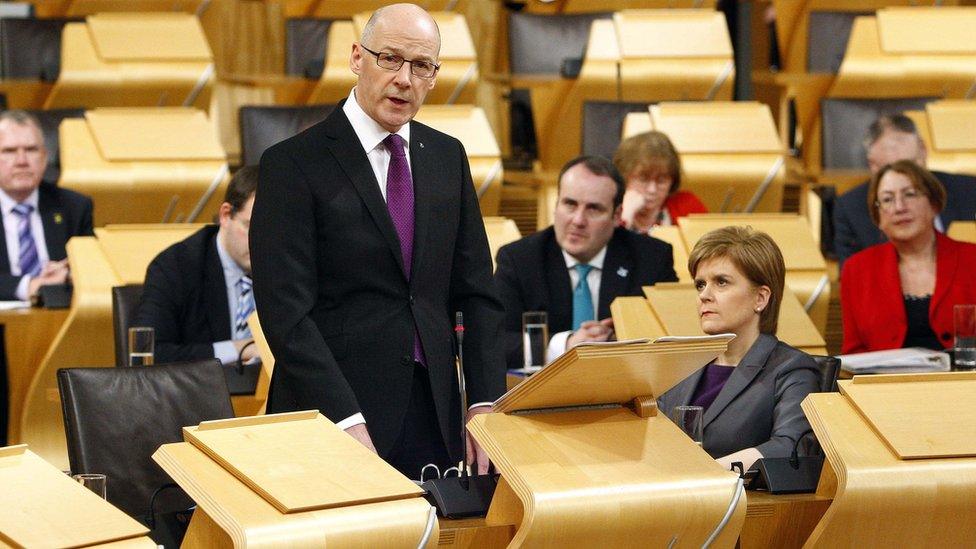

Finance Secretary John Swinney says the Scottish rate of income tax will remain the same as he sets out the draft budget for 2016-17

The finance secretary told the Holyrood chamber: "I propose that the Scottish Rate of Income Tax will be set at 10p in the pound - the rate people pay this year will be the same rate that they will pay next year.

"I hope that from 2017/18 this parliament will have more flexibility in setting income tax rates. However, that will depend on reaching agreement on a new fiscal framework and final passage of the Scotland Bill."

Among the other measures proposed by Mr Swinney were:

A new 3% Land and Buildings Transaction Tax levy on the purchase of many second homes from April 2016

£200m to be invested over the next five years in six new NHS treatment centres

Total revenue funding for local government of £9.5bn - which Cosla says amounts to a 3.5% cut

A commitment to increase free childcare for three and four-year-olds to 1,140 hours per year in the next parliament

College funding to be protected, and commitment to free tuition to continue

£33m for a school attainment programme as part of plans to close the attainment gap between the wealthiest and most deprived pupils

Council tax to be frozen for the ninth consecutive year

Work to begin on construction of the Dalry by-pass in Ayrshire and improvements to the Haudagin roundabout in Aberdeen

An additional £55m for Police Scotland, which follows criticism of the effect of merging the eight regional forces into a single national force

An extra £45m next year to fund improvements and develop new models of primary health care

An increase of £90m in the budget for affordable housing for next year

£4m for south of Scotland flood relief

A review of the business rates system to be launched

Greater controls over income tax are among the measures contained in the Scotland Bill which is currently being scrutinised by Westminster, but these will not come into force until 2017 at the earliest.

Mr Swinney said that the Scottish government aimed to set out its longer-term plans on income tax ahead of the dissolution of the Scottish Parliament in March of next year.

He said that the Scottish government's aim was to focus on tackling inequality and boosting productivity in order to "create the foundations for a stronger and more inclusive economy".

But he said that would need to be delivered within a "significantly constrained" public spending environment.

Opposition parties in Holyrood criticise the draft budget 2016-17 for glossing over cuts and not doing more to tackle austerity

Mr Swinney added: "By 2020 our budget will be 12.5% lower in real terms than when the Conservatives came to power. That is the equivalent of one pound in every eight that we spend being cut by Westminster by 2020."

He said that Land and Buildings Transaction tax, which replaced the stamp duty charge on property sales in Scotland, will remain the same for most transactions.

But he added: "The exception to this is for buyers purchasing an additional residential property - such as a second home or a buy-to-let - worth more than £40,000, who will face an additional charge of 3% of the value.

Mr Swinney said this was "proportionate and fair", adding the new levy "seeks to ensure that the opportunities for first-time buyers to enter the housing market in Scotland remain as strong as they possibly can be".

Spending on Scotland's NHS

£13bn

for 2016//17

-

£500m additional spending for 2016/17

-

6.5% increase on 2015/16

He also announced that he was allocating more than £500m to NHS budgets, which he said would result in total planned spending of nearly £13bn next year - an increase of 6.5% on the comparable figure for 2015/16.

But he warned that Scotland's ageing population meant that additional funding alone was not enough to equip it properly for the future.

Mr Swinney added: "To really protect our NHS, we need to do more than just give it extra money - we need to use that money to deliver fundamental reform and change the way our NHS delivers care."No change in Scottish income tax rate

Local government in Scotland

What's the 2016/17 budget deal?

£9,545m

Revenue funding for the country's 32 councils

-

£250m - new money for health and social care

-

£70m - to continue the council tax freeze

-

£88m - to maintain teacher numbers at 2015 levels

To this end, he said an extra £45m would be invested in improvements to primary care, with a further £200m funding six new treatment centres.

Mr Swinney said: "This will equip the NHS to carry out increased numbers of hip and knee replacements and cataract operations, in a way that does not simply add pressure to our emergency hospitals."

The draft budget is normally presented in September, but was delayed this year to take into account the Westminster spending review in November.

Analysis

By BBC Scotland political editor Brian Taylor

In practice, John Swinney was holding steady in this budget - for understandable reasons. Firstly, there are big changes pending: reforming council tax, reviewing business rates, extra tax powers from the Smith Commission.

All that plus there is still no final deal on the Fiscal Framework which will accompany the Smith powers - although one is now firmly forecast for February. All that adds up to a climate of arithmetical and political uncertainty.

But secondly there are elections to the Scottish Parliament in May. Mr Swinney does not lack fortitude but it would have taken a particularly courageous Finance Secretary (in the Yes Minister mode) to hike income tax, at the first time of asking under new powers, weeks before those polls.

Scottish Labour's finance spokeswoman Jackie Baillie said: "This is the most important budget since devolution, delivered by a party who promised to stand up for Scotland against Tory austerity.

"But it doesn't deliver fairer taxes, a long-term plan for Scotland or an anti-austerity alternative. Local services like our schools, roads and care of the elderly will face massive cuts."

Murdo Fraser of the Scottish Conservatives said Mr Swinney had chosen not to increase the resources available to him by levying additional taxes.

He added: "For years, the finance secretary has portrayed himself as a prisoner of Westminster austerity, but now that he has been given the key to the door of his cell, he has decided not to use it.

"So I trust we will hear no more from the SNP about austerity and Westminster cuts, when the party itself has made the choice not to increase the size of the budget available."

'No change'

Scottish Liberal Democrat leader Willie Rennie said Mr Swinney "has spent his entire political life campaigning for more tax powers. And what does he do when he gets them? The answer is nothing, no change, same rate and the same as in England.

"John Swinney cannot tell Scotland that he is rejecting austerity when he is not raising a penny more even though he has the new tax powers to do something about it."

Cosla president David O'Neill said the cuts to council funding "cannot be laid at Westminster's door this time around".

He added: "A cut of 3.5% is catastrophic for jobs and services within Scottish local government - because the harsh reality is that it actually translates to real job cuts that hit real families, in real communities throughout Scotland. Everyone will be hurt by this."

- Published16 December 2015

- Published16 December 2015

- Published16 December 2015

- Published13 December 2015