Grameen beats first-year lending target

- Published

A scheme which lends small amounts of money to small businesses and new start-ups has beaten its own target in its first year.

Grameen in the UK, the micro-lending initiative facilitated by Glasgow Caledonian University (GCU), has issued more than 100 loans.

It is the first such Grameen-style scheme in Western Europe.

Grameen aims to alleviate economic, health and social inequalities in some of Scotland's poorest communities.

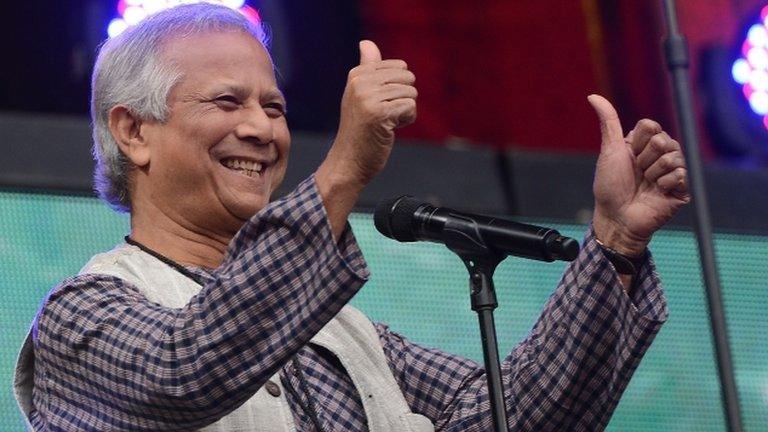

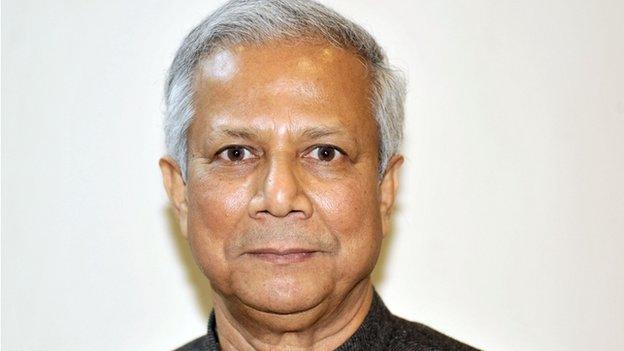

The original Grameen bank was founded in Bangladesh in the 1970s by Nobel Prize winner Prof Muhammad Yunus.

Grameen in the UK offers small loans, initially of £1,000, for up to 52 weeks to new start-ups and existing small businesses currently not served by any financial services.

The model has been used in developing countries to support entrepreneurship and alleviate poverty, and in many cases to empower women.

However in the UK, currently 60% of Grameen's borrowers are men.

The venture is backed by a number of funders including Tesco Bank.

The original Grameen bank was founded by Nobel Prize winner Prof Muhammad Yunus

Grameen in the UK chief executive Kevin Cadman told BBC Scotland the scheme had helped a whole variety of different businesses from hairdressers to markets stalls, from food to clothing retailers.

He said: "For one reason or another they weren't able to raise money through the normal banking system.

"Our model is based on relationship and trust. I always say it is a bit like what banking was 30 years ago. We don't credit score, we don't do background checks, we don't take security, we lend to the individual and we want to get to know the individual.

"So as the business grows, we will lend more money and we will support that individual in growing their business to generate more income for their family."

The UK scheme has now secured additional financial backing of £250,000 over next three years from the Whole Planet Foundation - part of Whole Foods Group - to fund new client loans.

The Moffat Charitable Trust has also granted £45,000 to fund the operational costs of moving services into Ayrshire.

The aim of Grameen UK is to have a chain of branches across the UK over the next few years but, more immediately, it has a target of issuing 500 loans over the next year.

- Published19 October 2012