Gers figures: Scottish economy deficit almost £15bn

- Published

Scotland's estimated oil revenues fell from £1.8bn to just £60m last year

Scotland's public spending deficit stood at just under £15bn in the past financial year amid plummeting oil revenues.

Official Scottish government statistics showed the country spent £14.8bn more than it raised in taxes in 2015/16, including a share of North Sea revenue.

That figure represented a 9.5% share of GDP, the report said - more than double the 4% figure for the UK as a whole.

Revised figures for the previous year put the Scottish deficit at £14.3bn.

The UK's spending deficit is £75.3bn.

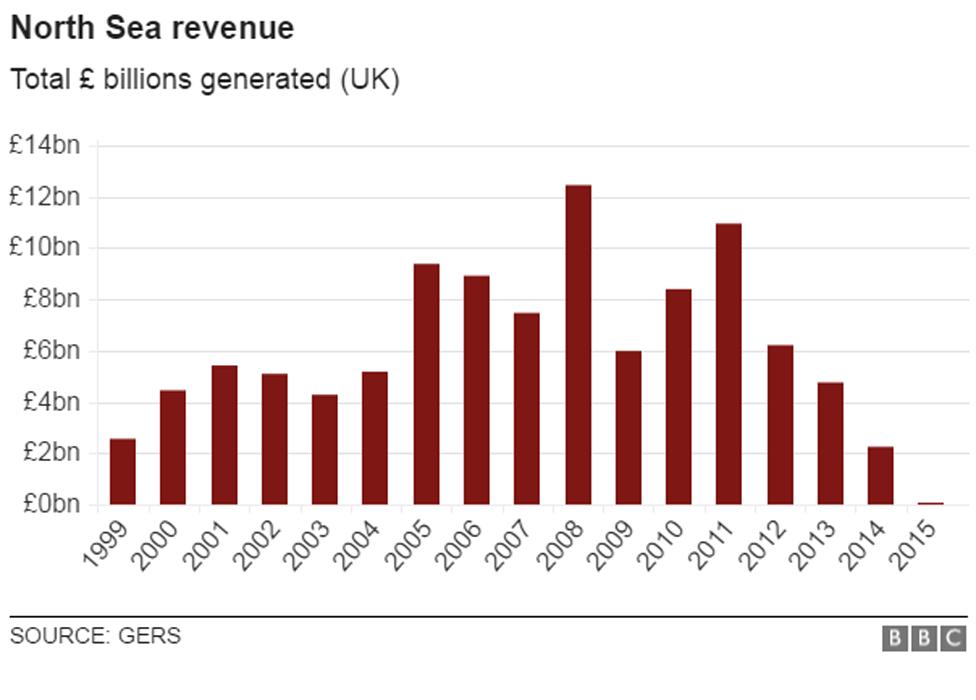

The Government Expenditure and Revenue Scotland (Gers) figures estimated that Scotland's share of North Sea revenues fell by about 97% from £1.8bn in 2014/15 to £60m last year, reflecting a decline in total UK North Sea revenue.

But this fall was offset by Scotland's onshore revenues growing by £1.9bn.

Overall, Scottish public sector revenue was estimated as £53.7bn - the equivalent of £10,000 per person, and about £400 per person lower than for the UK as a whole.

Meanwhile, total expenditure by the public sector was £68.6bn.

This was equivalent to 9.1% of total UK public sector expenditure, and £12,800 per person - which is £1,200 per person greater than the UK average.

The Gers figures for the 2014/15 financial year, which were published in March, estimated the Scottish deficit at £14.9bn, or 9.7% of GDP, including a geographic share of offshore tax revenue.

But the latest report revised that figure down to £14.3bn, or 9.1% of Scottish GDP.

First Minister Nicola Sturgeon insisted the "foundations of the Scottish economy remain strong".

She added: "The lower oil price has, of course, reduced offshore revenues, with a corresponding impact on our fiscal position - this underlines the fact that Scotland's challenge is to continue to grow our onshore economy.

"However, Scotland's long-term economic success is now being directly threatened by the likely impact of Brexit."

'Sharing resources'

The UK's government's Scottish secretary, David Mundell, said the figures "show how being part of the UK protects living standards in Scotland".

Mr Mundell said: "Scotland weathered a dramatic slump in oil revenues last year because we are part of a United Kingdom that has at its heart a system for pooling and sharing resources across the country as a whole.

"It is important that continues and the financial deal between the UK and Scottish governments, struck last year as part of the transfer of new tax and welfare powers to Holyrood, means real security for Scotland."

Douglas Fraser: What do the GERS figures tell us about Scotland's finances?

This approach to estimating how much Scots pay in tax, and how much they benefit from spending at all levels of government, goes back to the early 90s.

Conservative ministers in the Scottish Office thought it would help inform the debate on devolution, or at least it would help them make their case against a Scottish Parliament.

The numbers would show, they thought, how much more Scotland gained from the Treasury than it sent south in tax revenues.

That was one of those times when the oil price was low.

Seven years earlier, it was very high and oil revenues were like a gusher.

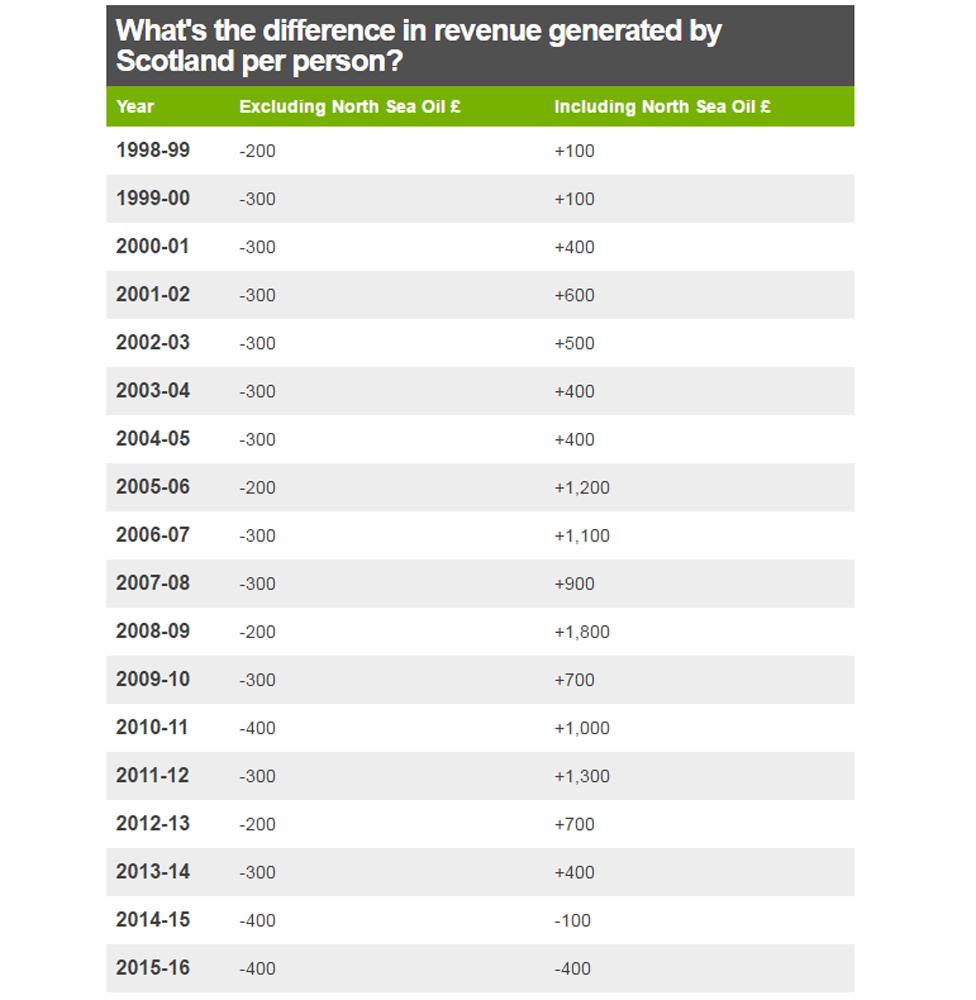

GERS: Extracts from Table E.2 (figures rounded to the nearest £100). The numbers listed refer to the difference compared with the rest of the UK.

GERS: Extracts from Table E.2 (figures rounded to the nearest £100). The numbers listed refer to the difference compared with the rest of the UK.

What has been the reaction to the figures?

Scottish Labour leader Kezia Dugdale said the figures should act as a "reality check" for those calling for another independence referendum. She added: "It's clearer than ever that Scotland benefits from pooling and sharing resources across the UK. Being part of the UK means higher spending on the public services like education and the health service that we all rely on. That's a strong, positive case for Scotland remaining in the UK - our most important social and economic union."

Scottish Green co-leader Patrick Harvie said the figures showed that Scotland could not rely on oil and gas for its future. He added: "Diversifying our economy will mean developing a broader range of revenue sources, giving us the confidence to invest in making Scotland a more equal country too. If we're serious about building up alternative viable industries, and ending our over-reliance on unburnable oil and gas, we must see a joined up plan from the Scottish Government instead of a myopic obsession with getting back to 'business as usual'."

Scottish Liberal Democrat leader Willie Rennie said the SNP's case for independence had been "swallowed up by a £14bn black hole". He added: "It's a dark day for Scottish nationalism but it is even darker for the Scottish economy. The oil shock and the Brexit shock should not be compounded with an independence shock."

Scottish Chambers of Commerce chief executive Liz Cameron said the Gers report made for "disappointing reading" and was a "wake up call that must be heeded". She added: "The Scottish economy can and should be performing so much better. Businesses are working hard to succeed and grow, creating and sustaining jobs and to drive up our productivity. We need our governments in Holyrood and at Westminster to focus, now more than ever, on the basics that our businesses need: a fair deal on taxation, investment in skills for our future and in our transport and digital infrastructure and services."

The Scottish Council for Development and Industry (SCDI) said the figures highlighted Scotland's "challenging fiscal position". Its director of policy, Claire Mack, said: "The impact of the low oil price and lower growth highlights the need to ensure businesses are able to take the steps necessary to improve their competitiveness if they are to endure in this new environment - especially with the prospect of Brexit. The stark numbers of this report show the importance of addressing the structural weaknesses of our economy, grasping technological change, and improving the agility of businesses and the public sector to respond and shape new trends and opportunities."

Professor Graeme Roy, of Strathclyde University's Fraser of Allander Institute, said: "Today's GERS figures show the harsh reality of the sharp decline in North Sea revenues on Scotland's public finances. Just four years ago, North Sea revenues contributed nearly £10bn to Scotland's revenues - this year that figure was just £60m. This is likely to be the new normal given the long-term outlook for the oil and gas sector."

- Published24 August 2016

- Published24 August 2016