President Trump: All hat, now where are the cattle?

- Published

It's hard to know where to start with the phenomenon that is president-elect Donald J Trump. But if we're finding it difficult to make that transition, imagine what it's like for him.

On the economic front, he's got some work to do. It's not that the US economy is in such bad shape. It's recovered better than the UK one.

The problem is more that he has portrayed it as being wrecked, and he has raised expectations of doubling the growth rate to 4%, while "bringing millions of jobs back to America".

"We're going to win so much. You're going to get sick and tired of winning. You're gonna be saying, Mr President, enough with the winning."

The Texans talk about blowhards as being "all hat, but no cattle". Well, Donald Trump has certainly done the hat bit. So now... ?

The economic plan is threadbare, and it's not clear who is going to be driving it in the Trump administration.

Over at the US Fed, it could get a bit wobbly, as the president-elect is not a big fan of Janet Yellen or her management of monetary policy, and he may want her replaced.

Tough on trade

The key elements are a big push on infrastructure, particularly in transport: "Believe me, it'll be second to none." Good news for the construction sector.

Market pundits are also talking up healthcare stocks, as Trump and his Republican allies set about dismantling Obamacare. There are profits to be made out of the wreckage there.

You might also buy shares in the coal-mining industry, which has been tanking of late, and it's collapsed almost entirely on this side of the Pond.

Targeting votes in rustbelt and mining states such as West Virginia, Candidate Trump went big on the prospects for reviving coal production.

Yes, it's dirty, but the president-elect believes climate change is "a hoax" perpetrated by the Chinese. So that could upend a lot of the growing green economy in the US.

And if eight years of Obama's climate change policy is to be thrown into reverse, repudiation of the commitments made to international limits on carbon emissions could entice signatories into doing the same.

But the bit that gives the markets the jitters is trade. It's been the signature element of his populist pitch - that the governing elite have signed up to trade deals that have neglected the interests of Ordinary Joe.

The signs have been there for a long time, but they are clearest in the stagnation of real earnings since the 1970s, and the reduced share of the economic pie that's gone to wages.

Donald's Trump's victory led to jitters in the international financial markets

The Trump Movement has, as its foundation, the giant shift in manufacturing and economic power, particularly to Asia.

And there are clear parallels there with the de-industrialisation and hollowing out of much of the north of England, which led to the vote for Brexit.

So the big question is what he is going to do about trade? Repudiating deals? Tearing them up? Imposing punitive tariffs in economic warfare? Or seeking to re-negotiate, with a mandate from the American people and the one trademark skill that he brings to the White House - deal-making.

The UK will be looking for a post-Brexit deal with the US. Trump has sounded more positive about that than others in Washington. But what kind of deal would it be?

The basis for international trading is that all sides win. The catch is that it can require painful adjustment within countries. Donald Trump doesn't like that adjustment, so the rhetoric points to a trade deal that is strongly favourable to Americans over its trading partners.

Stimulating growth

Also worth watching in his economic policy is the approach to taxation and spending. He has said he wants to lower tax on high earners and to simplify federal tax bands to three levels: 12%, 25% and 33%.

He also wants to cut headline corporation tax from 35% to 15%. That's not much below the level at which the UK Treasury has been aiming, and it's higher than Ireland's corporation tax rate.

That could stimulate growth. But tax experts in Washington think, with the promises on infrastructure and defence spending, that it will instead make the federal debt balloon, by perhaps more than $5 trillion.

That helps explain why the mighty US dollar is not in its customary role, acting as the safe haven for investors. The Japanese yen and the Swiss franc look more solid now.

But it raises the question of how much of this plan President Trump can get through Congress. He may be a Republican, but he's far from sharing the fiscal conservatism of his party's representatives on the Hill. Given their differences and Trump's mandate having been achieved without them, that relationship is going to take a lot of managing.

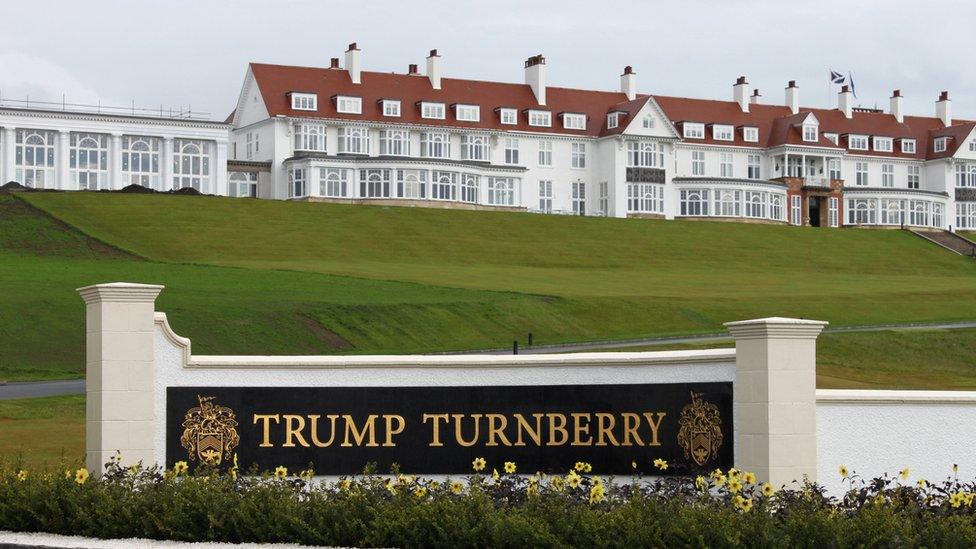

President-elect Trump is not expected to distance himself from his business interests

What will also require managing is the Trump business portfolio. Unlike other presidents and prime ministers, he does not intend to put it into a blind trust.

How could he, when the Trump brand is so prominent on his property and business interests?

So his family will continue to manage it. And as he's proven already to be a rather divisive character, they may have their work cut out to secure these Trump assets.

From the bling and buildings in the US to his golf courses north of Aberdeen and at Turnberry in Ayrshire, these are now extensions of the presidential brand. The Commander-in-Chief will surely want them to be protected as such.

- Published9 November 2016

- Published9 November 2016

- Published25 April 2017

- Published10 November 2016