CairnGorm Mountain: Where did the money go?

- Published

The Cairngorm mountain railway opened in 2001 but has been closed all winter

The private company that ran CairnGorm mountain went bust in November leaving behind a broken mountain railway and a failed plan to bring millions of pounds of much-needed investment to the snowsports centre near Aviemore. What went wrong?

From the beginning some people said what was promised at CairnGorm Mountain was too good to be true.

When Natural Retreats - a company until then most identified with running a holiday rentals company - took over, it promised a transformation.

Publicity material said the aspiration was to host the X games, a world-famous extreme sports event, and produce multiple gold medals at the Winter Olympics by creating a world class training facility.

That would have represented a major turnaround for any Scottish resort - never mind one that had struggled to overcome problems caused by the unpredictability of the weather and the need to find a revenue stream that could support a £20m mountain railway.

When the company that ran the mountain went bust last autumn much of the focus understandably was on protecting jobs and making sure there was a ski season of some sort this winter.

But we wanted to try to understand what happened, whether it was preventable and what could be learned from it.

That meant unpicking a complicated web of public bodies, private companies and unmet expectations.

Even working out who owned what wasn't simple.

Natural Retreats ran the mountain until it went bust in November

The infrastructure on the mountain - the lifts and railway - are in public hands.

Highlands and Islands Enterprise owns them and the land.

Until 2014 they ran the mountain through an operating company - CairnGorm Mountain Limited.

That year they announced that Natural Retreats were taking over.

They were a leisure company who had started off developing holiday rentals in national parks.

The operating company - along with assets like vehicles and movable infrastructure on the hill - were sold for just over £230,000.

We can see from the original tender document that financial backing was crucial to getting the contract.

It says: "The potential operator would be required to provide capital investment to support their business model. Consequently bidders will be expected to demonstrate a credible access to finance."

Thousands of people use the funicular railway to access the slopes

Almost immediately bloggers who were critical of the management of the mountain started digging away.

They discovered that the company had in fact been sold to Natural Assets Investments Limited (NAIL) - a company with many of the same directors as Natural Retreats.

Natural Retreats had the lease to operate the mountain - but the assets had been transferred to the wider group.

The funicular carries large numbers of snow sports enthusiasts to the slopes

NAIL was also in debt. HIE has since said financial checks were done on both companies.

In a 2014 media release, HIE welcomed Natural Retreats' decision to invest more than £6m in the mountain.

This was the key to the deal - sell the operating company and release private capital to allow the mountain to diversify.

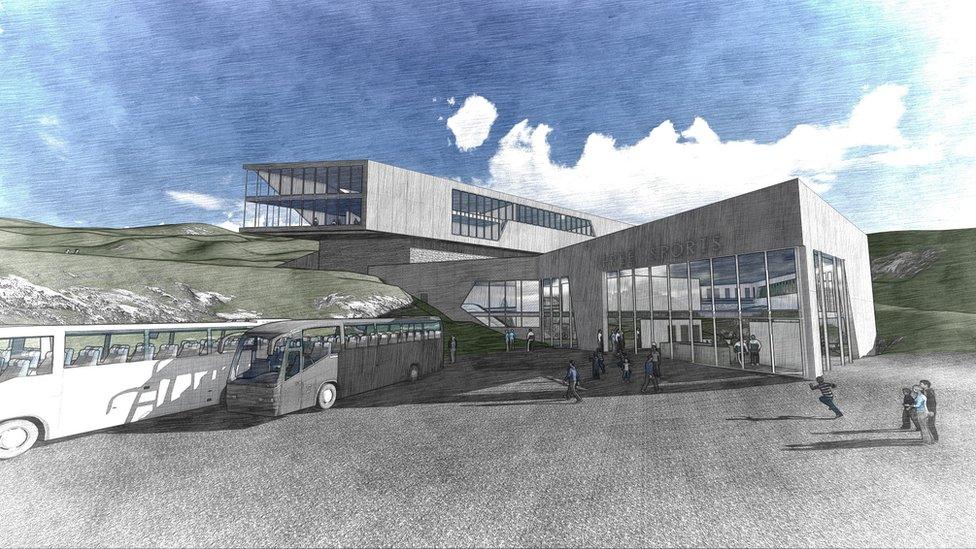

An artist's impression of a planned revamp of CairnGorm Mountain that never materialised

The hope was that there would be an investment in the ski business.

But more than that the intention was to develop the summer business too - this would protect the mountain from the ups and downs of weather-affected skiing.

Our research has established that this £6m wasn't quite what it seemed.

Built at a cost of £26m, the funicular was first opened in 2001

When we sat down with HIE they told us that £4m of that was to be a loan of public money from HIE to Natural Retreats.

Two years after the handover Natural Retreats still hadn't taken that up.

The company came to HIE and said that they wanted to change the business model which had won them the original contract.

HIE approved a new business plan but that investment didn't happen either.

Highland and Islands Enterprise told us that Natural Retreats invested about £1m in the Day Lodge on the mountain.

So the whole basis for the asset transfer was never realised.

As we spoke to local people who had investigated Natural Retreats' time on the mountain it became clear the concern wasn't simply what hadn't been invested, it was also what had been taken out.

Natural Assets Investment Limited and Natural Retreats share directors.

There are also other leisure companies registered at Companies House where the same names come up over and over again.

Their accounts show a complex system of inter-company charging.

This isn't unusual or in any way wrong.

The structure of an operating company and a property company that charge between each other is common in the leisure industry.

But what people wanted to know was if Natural Retreats wasn't investing as originally planned, was it also taking money out?

That's where the Administrator's Statement came in handy.

It's a document produced by those charged with realising the assets of a company that has gone into administration and settling its debts.

It said that there was a monthly "management fee" paid from the operating company CairnGorm Mountain Limited to Natural Retreats of £40,000.

When we asked HIE about that they confirmed that had been negotiated at the point of handover and represented an industry standard level of fee.

There were other payments in the accounts that stood out.

CairnGorm Mountain Limited was paying administration charges to the wider NAIL Group.

These amounted to more than £2m in the period 2014 to 2017.

That's more than the management fees that were signed off by HIE as part of the asset transfer.

What were these for?

We asked HIE and they said they didn't know - but were still trying to find out.

Public domain

Which brings us to Natural Retreats.

We had a lot of questions. In particular we wanted to know about the flow of money in and out of Cairngorm Mountain Limited.

We put them all to the company - which seems to have rebadged itself as Travel Together in the past two weeks.

They were not willing to answer any of them, saying that relevant information was in the public domain.

They also said that ongoing investigations into the fate of the funicular meant they were not in a position to comment.

There was other information in the administrator's statement that raises questions about the relationship between HIE and Natural Retreats.

It makes clear what happened when Natural Retreats realised that a combination of the funicular being out of operation and other factors meant administration was inevitable.

HIE entered a process where it was the sole bidder to take the operation of the mountain back over.

It put in more than £150,000 of public money to cover the November wage bill.

Viability of the mountain

Then it negotiated a deal to buy the assets of CairnGorm Mountain back.

At this point the funicular was out of operation and HIE was the only bidder.

It paid over £440,000. That's almost twice the original price paid by NAIL.

How would HIE explain paying double when the ski operation was struggling to cope with the loss of the funicular?

They told us they were securing important assets for the future and that they had paid a fair price.

They also said that the original sale had involved a transfer of a company with debts as well as assets and that was reflected in the price in 2014.

The agency was clear - it's role was to protect the future viability of the mountain.

HIE also told us that over the period Natural Retreats was in charge, HIE spent an additional £3.5m of public money on infrastructure.

If the original intention of the handover was to bring private capital into the picture and relieve pressure on public funds then what's detailed in the administrator's statement, combined with what HIE told us, suggests that there was far more public cash than private cash being invested.

There is one last potential twist.

When Cairngorm Mountain went into administration it owed more than £2m to the NAIL Group.

That makes the company by far the largest unsecured creditor.

So whatever is realised by the administrators could largely be paid back to NAIL.

Over the last week or so we've seen winter return to our mountains with a vengeance.

That holds out hope for all our ski resorts, including CairnGorm.

As the wider impact of CairnGorm Mountain Limited going into administration becomes clear the immediate worst case scenarios have not appeared.

Jobs have been protected, skiing is happening this winter and there are negotiations under way with community groups about the potential for a community buy-out.

Nevertheless, it's still not at all clear that the past four years represent anything other than a wasted opportunity for a business dependent on public money and crucial to the future of a community that desperately needs it to succeed.

- Published13 February 2019

- Published14 December 2018

- Published3 December 2018

- Published29 November 2018