Personal insolvencies in Scotland 'return to trend'

- Published

Personal insolvency numbers have returned to "relative stability" in Scotland following the introduction last year of new bankruptcy legislation, according to officials.

Accountant in Bankruptcy, external (AiB) reported 2,405 insolvencies between April and June - 7.8% up on the previous quarter.

There were 1,144 bankruptcies, which was up 14.7% on the previous quarter and 51.1% more than a year ago.

However, AiB said the figures showed a "return to trend".

A year ago, the number of personal insolvencies in Scotland fell to its lowest level for more than 14 years following the introduction of the Bankruptcy and Debt Advice (Scotland) Act.

The legislation introduced new measures such as mandatory money advice for people seeking access to statutory debt relief solutions such as sequestration.

Although the latest bankruptcy figures were sharply up on a year ago, they were 41.7% lower than the same quarter in 2013-14 and 34.9% lower than in 2014-15.

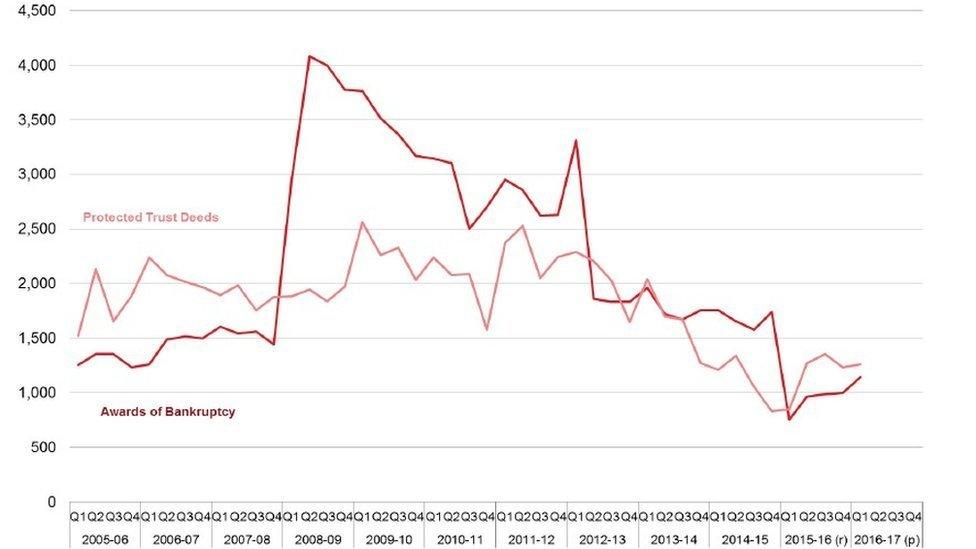

Personal insolvencies include both bankruptcies and protected trust deeds (PTDs).

The number of PTDs recorded between April and June remained largely stable at 1,261, a 2.1% increase from the previous quarter.

New debt payment programmes approved under the Debt Arrangement Scheme (DAS) fell slightly by 5.2% on the previous quarter, to 510.

Quarterly figures for bankruptcies and PTDs since 2005-06:

Source: Accountant in Bankruptcy

Business Minister Paul Wheelhouse said: "These figures indicate that people are becoming more accustomed to the new insolvency legislation and processes.

"We are now seeing the numbers settling down to a more regular pattern following the significant, and expected, drop after the introduction of the new laws.

"Compared to the same quarter from two years ago, prior to these changes, the number of people falling into insolvency today is down by more than a third.

"This shows those most in need can access the debt relief they require to help them on the road to a fresh financial start - but also that the long term movement is a downward one."

Eileen Blackburn, from insolvency trade body R3, said: "This quarterly rise, driven mostly by an increase in bankruptcies, bucks the wider downward trend in Scottish personal insolvencies we've seen in past years.

"The number of insolvencies have been falling steadily since their peak in 2012, and this quarter represents a return to more stable levels.

"The rise is probably less do with the EU referendum result, which only happened towards the very end of the quarter, and more to do with ongoing difficulties in the Scottish economy and the end of the financial year in March."