How has the oil price fall hit Scotland's north east?

- Published

Aberdeen's harbour is a bustling one - but it is facing the economic impact of falling oil prices

You can tell that the economy in Aberdeen is in trouble before you even get there. It used to be almost impossible to find a hotel room unless you booked far in advance.

I've had to stay many miles outside the city in years gone by.

Now you can easily find a bed for the night and it's significantly cheaper than it was even just a few months ago.

Hotel occupancy rates have dropped by a third over the last year which is good news for the visitor but bad news for the local businesses who are feeling the effects of the oil price slump right across the economy.

Overtime slashed

As soon as I got in a taxi the driver greeted me with the news that the price of Brent crude had hit a new low.

I had not mentioned I was in town to report on the economic impact of falling oil prices. I assume all Aberdeen cabbies keep a careful eye on the market because it impacts on their trade as well.

Everyone you meet in Aberdeen has a tale to tell about how their business has been affected.

They tell you about friends and relatives who've lost their jobs or had their hours cut.

Woolland and Henry manufacturers specialist equipment for the offshore oil industry

"There are horror stories everywhere," Craig Watson told me when I visited his workplace.

Woolland and Henry is a small factory which manufactures specialist equipment for the offshore oil industry.

It also makes high quality watermarked paper goods which has kept the business afloat while the oil price tanks.

But even that hasn't stopped some job losses.

And the workers who are still there have seen their overtime slashed so they are taking home wage packets hundreds of pounds lighter than they are used to every month.

That means they are spending less in the local economy and so it goes on.

Bad news about job losses keep hitting the city.

On Tuesday BP announced it was cutting a fifth of its North Sea workforce. 600 jobs in all.

The day before another oil company - Petrofac - said it could lose 160 jobs. It all adds up. The industry body, Oil and Gas UK estimate that well over 65,000 jobs have already been lost as a result of the tumbling price of oil.

Lower oil prices can have positive boost on the economy thanks to lower production costs for business and more disposable income in consumers pockets.

But in Scotland those positives are more than outweighed by the negative effects.

The whole of the Scottish economy is being dragged down by the cold wind coming off the North Sea. You can see the chilling effect of the oil price drop in the official statistics.

Figures published by the Scottish government show the Scottish economy is growing, but only very slightly and the recovery is much weaker in Scotland than it is across the UK as a whole.

Used car sales

In the third quarter of 2015 the Scottish economy grew by 0.1% compared to 0.5% in UK.

The second quarter figures showed the same anaemic growth in Scotland at 0.1% whilst the UK economy grew by 0.7%. It's starting to look like a disturbing trend.

Economists say the drag on the Scottish economy is largely due to the effects of the falling oil price.

Stuart Benzie who runs Westhill Cars says his business has seen the affects of an oil industry making job cuts

No one knows the health of the local economy better than a used car salesman - Stuart Benzie runs Westhill Cars.

The high end premium cars, the Audis, BMWs and Jaguars are still parked at the front at of the lot. But he knows customers are looking for lower priced models these days.

Much of his custom comes from people trading in more expensive cars for cheaper ones.

Economic crisis

He told me about a woman who came in recently to buy a nice car, she agreed a loan and left happy about her new motor.

Three days later she came back to explain that she had just been told she was losing her job and could no longer go through with the purchase.

No sale for Stuart, no business for the loan company and financial disaster for the customer who'd been made redundant.

A tale that sums up the economic crisis hitting the North East of Scotland.

Oil prices - key questions answered

Why is the oil price so low?

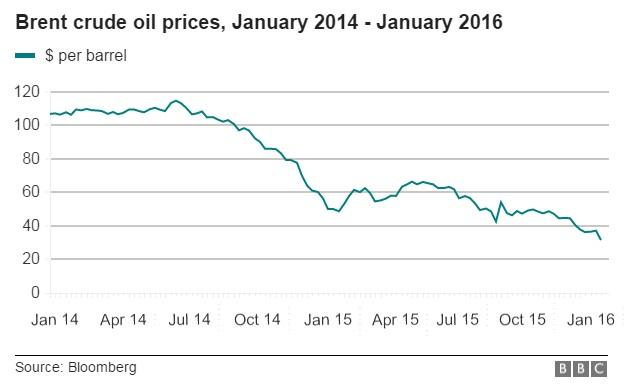

Oil prices have fallen by about 70% in the past 18 months as supply has outstripped demand. The demand for oil from China has fallen as its economic growth has slowed. Meanwhile supply has increased, partly due to the rise of US shale oil. In addition, the world's largest exporter of oil, Saudi Arabia, has refused to cut production - something it has done previously to support oil prices. Analysts estimate that about one million barrels of oil are being produced above demand every day.

Who benefits?

Consumers and some businesses have benefitted from lower oil prices. UK motorists have seen the price of petrol and diesel fall from about £1.40 a litre 18 months ago to about £1 now. Transport operators and airlines should also be benefitting from cheaper fuel. The lower fuel costs have also helped to keep inflation close to zero in many countries.

Who suffers?

Oil exporting nations that rely on a higher oil price to break even are suffering, such as Russia, Nigeria and Venezuela, as are oil firms generally. There have been thousands of job losses in the North Sea's oil industry. Investment in exploration has also been cut by big oil firms such as Shell, BP, Total and Exxon Mobil.