RBS court battle with investors adjourned again

- Published

The majority of claimants suing Royal Bank of Scotland at London's High Court have indicated a willingness to settle the action, a judge has been told.

RBS has been trying to reach a last-minute settlement with thousands of investors who say they were misled over the bank's financial health in the run-up to its near-collapse in 2008.

The civil case was due to begin on Monday.

But it was adjourned to allow settlement talks to continue.

On Tuesday, Mr Justice Hildyard granted a second 24-hour adjournment after being told discussions between the parties were making significant progress.

The claimants are demanding £520m from the bank and four former directors, including former RBS boss Fred Goodwin.

RBS has now offered the investors 82p a share, almost double its previous offer.

Jonathan Nash QC, for the claimants, told the judge: "The present position is that the majority of claimants have indicated their willingness to accept the latest offer from the defendant.

"There now appears to be a good prospect that within the course of today the remaining claimants, or nearly all, will confirm they will also agree in principle so as to bring a practical end to the proceedings."

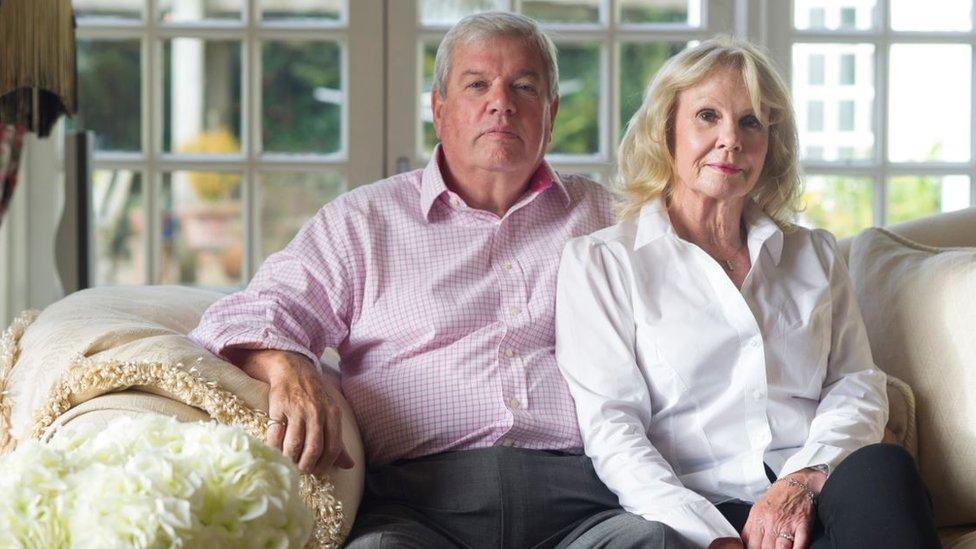

The claimants are demanding £520m from the bank and four former directors, including Fred Goodwin

The judge, in granting the further adjournment, said: "There is obvious interest in the court in seeking to facilitate a full and final settlement agreeable to the parties."

But he pointed out it was also important that the court's time was not was not taken up idly with adjournments and there had to be a "realistic timetable".

He said: "There will come a time when the claimants must simply realise that it is incumbent on them to make up their minds whether to continue with the litigation."

Mr Nash said, barring "unforeseen developments", an adjournment of a day would be sufficient.

He also said if the trial had to go ahead the parties were confident the case could be heard within the allotted time.

The case centres on a rights issue aimed at funding a multi-billion-pound deal to buy Dutch rival ABN Amro at the height of the financial crisis in 2007.

It involved asking existing shareholders to pump £12bn into the bank in exchange for discounted extra shares.

The bank and former directors deny any wrongdoing.

The bank has already settled the majority of claims over the issue, but has not admitted liability.

- Published23 May 2017

- Published22 May 2017

- Published18 May 2017