Carrying on banking

- Published

The HBOS story comes with a fine cast of characters and a compelling script

Imagine an Ealing comedy of our time - a very British fiasco in which a gang of blithering incompetents take part in an elaborate reverse heist.

They take over the running of a bank and proceed to throw colossal amounts of money out the door, unclear where it's coming from or what they're going to do to get it back.

Pick a fine cast of character actors; a greedy, ambitious Yorkshireman who thinks he's the brains of the outfit: the amiable toff, who's nice but dim: the quiet Scotsman who appears, wrongly, to be good with numbers: the impressionable younger one who blunders in off the street and is handed control just as events are about to blow up in their faces.

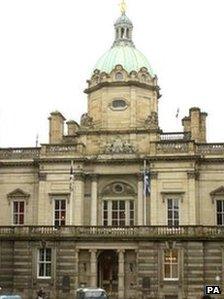

They rent a place on the Mound in Edinburgh from a little old lady who owns a would-be guard dog.

It could rumble them, but is too easily intimidated or distracted into running off in the wrong direction. In any case, its teeth are rotten.

You're imagining 'HBOS: the movie". It's a story that leaps off the pages of the report of Parliament's Banking Standards Commission, issued today.

Lights, camera, lending

I've read many pages of reports and analysis of what went wrong in the Great Credit Crunch and Banking Crash. This one stands out as a cracking page turner.

It's partly because its authors - MPs and members of the House of Lords, improbably including the new Archbishop of Canterbury - have an unsparing turn of phrase, of which more later.

It's also because they've made this a story about the people at the top of Halifax Bank of Scotland, and their individual and collective roles in driving it spectacularly over a cliff.

And it's because the story, once stripped down to its essentials, is quite a simple one.

As they put it: "Whatever may explain the problems of other banks, the downfall of HBOS was not the result of cultural contamination by investment banking. This was a traditional bank failure pure and simple. It was a case of a bank pursuing traditional banking activities and pursuing them badly."

Really badly.

Can't say 'no'

The new material in this report is in the figures. We knew they were big. But did you know they were this big?

The Commission reckons shareholders lost 96% of the company's value, and only saved the remnant because the Government stepped in.

HBOS losses between 2008 and 2011 ran to £46bn. Break that down, and you find the corporate division, led by Peter Cummings, has had to face up to £25bn in impaired loans. That's a fifth of everything on its books.

You may recall that Cummings was reported saying, in October 2007: "Some people look as if they are losing their nerve, beginning to panic even in today's testing property environment; not us."

He had, by this time, moved HBOS from, in 2002, having the biggest single name loan under £1m, to a position where nine individuals had loans in excess of £1bn. The focus was in the most vulnerable areas: commercial property, hospitality and retail.

The Commission's verdict: "The picture that emerges is of a corporate bank that found it hard to say 'no'."

Big bad loans

But the problems were not limited to his division. HBOS set off for Australia, aggressively. There, it lost 28% of its loan book, or £3.6bn. Likewise, it went into Ireland, where it lost around £11bn, or 35% of loan value.

Anglo Irish Bank was the stand-out catastrophe in Ireland, with 48% losses, but HBOS was second worst by a wide margin. The much-maligned Royal Bank of Scotland, through its Ulster Bank subsidiary, took half the scale of loss of its Edinburgh rival.

In HBOS's retail division - the mortgage-based business at which Halifax had long been market leader - the damage wasn't nearly as bad. The Commission reckons impairments in the three years after collapse came to £7bn, out of £255bn.

(Note: that's with a more benign residential housing market than in, for instance, commercial property, but the housing market correction probably hasn't ended yet).

Overall, HBOS is reckoned to have sustained 10.5% losses on the £435bn loan book it had, pre-crash, in 2008.

The comparable figure for RBS is £8bn lower - that is, £37bn. At 5.1%, that's less than half the scale of HBOS losses.

It's worth noting, while mentioning RBS, how different the two collapses were. They were both about greed for growth, ambition and unmanaged risk, but the Royal Bank story was one of an over-dominant individual and a vast organisation mired in over-complexity which no-one understood; HBOS was about a group dynamic that failed at doing the really simple stuff that anyone should have understood.

"Wildly ambitious"

So what had gone wrong? In the words of the bank's own finance director in 2004, it was "an accident waiting to happen" - words which no-one seemed to do anything about.

The Bank of Scotland headquarters building in Edinburgh is a location waiting to be filmed

There was the wrong culture: it was brash in pursuit of a "wildly ambitious growth strategy". There was a lack of controls for risk: "The risk function was a cardinal area of weakness," and this was "a matter of design, not accident". No-one stayed long atop the risk management division: instead, ambition took them up the career ladder and off to the moola-making divisions.

There was a lack of controls of different divisions from the centre, and of the necessary banking skills at the top. Andy Hornby came in from retail, having been at Asda; other key figures were from insurance. The top team were "incapable of even understanding the risks that some elements of the business were running, let alone managing them".

Shareholders and ratings agencies failed to spot what was going on, or to provide a challenge to management.

And there was a lack of oversight from the regulator, the Financial Services Authority: it was "thoroughly inadequate... not so much the dog that did not bark, as a dog barking up the wrong tree".

Underlying this report is an implicit challenge to the successor regulator to the defunct Financial Services Authority, which has yet to publish its own report into HBOS: produce a robust report like this one, rather than the bland one produced by the FSA on the Royal Bank.

Brash and corrosive

And what of the individuals in this extremely expensive Ealing comedy production? It's understood that Peter Cummings is comfortable with the findings. That's not surprising. He's the only person in the entire banking fiasco who had already been punished by the regulator, with a £500,000 fine.

This report doesn't let him off the hook, but it impales others alongside him. And it calls for powers for regulators to punish former directors, rather than accepting an assurance that they're off quietly to spend more time with their pensions, and, er, not to worry, chaps, they won't be troubling the financial sector again.

Sir James Crosby, although he retired in 2006, is hauled back into the frame, taking the blame for "sowing the seeds of the bank's destruction" by his ambitious growth strategy, and with a "brash" and "corrosive" culture.

Andy Hornby exited finance with the crash, and soon turned up on £1m-a-year as head of Alliance Boots (the chemists), before shifting to Gala Coral, the leisure-to-bookies firm.

He's no longer being dismissed as the poor guy who jumped on board when it was too late to stop the train wreck. He "proved unable or unwilling to change course", and is placed firmly in the stocks of shame.

But there's a special place there for the one man who was chairman of HBOS, from wildly ambitious beginning to sticky end: "Lord Stevenson has shown himself incapable of facing the realities of what placed the bank in jeopardy from that time until now".

The report goes on: "The corporate governance of HBOS at board level serves as a model for the future, but not in the way in which Lord Stevenson and other board members appear to see it. It represents a model of self-delusion, of the triumph of process over purpose".

And having reported, incredulously, that the deputy chairman, Sir Ron Garrick, thought HBOS to have been blessed with "by far and away the best board I ever sat on", the report concludes:

"Membership of the board of HBOS appears to have been a positive experience for many participants. We are shocked and surprised that, even after the ship has run aground, so many of those who were on the bridge still seem so keen to congratulate themselves on their collective navigational skills".

There is "profound regret" that the FSA failed to find punishments to fit the incompetence and wrong-doing in Scotland's two biggest banks.

The Banking Standards Commission has demonstrated, however, that ridicule isn't such a bad substitute.

- Published5 April 2013