Scottish businesses welcome plans for business rates review

- Published

Scottish business groups have welcomed plans for a review of business rates north of the border.

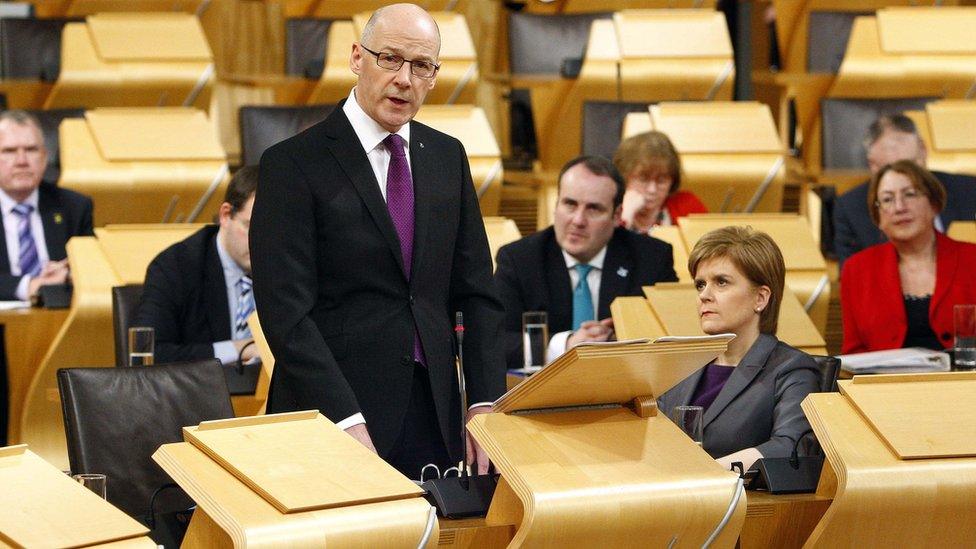

The move was announced by Finance Secretary John Swinney in his draft budget.

The Scottish government said the review would help to ensure that Scotland's system of business rates "minimises the barrier to investment".

However, some business groups expressed concern at proposals to increase rates paid by larger firms.

Mr Swinney said he was planning a "modest increase" to the Large Business Supplement in order to maintain the Small Business Bonus Scheme, which offers rates reductions for small firms across Scotland.

He also said he was asking Scotland's biggest businesses to pay more in order to support investment of £345m in research and innovation and £1bn of investment in higher education.

'Great opportunity'

Scottish Retail Consortium director David Lonsdale said: "We are delighted that the Scottish government has listened to the retail industry and the growing chorus from across business and commercial life in Scotland who have spoken up in favour of fundamental reform of business rates, and we very much welcome the promised review of business rates.

"The review heralds a great opportunity to recast business rates for the decades ahead and we look forward to working with the government to ensure the reformed system is modern, sustainable and competitive.

"Business rates are set to generate almost £2.8bn in tax revenues next year, up from £2.1bn just six years ago.

"A fundamentally reformed rates system and a substantially lower tax burden would increase retailers' confidence about investing in new and refurbished shop premises, create more jobs and help revive high streets."

He added: "The hike in the large firms rates supplement is concerning, and it now appears that larger firms operating in Scotland will be paying more in business rates than firms operating in comparable premises down south.

"That would be a departure from the pledge to keep rates here at the very least in line with the rest of the UK, and undermines claims to have the most competitive rates regime in the UK."

'Piecemeal promises'

The Scottish Chambers of Commerce said that while the Scottish government had "sensibly refrained from making changes to the Scottish Rate of Income Tax for the coming year, it is notable that businesses have once again become a target for tax rises in Scotland".

Chief executive Liz Cameron said: "The Scottish Government's plans to raid Scottish businesses to provide a further £130m in business rates next year does not sit well with its stated aims of supporting growth, jobs and exports.

"The deputy first minister also promised a review of business rates in Scotland and we welcome this.

"Scottish Chambers of Commerce has been calling for a genuine and fundamental review of business rates since the last revaluation in 2010.

"Previous government promises to review this tax have been piecemeal and ineffective and we will hold them to account on this latest pledge."

- Published16 December 2015