Hope for gold mining potential in Argyll's Glen Fyne

- Published

Scotgold is "encouraged" by the tests it has carried out near the village of Cairndow

A village in Argyll could become a new focus for Scotland's gold-mining industry.

Scotgold Resources said it was encouraged by tests of soil samples from Glen Fyne, near the village of Cairndow.

The firm described the results as "exciting, new and potentially significant".

Scotland's first commercial gold mine, close to Tyndrum, is forecast to make £147m in pre-tax earnings.

The samples from Glen Fyne are said to be far more promising than equivalent tests for the existing mine.

Scotgold said they were three times better for gold, and nearly as twice as good for silver.

It is not clear how extensive the precious metal deposits could be.

Geological anomaly

But a sampling of stream sediments showed promise of this being "anomalous", meaning gold could be present, and that the area could be 3km (1.9 miles) long.

The Inverchorachan area, which is as close as 5km (3.1 miles) from Cairndow, is described as a geological anomaly.

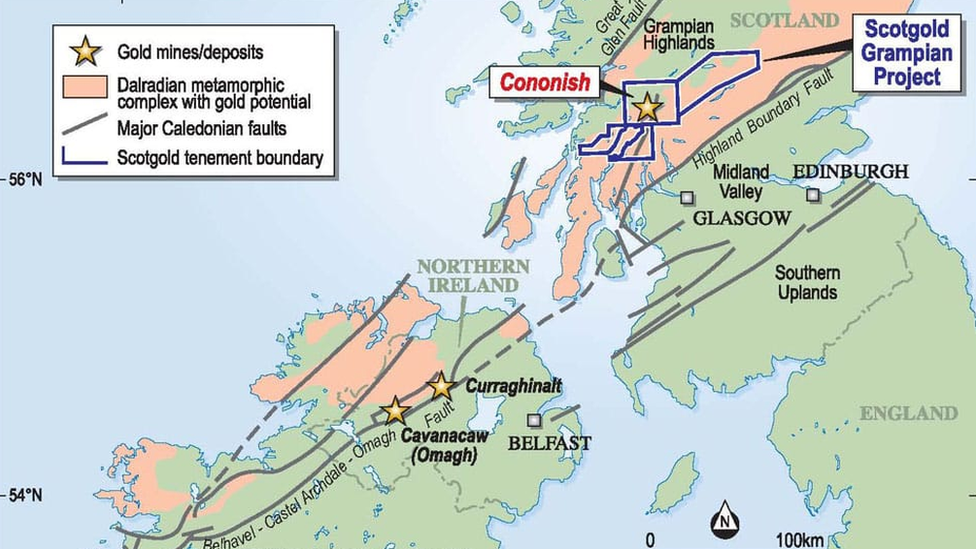

It is linked through the "Tyndrum fault" to the existing mine at Cononish.

The company is exploring the gold mining potential of several sites

The start of commercial production at Cononish, 12 years after Scotgold's work began on prospecting there, has been delayed from next December to February, due to the late delivery of equipment.

But with gold prices higher than previously forecast, the company is now assuming a market value of £1,200 per ounce of gold. That does not allow for a premium on Scottish gold, which it received for its first, small-scale batch.

The firm has reworked its financial prospects, telling investors they could see earnings of £147m over the lifetime of the Cononish mine.

That's up from the previous earnings forecast of £101m. The figures assume capital costs of £27m and operating costs of £73m.

Richard Gray, the company's chief executive, told investors: "The combination of the gold price being in excess of £1,200 per ounce, and the pipeline of projects that we anticipate will result from our Grampian exploration work, bode well for the company's long term outlook."