Why Amazon boss Jeff Bezos is feeling the chill in India

- Published

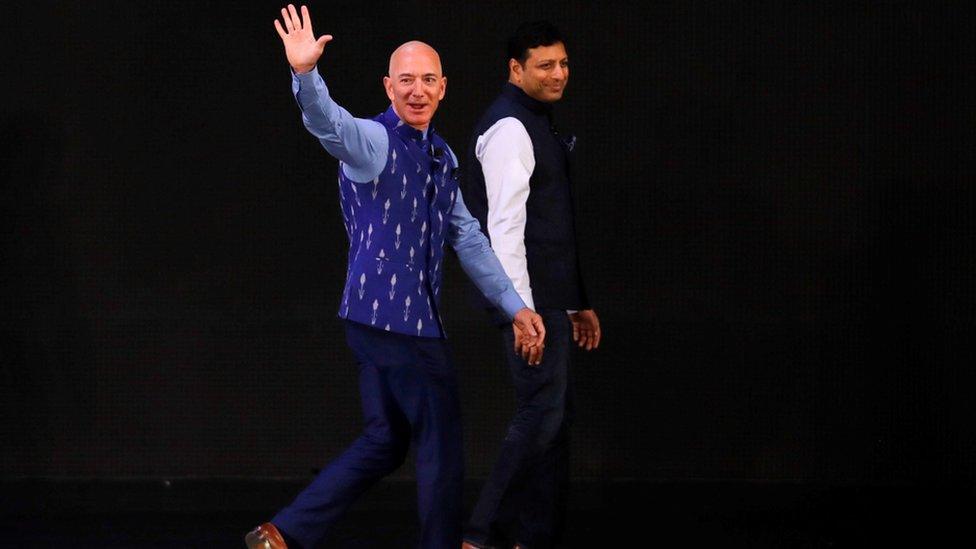

The Confederation of All India Traders protested against Jeff Bezos' visit

If Scottish retail figures look bleak, midwinter has a warmer feel and spicier smell in India's bazaar - but Amazon's boss is feeling the chill.

Retail could play a significant part in post-Brexit trade talks, having been a blockage when the EU tried to do a deal with Delhi.

A sharp spike in India's consumer price inflation is being explained by the recent onion and garlic crop.

If it feels like Scottish retail has been through a bleak midwinter of stalling and falling sales, much of the chill has come from online e-commerce.

Along with the Scottish Retail Consortium figures, the fashion retailer Quiz reported another grim set of figures on Wednesday morning. Black Friday stood up OK, it said, but Christmas saw a 7% dip.

I've been looking at the clash between retail clicks and mortar in a far-off market - India, where a much bigger retail market is entering a vital phase.

Today is a Hindu festival, to mark mid-winter, with seasonal food featuring the sesame seed. I'm told this helps absorb the limited amount of light. It doesn't feel very limited to me.

Jeff Bezos attended a company event in New Delhi

The bazaar and the vast army of small-time shopkeepers are the beating commercial heart of this country.

They are expected to protest this week in 300 cities against the presence of Amazon's boss Jeff Bezos, who is on a three-day, high-profile visit.

Bezos responded with flattery, scores of rupees and export prospects: paying homage at a shrine for Mahatma Gandhi, telling Indians the 21st Century will be theirs, promising to invest a further $1 billion in helping small and medium-scale businesses go digital, and pledging to source a vastly increased quantity of Indian goods to his customers around the world.

Amazon offers home delivery in India, and is pushing hard into the mobile phone market. But its domestic pitch, for now, is less about home delivery and more about its cloud services and business support, as well as streaming video and music.

A formidable political force

Given their number, their spread and their reach into every community, India's small-time traders can mobilise a formidable political force.

So the government has tight restrictions around ownership of the subsidiaries of multi-national retailers.

On Monday, it opened an investigation into anti-competitive practices by Amazon and Flipkart, an online retailer owned by US giant Walmart, which also owns Asda.

They are supposed to operate as neutral retail platforms, but are accused of favouring some retailers and their own brands.

The government is also reported to be giving Mr Bezos the cold shoulder because he also owns the Washington Post newspaper. Its coverage of the BJP administration in New Delhi is not appreciated.

Post-Brexit trade talks

Retail investment is relevant also to forthcoming trade talks between post-Brexit Britain and the New Delhi administration.

EU trade talks with India stalled due to several blockages - one of them India's resistance to Tesco and France's Carrefour entering the supermarket sector.

Along with visas for Indian workers and the 150% tariff on imported whisky, it may remain an issue when Liz Truss's trade team touch down at Indira Gandhi airport in Delhi - although British retailers' enthusiasm for Asian expansion has waned.

Another challenge facing India's retailers was highlighted this week, with the December figure for consumer price inflation.

It's a long way from the UK figures, as the basket of goods surveyed across the country each month is heavily weighted towards food.

The target for inflation is 4%, but it rose to 7.3% last month. That's roughly the same as the slowed economic growth rate.

The problem seems to be onions and garlic. Despite a strong monsoon season last year, vegetable prices were up 60% on the previous year, garlic by 153% and onions by 328%.

Economists seem to think this is a blip, and inflation will fall as government releases its stocks of this humble staple of the Indian diet.