Holiday let owners 'should pay business rates'

- Published

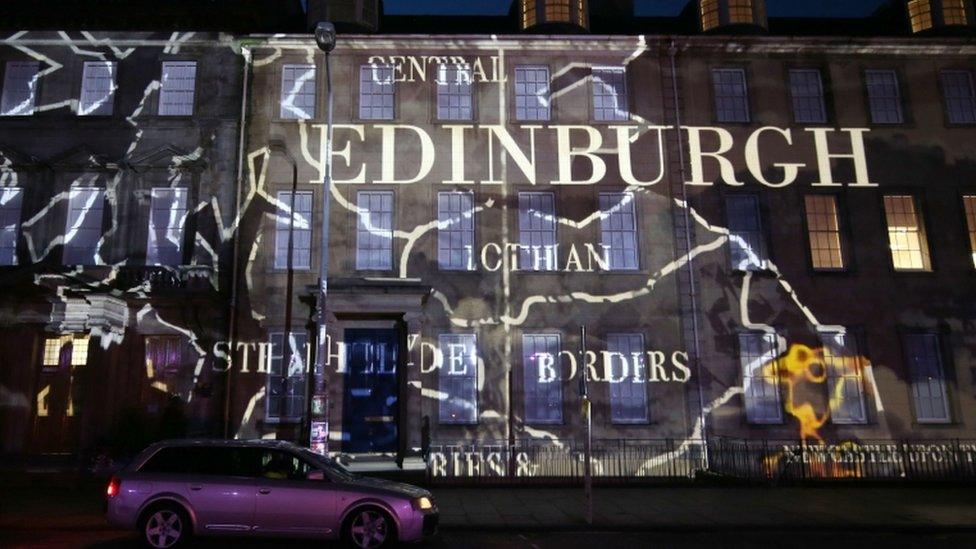

The population of Edinburgh is said to treble during the annual arts festival

Homeowners who rent out their property for the Edinburgh festival season should have to pay business rates, according to a Scottish Green MSP.

Andy Wightman said the owners of short-term lets in Edinburgh were avoiding more than £10m in taxes each year.

The city has seen a boom in homes being rented out as holiday accommodation, particularly at festival time.

Mr Wightman said the vast majority of these properties currently do not pay business rates.

The rates, also known as non-domestic rates, are a tax on non-residential properties to help pay for local council services.

Fully exempt

Properties become liable for non-domestic rates rather than council tax if they are rented out for more than 140 days - but Mr Wightman said only half of such properties in Edinburgh are declared.

His research, external also suggested that 83% of short-term lets in Edinburgh that are declared for non-domestic rates have a rateable value below £15,000.

They are therefore fully exempt from paying business rates under the Scottish government's Small Business Bonus Scheme, external.

Mr Wightman said an additional £10.6m in tax revenues would be generated if all short-term lets of more than 140 days per year paid non-domestic rates.

Mr Wightman said there was no justification for holiday lets to be exempt from paying business rates

The Lothians MSP argued there was no justification for short-term lets being exempted from paying taxes to help meet the costs of public services in Edinburgh.

He said he had been inundated with complaints from constituents concerned about the rise in private homes being let out as holiday accommodation, and the impact on local housing supply and anti-social behaviour.

And he warned that on current trends, half of the homes in the EH1 postcode - which mostly covers the city's Old Town - will be holiday lets within a generation.

Mr Wightman said: "It is disappointing that the Scottish government has not conducted an economic impact assessment of the Small Business Bonus Scheme in the ten years of its existence.

"Thanks to this scheme and the failure to declare properties as short-term lets, landlords - many of whom are overseas investors - profit from these services without contributing a penny.

"It is time to bring short-term lets fully into the planning system and give the council the powers to protect the availability of residential accommodation for the citizens of the city."

Rapid growth

Short-term or holiday lets are properties that are rented out for just a few days or weeks at a time, usually to tourists and visitors looking for self-catering accommodation.

The rapid growth in demand for this type of accommodation has been driven by websites such as AirBnB.

Mr Wightman said he had found 6,200 Edinburgh properties available for let on one internet platform alone - of which 3,410 were entire homes where the homeowner was not present.

He estimated that about 2,500 of these homes were available for let more than 140 days a year, with the number increasing every year.

But the profitability of short-term lets means that many speculators, often from overseas, are buying residential properties in Edinburgh purely to rent out as holiday accommodation.

Mr Wightman stressed that short-term lets were not a new phenomenon or one that was confined to Edinburgh - with the number of holiday homes in many rural areas being a cause of concern for many years.

There have been complaints that the number of rural homes being used as holiday accommodation makes it harder for local people to buy properties to live in.

A Scottish government spokeswoman said the Small Business Bonus Scheme had saved businesses around £1.3bn since its introduction.

She added: "We are aware of the position regarding holiday lets and have published research on the supply and demand for short-term lets.

"The research was commissioned to inform the work of our expert advisory panel on the collaborative economy, who are due to report to ministers by the end of the year.

"The Barclay review of non-domestic rates will report this month and we have committed to respond swiftly."