'Vicious circle' for people pushed to wrong debt help

- Published

Cassandra ran up thousands of pounds of debt as she tried to make ends meet.

Some debt management companies are profiting from entering people into the wrong debt solutions and pushing some into further financial hardship, a BBC Disclosure investigation has found.

These companies are receiving payments for passing clients on to insolvency practitioners who then charge fees.

Three years ago, Cassandra Naylor was raising three young children on her own and was struggling to cope.

She ran up thousands of pounds of debt as she tried to make ends meet.

"I would pay gas and electricity with a credit card, and then couldn't pay the card back," she said.

"If I paid the credit card one month, I'd need to use it a week later because I didn't have the funds in the bank to cover the rest of the bills.

"It was a vicious circle all the time and I hit breaking point."

Alternative to bankruptcy

Drowning under the stress of unaffordable debt, the 30-year-old, from Wishaw, went in search of help online.

Within hours of typing in key words relating to debt help, she found her social media feed bombarded with adverts for debt packaging companies.

She contacted one which was making big promises to help with her situation and soon entered into a popular debt solution that is an alternative to bankruptcy - a Protected Trust Deed.

What Cassandra did not realise was that the company would receive £1,000 "referral fee" simply for passing her details on to a Trust Deed provider.

Over the next two years, Cassandra made more than £2,000 in payments to the company overseeing the Trust Deed.

She thought she was making good progress in paying back what she owed.

But when she received an interim statement from the company, she realised how little of her money had actually gone to paying off her debt.

Those she owed money to, she discovered, have received less than a penny for every pound she had paid in.

The bulk of her money has gone to the Trust Deed company in fees - including paying for admin, stationery and postage - rather than paying off her debt.

What is a protected trust deed?

A Protected Trust Deed (PTD) is an insolvency solution in Scotland. It is similar to an Involuntary Arrangement (IVA) in England and Wales.

It is the most common type of insolvency solution in Scotland. Almost 5,500 people went into Trust Deeds in the last financial year, which is nearly double the number entering bankruptcy.

An insolvency practitioner controls the Protected Trust Deed and it means creditors cannot chase the person in debt for payments.

The debt is consolidated and the client pays a reduced amount to the Trust Deed provider every month.

It is regarded by finance experts as a good solution for those with a reasonable disposable income who can afford to pay a regular amount.

It normally lasts four years, after which the Trust Deed completes, and a significant portion of what is left of the debt is written off at the end.

'Prioritising profit'

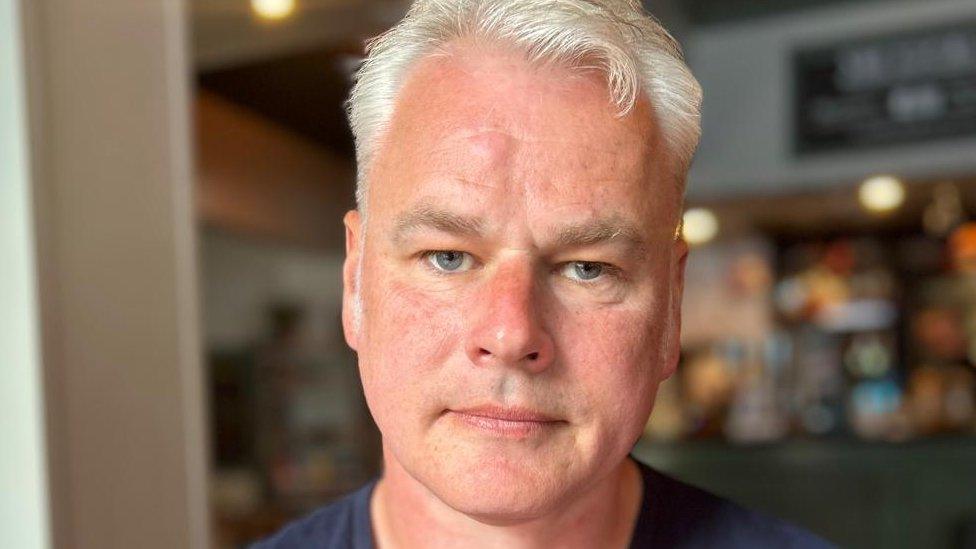

Ged Mulvey, from Money Advice Scotland, said he had concerns about the industry in Scotland.

He told the BBC that certain debt packager companies were "prioritising profit" by receiving referral fees for passing clients on to insolvency practitioners who then charge fees.

"I've been in this job for 11 years and I still don't understand how people can make money from people who don't have any money," he said.

Mr Mulvey said the financial incentive of signing someone up to a Trust Deed means people are often being directed towards this solution when there are other debt solutions which may be more appropriate or cost them less money.

One downside of a Trust Deed is that if the debtor does not keep up with payments, the Trust Deed can fail.

When that happens, none of the debt is written off and the person in debt is back to where they started, even if they have paid out thousands in fees to the Trust Deed provider.

Ged Mulvey, from Money Advice Scotland, said he had concerns about the industry

As part of the BBC investigation, Ged Mulvey examined Cassandra Naylor's paperwork and said she should never been signed up to a Trust Deed in the first place.

He said: "I know there's good people out there, doing these Protected Trust Deeds, and they're good, they are the right solution. But this is just shocking.

"There's so many people out there who could have helped this woman. She's basically been left with £6,000 worth of debt, and paid two grand for the privilege."

It is illegal to take money from someone's state benefits to pay into a Trust Deed. This is because benefits don't leave enough disposable income to keep up with the regular payments.

Cassandra said: "I told them I was on benefits, when I got it, how much, and what benefit it was.

"I didn't really have other incomings. My partner and my family helped, if and when they could."

That extra money was classed by the debt company as private income and meant she could be signed into a Trust Deed.

The company managing her Trust Deed then changed hands and said she should not be on one because she is on benefits.

Cassandra is now in limbo and does not know whether her debt will be wiped or she will be back to square one.

Inconsistent advice

BBC Scotland's Disclosure programme spoke to several companies operating in Scotland.

Reporter Sam Poling posed as a single mum of two who was out of work and on benefits.

Some companies told her that a Protected Trust Deed would not be appropriate for someone in that situation and pointed her towards debt charities offering free advice who could help.

Others advised that being on benefits would not exclude her from signing up to a Trust Deed and suggested irregular payments from her children's father could be classed as private income.

One company, Debt Help Group Ltd based in Glasgow, is currently on the Financial Conduct Authority's warning list of unregulated companies the public should avoid.

When Poling contacted Debt Help Group Ltd looking for help for debt, her details were passed on to another debt company without her knowledge or consent.

Debt Help Group Ltd told us they "remain in dispute with the FCA".

They are "challenging the entry" on its warning list and they state they are "exempt" from FCA regulation as "Debt Help Group is a trading style" of an insolvency practitioner company.

With regards the passing on of customer details to other companies, they said "information is only passed with the customer's consent" and "Debt Help Group Ltd will not sell the customer's data".

Change is coming

The Financial Conduct Authority (FCA), which regulates the financial services industry, says vulnerable people have been taken advantage.

It announced on 2 June that it was banning debt packager companies from receiving referral fees from October.

Sheldon Mills, executive director of Consumers and Competition at the FCA, told BBC Scotland's Disclosure programme: "We will be supervising the markets so we will be able to seek and detect whether or not these firms are trying to morph into some other type of practice and our action doesn't stop with a ban. We continually monitor the market in order to do our best to protect consumers."

Insolvency practitioners who oversee Protected Trust Deeds are exempt from FCA regulation.

That means they will still be able to charge the person owing debt fees for overseeing the Trust Deed.