Clydesdale Bank posts first annual profit in five years

- Published

The Clydesdale and Yorkshire banking group (CYBG) has reported its first statutory profit for five years in its maiden annual results.

CYBG, which demerged from former owner National Australia Bank in February, posted pre-tax profits of £77m for the 12 months to 30 September.

This compared with a loss of £285m the previous year.

On an underlying basis, pre-tax profits for the Glasgow-based group rose by 39% to £221m.

CYBG described it as a "landmark year" for the bank.

Analysis by Douglas Fraser, BBC Scotland business and economy editor

The first full-year results from the newly-independent CYBG are mercifully short on the 'noise' that has been afflicting its larger rivals, as they set aside colossal amounts for legacy costs and litigation.

The Clydesdale left that burden behind in Melbourne, before being floated by National Australia Bank. So it should have more management headspace to look ahead and act nimbly, to establish itself as a significant challenger to the dominant players.

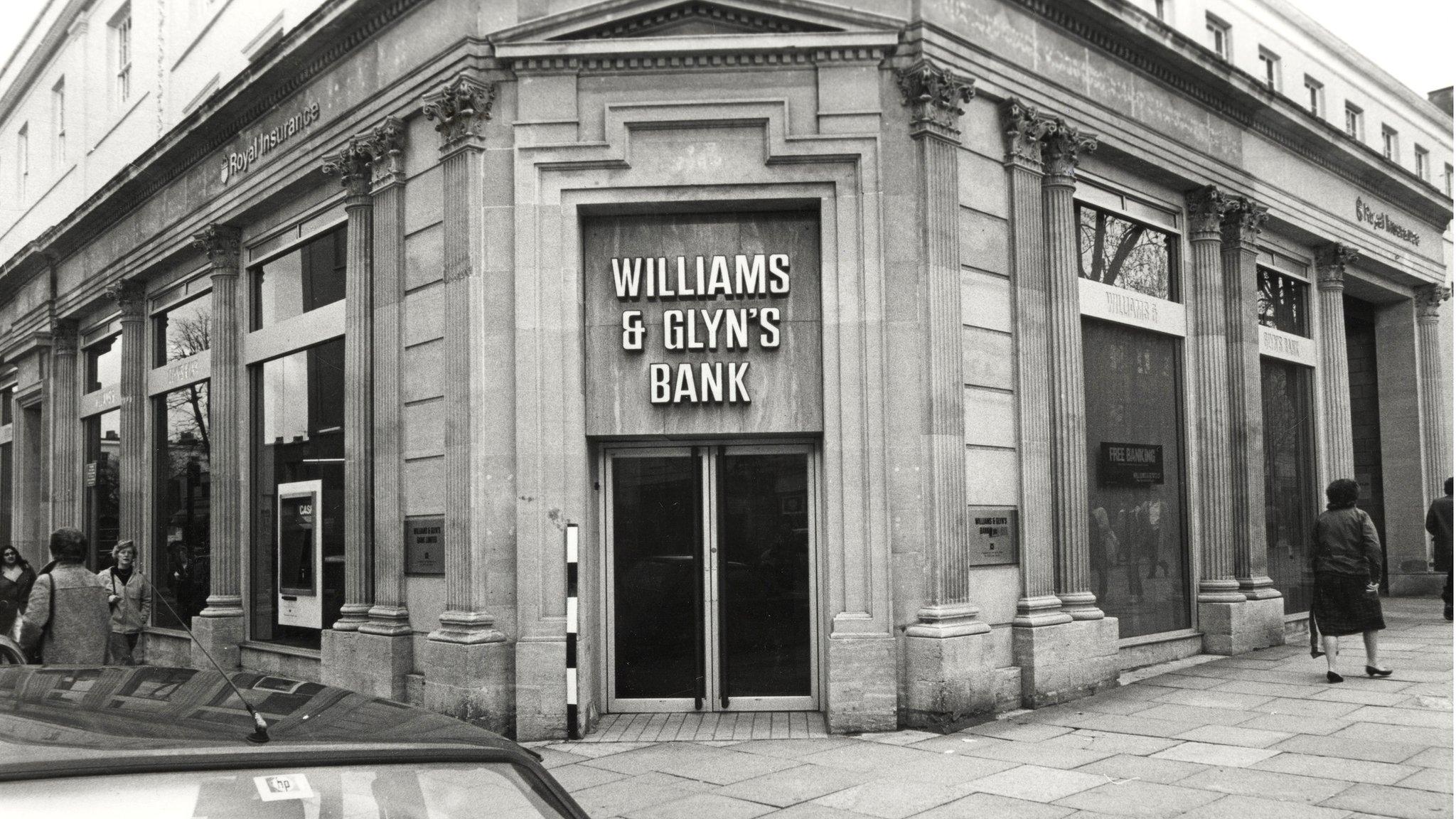

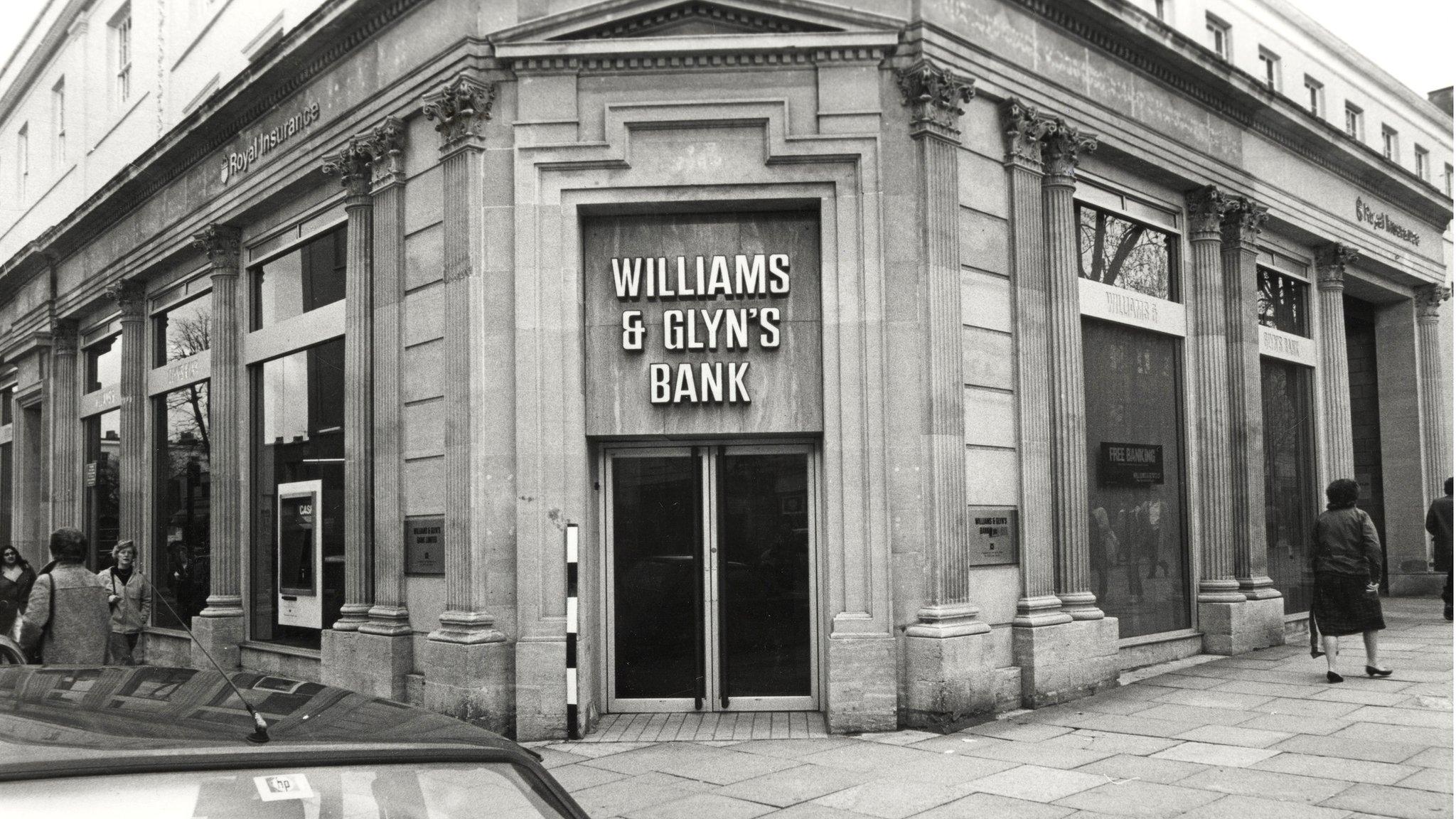

The talks on buying the Williams & Glyn division of RBS - carved out and put on the market to meet a European Commission requirement - remain shrouded in legal secrecy.

If it gets to a deal, that could be a game-changer. There's a question of price, of course, but also the conditions CYBG can place on RBS for continuing IT glitches and costs (already eye-watering) and whether the Glasgow-based bank can carve out only the bits it wants.

The only clear public message about it is that any deal will have to meet strict strategic criteria, as would other acquisitions. "We're very calm and totally strategic," says the chief executive. "We're not into anything ad hoc."

CYBG already has a footprint in Scotland and Yorkshire. There are opportunities to push into other parts of England, with new flagship branches planned for Manchester and Birmingham.

Chief executive David Duffy reels off impressive statistics on improved customer satisfaction and employee engagement. A lot is pinned on the 'B' app, launched in May, which uses artificial intelligence to offer reactive advice on the customer's spending profile. We're told it has got off to a very strong start with customer satisfaction.

It's a modest start though, having 30,000 users so far. Such technology is expensive. A ratio of costs to income of 74% is expensive by industry standards.

The share price since February tells us that CYBG has got off to a good start. To make sense of its ambitions, it also has to build scale.

CYBG grew its mortgage lending by 6.5% over the year. CYBG also saw growth in loans to small businesses for the first time in four years, with more than £2.2bn of new loans and facilities made available.

The group said it had seen a "limited" impact on its business from the Brexit vote.

But it added that prolonged lower interest rates - following the cut to 0.25% in August - would put pressure on its interest margins, which would be only partially offset by the Bank of England's low-cost funding scheme for lenders.

The bank reported it had not increased cash set aside for payment protection insurance (PPI) compensation, despite the recent move to put back the deadline for claims by a year.

Cost savings

Last month the group confirmed it had made an offer to buy Royal Bank of Scotland's 300-strong Williams & Glyn branch business, after Santander pulled out of talks.

However, CYBG is also cutting jobs and shutting branches as part of a drive to cut costs by an extra £100m.

It said in September that it would trim its branch network further, from 248 to less than 200 over the next three years.

Alongside the cost savings, it is investing more than £350m over the next two years on improving its online banking offering and boosting technology platforms.

CYBG chairman Jim Pettigrew said it had been a "landmark year" in the long history of the bank.

He added: "Our ambition is straightforward: to become the credible alternative to the big UK banks."

Shares in CYBG were down by about 4% in early trading, although the stock has risen by nearly two-thirds since its demerger in February.

- Published26 October 2016

- Published25 October 2016