No changes to Scottish income tax rates in budget

- Published

- comments

Kate Forbes told MSPs that "exceptional circumstances require an exceptional response"

No changes will be made to income tax rates and bands in the coming year after the Scottish government set out its budget plans.

Finance Secretary Kate Forbes told MSPs that this was a time for "stability, certainty and targeted support".

She also pledged an "exceptional response" to the Covid-19 pandemic, with extra funding for jobs and skills.

Local authorities will also be offered incentives to freeze council tax rates to prevent household bills rising.

Pandemic tax reliefs for businesses are also to be extended, while the poundage rate of non-domestic rates is to be cut for the first time in the history of devolution.

Meanwhile, the Scottish Fiscal Commission has warned that the economy will not return to pre-pandemic levels until 2024.

The budget plans come almost one year on from the first confirmed case of coronavirus in Scotland, with Ms Forbes saying "the pandemic has shaken our society and economy to their core".

She said her goal was to "bring much-needed support and stability" and to lay the groundwork for a "fairer, stronger and greener" economy in future.

The budget includes £1.1bn of spending on jobs and employment support, extra cash for the health service to tackle the Covid-19 pandemic, and £3.1bn for education.

A cut to land and buildings transaction tax announced during the pandemic will not continue after March

Income tax rates and bands are to remain unchanged, with the thresholds for all but the top rate to rise in line with inflation.

The government has earmarked £90m for councils as an incentive to freeze local rates - the equivalent of a 3% increase - in a bid to protect household budgets.

However a tax cut for housebuyers announced during the first lockdown will end on 1 April, with the starting point for Land and Buildings Transaction Tax to return to £145,000 - although relief for first time buyers will continue.

Ms Forbes said: "This budget is focused on delivering tax policies that will support economic recovery and maintain our commitment to creating a fairer and more progressive tax system.

"It is about striking the right balance between raising the revenue required to fund our public services and supporting the economic recovery through targeted interventions."

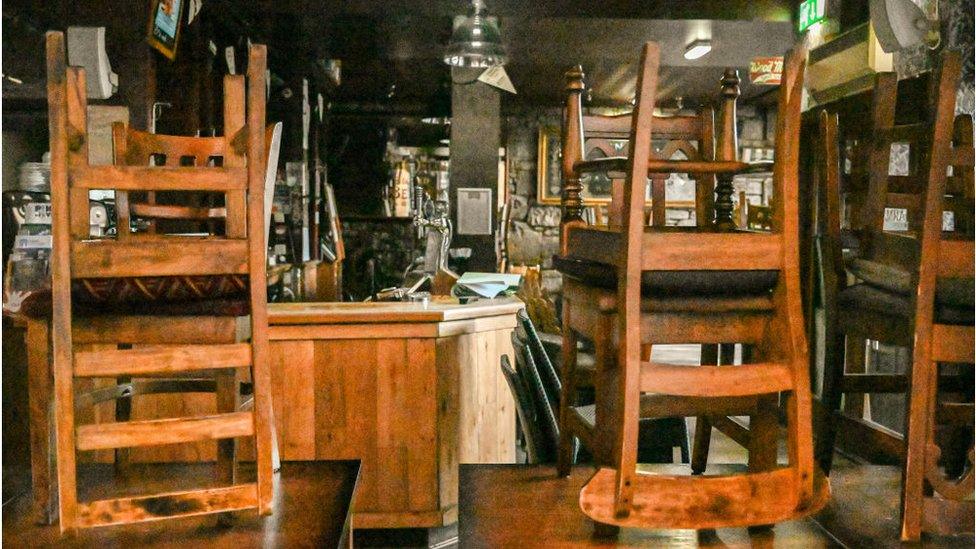

Non-domestic rates relief for retail, hospitality and leisure businesses will be extended by at least another three months, with Ms Forbes saying this could be extended further if the UK government makes a similar move in its budget in March.

And the finance secretary took the "unprecedented step" of reducing the poundage rate of non-domestic rates to 49p, which she said would save firms more than £120m.

Spending plans include a record £16bn for health services, along with an extra £869m to tackle Covid-19, and £11.6bn in total for local government.

Ms Forbes also announced an uplift in police budgets and "significant extra funding" for the justice system, with £50m aimed at clearing the backlog in court cases.

Other spending plans include:

£3.6bn for social security, including £68m for the Scottish Child Payment

£1.1bn for mental health services

additional £50m for the "national mission" to tackle drug deaths

£1.6bn for bus and rail services

£800m for agricultural support

Ms Forbes will now enter negotiations with opposition parties over the plans, with the minority SNP administration needing the support of at least one other party to pass a budget.

Scottish Conservative finance spokesman Murdo Fraser welcomed the tax plans, and called for rates relief for businesses to be extended for a full 12 months.

He also said the government must focus "100%" on managing the pandemic and the economic recovery, pointing to "unprecedented support" from the UK Treasury over the past year.

Scottish Labour's interim leader Jackie Baillie welcomed "renewed focus on the economy" and jobs, saying she looked forward to talks with ministers.

However, she warned the country was heading for "a huge economic crisis and a cost of living crisis not seen since wartime", and that the support for local government "falls short of what is required".

The Scottish Greens have backed the SNP in every budget vote in this parliamentary term, but co-leader Patrick Harvie said the plan announced on Thursday "does not pay for a green recovery" and amounted to "moving pennies here and there".

Scottish Lib Dem leader Willie Rennie, meanwhile, called for more funding for mental health services and a greater focus on education and business support.

Business groups called for tax breaks for firms hit by lockdowns to be extended by a full year

The budget includes plans for public sector pay, including a 3% rise for those on salaries below £25,000 and a 1% rise for others. Ms Forbes said this was a "progressive and restorative approach".

However, public sector unions criticised the move, with GMB Scotland saying it "won't amount to more than a tenner a week for most". The FDA described it as "a slap in the face to the very workers this government has publicly applauded".

And the EIS said the move was "an effective pay freeze" for teachers which would be met with "deep disappointment".

Business groups meanwhile welcomed many of the measures, but called for support - in particular on tax rates - to go further.

The Scottish Chambers of Commerce said the plans in the budget were "welcome, but do not go nearly as far enough as to avoid risk of widespread business collapse and job losses".

Chief executive Dr Liz Cameron said restrictions on firms had been "devastating", and that the three-month extension of rates relief was "too short a reprieve" to give certainty.

The Federation of Small Businesses echoed calls for the tax breaks to be extended to a full year, with policy chair Andrew McRae saying: "If we lose businesses in the jaws of this crisis, then bouncing back becomes that much harder."

CBI Scotland said Ms Forbes was right to put business support and economic recovery "front and centre" of the budget, welcoming the rates relief and income tax plans.

Director Tracy Black said that while "health must come first" and lowering transmission rates should be the government's priority, it was "only right that proper consideration is given to reopening the economy when it is safe to do so".

Related topics

- Published29 January 2021