Johnston Press announces £300m pre-tax loss

- Published

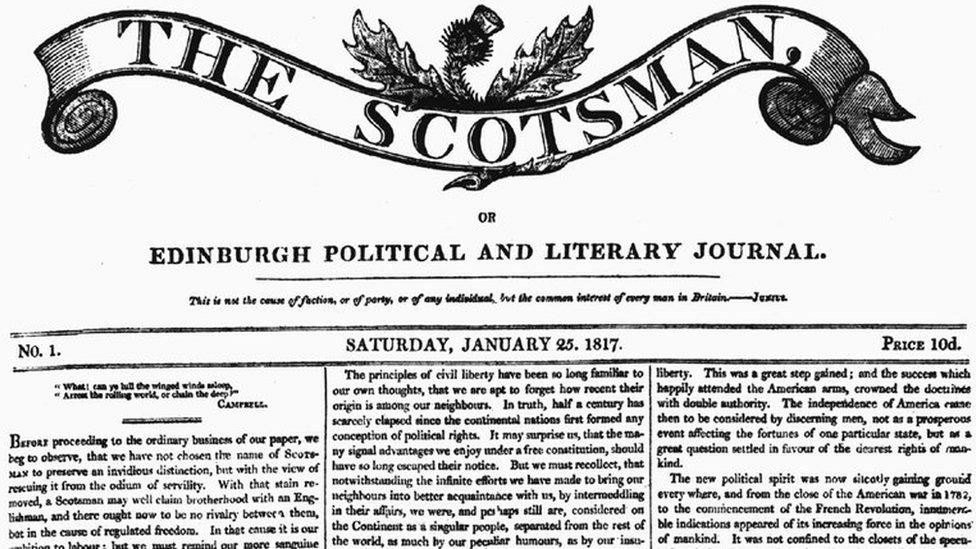

Johnston Press, publisher of The Scotsman, Yorkshire Post and 'i', has announced a pre-tax loss for last year of £300m.

The valuation of its titles has been slashed in two tranches over the past year.

With its half-year results, it announced a write-down of £224m. To that, it has added a reduction of £120m with its full-year figures.

Company assets are now worth less than half of called-up share capital.

By law, that means it has to summon a special shareholder meeting in the next four weeks to discuss how it should respond.

An activist investor fund, Crystal Amber, has been pushing for changes to company strategy, while building up a stake of more than 20% of Johnston Press shares.

Viability statement

The share price dropped 9% after the annual results were published.

An additional challenge in the results was a large increase in pension liability, up from £27m to £68m in the past year.

In a "viability statement", company directors have set out the risk of insolvency if trading patterns from last year are continued until 2019. That is when £220m of bonds are due to be re-financed.

They concluded that they have a "reasonable expectation" of being able to continue in operation and meet liabilities, but that is subject to many uncertainties.

The i newspaper was said to have "bucked the trend"

Johnston Press is based in Edinburgh, where it publishes The Scotsman. In addition to 'i', it is also owner of the Yorkshire Post, the Northern Ireland News Letter and nearly 200 local titles.

It has sold some papers in Ireland, the Isle of Man and East Anglia, to raise funds with which to lower debt, having borrowed heavily to expand before the financial crash. It has stopped actively looking to sell titles.

Last year saw a continued decline in advertising revenue for the company, down by 18%.

Hopes that digital revenue would replace print advertising were undermined by a small decline also in those digital sales, mainly due to a "very difficult summer".

This was most notable in job advertising, mainly by small and medium-sized enterprises, and down 27%. Johnston Press believes the sharp fall in the third quarter of last year was due to uncertainty following the Brexit referendum.

However, it said there were improving trends in more recent months.

'Significant downward pressure'

Print advertising was down from £149m to £123m in 2016. Digital advertising remained below £19m.

Costs continued to be cut, to £179m, down £26m on last year, and by £100m since 2012. Following major cuts in journalist numbers, last year saw 200 jobs going in sales and distribution.

Other costs include the £20m annual cost of servicing the debt, and £10m extra for pensions.

There was an operating profit of £42m, but the major revaluations took the pre-tax statutory loss to £300m.

Readership was up, including online and mobile users of its 173 websites, rising from 19.5m monthly unique users in 2015 to 22.5m last year. Links through Facebook also drove viewers to its news stories in fast-increasing numbers.

The company bought the 'i' newspaper in April last year, for £24m. It helped boost circulation revenue by 11% to £80m. However, not including 'i', circulation revenue was down 9%.

Ashley Highfield, Johnston's chief executive, said: "Despite an industry-wide backdrop of significant downward pressure on revenues, the actions we have taken to pilot the business through this rapidly-changing market and create the conditions from which to create growth are starting to bear fruit.

"Circulation figures of key titles are improving, the 'i' has bucked the trend of declining national newspaper sales".

He said digital advertising had returned to growth in the first quarter of this year, and argued that advertisers would be attracted to more conventional news publishers, following controversies around advert placing next to unacceptable material and fake news.

- Published3 February 2017

- Published25 January 2017