Scottish Budget: careful canny or radical reform?

- Published

Kate Forbes' draft budget was mainly about stability in unstable times. Yet the result was some unintended giveaways to those who deserve them least.

With debt and deficits high, a consultation by the Scottish government brought forward ideas for using this opportunity to scrap some old taxes and replace them.

In normal times, a pre-election budget is a cue for Punch and Judy politics. It would conclude with a surprise reveal, with which the opposition would be battered.

But these are not normal times and Finance Secretary Kate Forbes isn't a natural at puerile puppetry or political pugilism.

Instead, her draft budget risked being a bit careful for the knockabout of election season. Careful, but canny.

There was a defence put in place against the charge that Scotland is the highest taxed part of the UK.

It is that for above-average earners, she said, but by a very narrow margin. Scotland has lower tax for lower earners.

There will now be a council tax freeze for next year, if councils prefer their share of £90m to taking the heat for raising bills more than 3%. That looks like a no-brainer.

Public sector pay

At the same time, the draft budget put defences in place against Labour's charge that lower-paid public sector workers are being let down.

Those earning up to £25,000 a year will get a pay rise at a minimum level of 3%.

Those on higher salaries will get a 1% rise, capped at £800 for those earning £80,000 a year or more, while separate negotiations are taking place on NHS workers.

The ceiling on pay is highly unsatisfactory for at least the GMB trade union but the SNP can say it is more generous than Westminster's.

Business support

And there's red meat there for the independence movement to chew on, in that the budget is constrained by Westminster in meeting the needs of businesses that are in financial distress because of lockdown.

Kate Forbes found funds for a three-month extension of the business rates holiday that has helped retail, hospitality, tourism and aviation get through the current financial year.

Business groups welcome that, but say it's not enough. They want the full year. So Ms Forbes point their demands towards UK Chancellor Rishi Sunak, who has the borrowing powers to get the money for a full year extension, and for the whole UK.

More progressive?

The Scottish National Party describes the budget as "progressive". That's a bold claim, when it's the better off who gain from some of these measures.

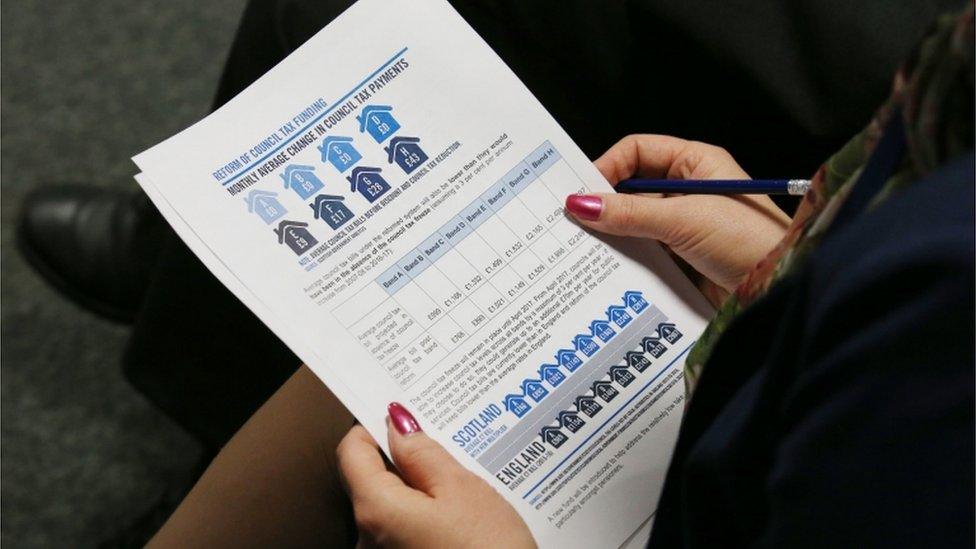

If you're freezing council tax, the savings are bigger for those in the bigger houses. Is that the most progressive way to spend £90m? No.

If you put up thresholds for income tax, it isn't much of a tax cut, but those who save the most are in the higher rate of tax.

The people who don't save anything are the part-time workers who don't make it to the £12,750 threshold for starting to pay income tax.

And if you make business rates free for all retailers and hospitality, it's the huge retail chains that stand to save the most.

Savings for supermarket chains were so large in the current year, when they've had some healthy trading, that they gave a lot of that money back. That refund is what's providing the money for the extension of the business rates holiday across April, May and June.

'Hated council tax'

A truly progressive approach would be to reform tax, but there wasn't much talk of that from Kate Forbes.

Only one element of Land and Buildings Transaction Tax is to come under scrutiny, and that's because of the unintended effects of an additional charge for those with two homes.

At 4% of value, it's a significant hit aimed at the well-off with holiday and investment properties. But it also hits separating couples when they are already under stress, and those who buy homes while intending to sell, but struggle to do so.

Some business lobby groups say that a holiday from business rates should become permanent. They say the system is no longer fit for purpose in a digital economy. The obvious place to look for a tax base instead would be from turnover, though that is much harder to pin down and collect.

Council tax was described as "hated" when the SNP came to office 14 years ago. They were going to replace it with a local income tax. It looked fairer, but on closer inspection, it also looked politically difficult.

So that hasn't happened. But tax experts are all agreed that it's idiotic to retain a system based on 1991 valuations of property, refusing to revalue because it's also politically awkward.

That's right: the council tax is still based on valuations set when the finance secretary was less than one year old.

Tax reformers point out that council tax is regressive. Higher earners and those with more wealth tend to pay a much lower share of their earnings or wealth in council tax than those on lower earnings or with little wealth. The system has been made fairer in recent years, but only slightly.

Then there's Land and Buildings Transactions Tax. There's no reason to tax people for buying property, except that it's easy to do.

In recent weeks, an idea has been floated for Westminster to recognise that exceptional times call for radical changes.

The economically efficient thing to do, as floated in the press, would be to scrap both council tax and transactions tax/stamp duty, and move to raise the same amount of money from a single property tax based on the value of the property.

If Westminster moves in that direction, there would be pressure on Holyrood to do likewise.

Yes, there would be winners and losers. And among the losers would be people in big houses with low income.

No politician wants to tax granny out of a big family home she has occupied for many decades. But heartless economists would be ready to do so, throwing in incentives for her to move to an agreeable retirement community, thus freeing up space for families who need more space.

Sticks and carrots

Is this the right time to be talking of such big changes? It could go either way. The level of dislocation of normal economic activity makes this the perfect time to shake things up.

But the Kate Forbes approach, on this week's evidence, is that this is the perfect time to provide some tax stability and reassure people.

Such arguments were made in a consultation the Scottish government held last autumn, from which the results have just been published. It sought opinion on tax reform. There were not many responses. It's a big, daunting subject.

Some individuals took the opportunity to demand more tax powers for Holyrood. Others wanted more tax of the wealthy.

Groups and campaign bodies thinking seriously about tax reform often want to see it used more progressively or more effectively to create tax sticks and carrots around the environmental agenda.

So there were responses to the consultation suggesting higher charges for road use, to push people into either less travel or more use of public transport.

Though not a choice for Holyrood, it is pointed out that the lower rate of VAT on household fuel, at 5%, is not much of an incentive to reduce its use, when that is one of government's main environmental objectives.

The National Trust for Scotland responded to St Andrew's House: "…this budget represents an opportunity to secure a green recovery for Scotland… [and] better define what we consider 'public goods' and how these are funded." ('Public goods' include a cleaner environment and less pollution.)

"It also provides opportunity to use tax proposals to protect the creative industries and tourism sector, as well as encourage market activity and consumer behaviour that contribute towards carbon net-zero and biodiversity targets."

Others point out that there is a reckoning ahead for the high level of debt and deficit built up in the past year. Those who argue for Scottish independence have further reasons to want to address deficit challenges.

If the tax burden is going to increase, then there's a need to raise it fairly and efficiently, and that points more towards the case for reform rather than stability.

The academics of the Royal Society of Edinburgh argued: "As far as possible, the economic recovery should focus on achieving sustainable regeneration of the economy while also addressing strategic priorities which aim to reduce inequalities and create a more resilient economy.

"In some ways, the crisis presents an opportunity to address the problems and inequalities within the current system."

If they're right, it's over to the manifesto writers for the Holyrood election.

Related topics

- Published28 January 2021