Council tax freeze planned for Inverclyde

- Published

Inverclyde Council has announced plans to keep basic council tax bills frozen, after the national council tax freeze ended this year.

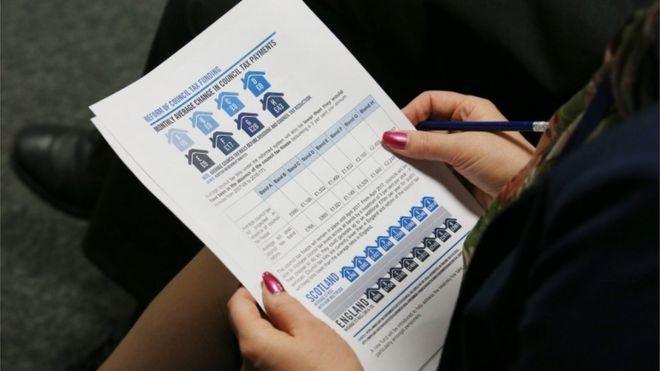

Those in Band E-H properties will still see their bills rise because of national changes.

The council's cross-party budget working group said it wanted to avoid adding to the burden on households already facing potential rises.

A decision on the council tax will be taken by the council next Thursday.

Inverclyde Council is led by Scottish Labour but it does not have a majority.

It is the second Scottish Labour council to say it intends to freeze the basic council tax bill.

South Lanarkshire has also said it plans to do this but has not yet taken a formal decision.

The Inverclyde budget working group said there would be no fresh cuts to local services on top of those already agreed in a two year deal last year.

The group said the council was facing a reduction of nearly £5m in its grant from the Scottish government, but planned to use the council's reserves to plug the gap.

A statement from the group said: "The group had considered closing some of the budget gap with a 3% council tax rise for all council taxpayers as recommended by the Scottish government.

"However, on balance, members of the group decided against this.

"They are conscious that 7,000 households in Inverclyde already face potential rises of between 7.5% and 22.5% and did not wish to add to the burden on these families."

"Members of the group recognise that if the Scottish government continues to cut the council's funding year on year a rise in the basic level of council tax is inevitable next year and every year thereafter."

ANALYSIS - By BBC Scotland's local government correspondent Jamie McIvor

So far two councils have said they are likely to freeze the basic council tax - and both these councils are led by the Labour Party.

Their argument is that they do not want to pass the impact of what they say are government cuts onto local council tax payers.

Instead they will find other ways - such as their reserves - of minimising cuts.

So far other Labour-led administrations including Glasgow and West Dunbartonshire have indicated a 3% rise is likely. Some others have given no public indication of intent.

Any Labour-led administration which freezes the council tax leaves itself open to political attack.

SNP supporters could argue that a council can hardly complain about the amount it is getting from the government if it does not raise the council tax.

Anti-austerity campaigners could also claim that any council which claims to oppose cuts should at least try to use council tax rises to limit them.

If a significant number of Labour-led councils opt to freeze the council tax, it could leave the party nationally open to some criticism.

On the other hand, local administrations may retort that they are trying to do their best to help tight family budgets - ironically an argument made by government supporters in previous years to defend the national freeze in the face of criticism from some Labour councillors.

One consideration, of course, for all councillors across Scotland is that the council elections are just three months away.

Locally might a continuing freeze prove popular? Especially when those in high band properties face automatic increases because of national changes to the system.

- Published8 February 2017

- Published16 January 2017