Hard hat warning for Scottish construction industry

- Published

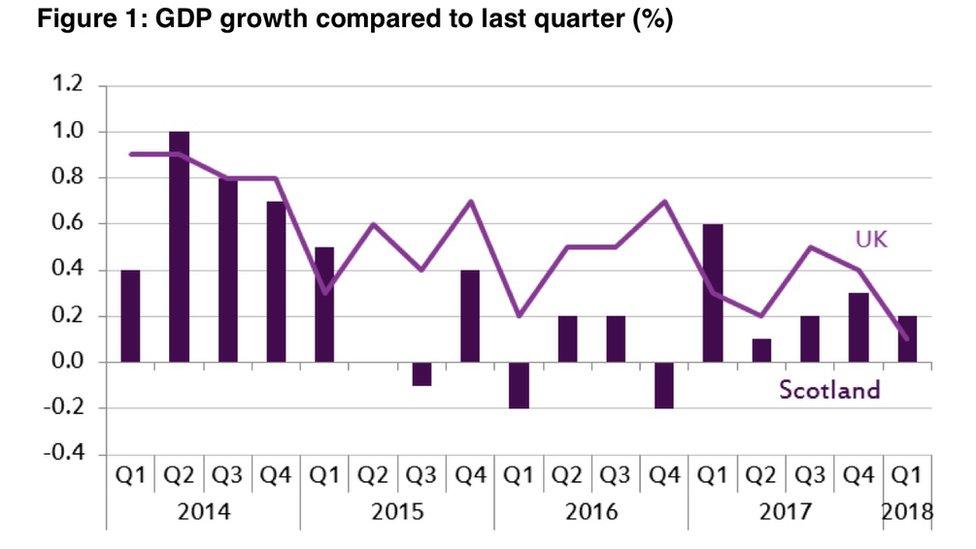

The good news about Scotland's economic performance in the first three months of the year is that things are better, by the narrowest of margins, than in the UK as a whole.

The bad news is that things in the UK-as-a-whole are getting worse.

Thus, the story of Scotland's economy continues to be one of comparison with its nearest neighbours, when there are bigger and tougher targets to be hit.

There have been signs that Scotland's economy was beginning to pick up a bit, from a long, stale period. It now looks like the uptick is being pulled back by weakness in its biggest "export" market.

Bad weather from January to March, and the chill winds of Brexit uncertainty, look to be the more likely culprits.

The weather changes. Brexit barely does.

The uncertainty surrounding it is becoming more of an acute problem, if business messaging is any guide.

Total economy

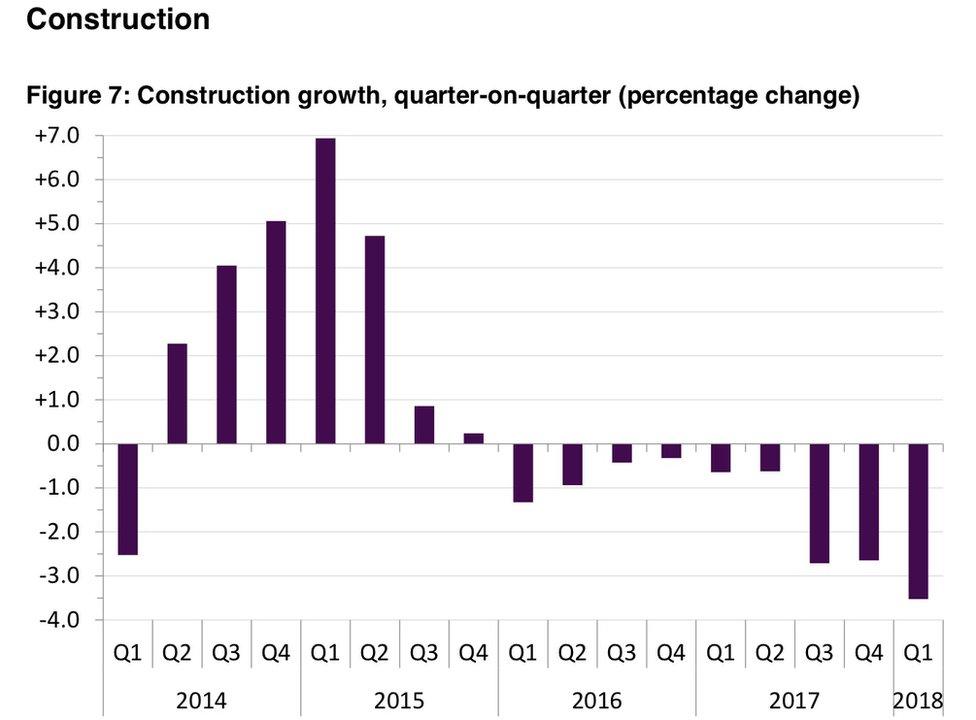

With better weather, construction workers can get back to work (though this week, they should be wearing sunscreen).

Despite representing less than 7% of the economy, their woes have been one of the main drivers of recent trends in output from the total economy.

Construction output was down 3.5% between the first quarter of 2018 and the previous quarter, and down 9.2% on the start of last year.

A year-on-year fall could be seen across the UK, but at -2.7%, it was far smaller.

As pointed out by John McLaren, the economist who runs the Scottish Trends website, the three-year comparison shows a 7.3% decline in Scotland and 7.5% growth across the UK. The difference is nearly 15%.

The latest figures represent nine consecutive quarters of decline for Scotland's construction sector. That's partly because the industry has been winding down big infrastructure projects - from the Queensferry Crossing to the big central Scotland motorway projects. It hasn't found sufficient replacements, either from the budget-constrained public sector or from private firms.

John McLaren's analysis looks also at the figures from the Office for National Statistics - compiled in a different way, but giving some more detail of what may be going on in the construction sector.

Key measure

A drop of 11% (compared with -3% for the UK) takes output back to the place it was three years ago. "This suggests there may be yet more to come in terms of falling Scottish construction output," says Scottish Trends.

"New infrastructure work has fallen to almost half the level of the peak seen in the second half of 2015. New public work is at its lowest level in almost four years, and new private commercial work has fallen to its lowest level in almost five years."

Another key measure highlighted is that Gross Domestic Product (total output) per head in Scotland has gone nowhere in the past three years, while there has been very modest growth of 1% in that measure across the UK.

However, what McLaren also does is to devise his own measure of economic health, by stripping out the bits that cause the most volatility. That includes construction.

The so-called "active economy" - manufacturing and non-financial private sector services - has seen growth of 2% between the start of 2017 and early 2018. The improvement in the fortunes of the offshore oil and gas industry can take some of the credit.

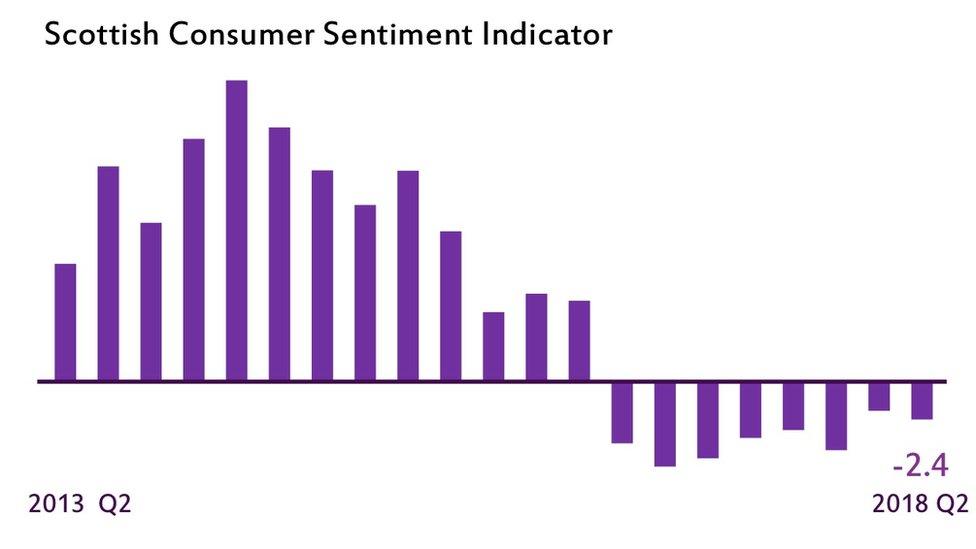

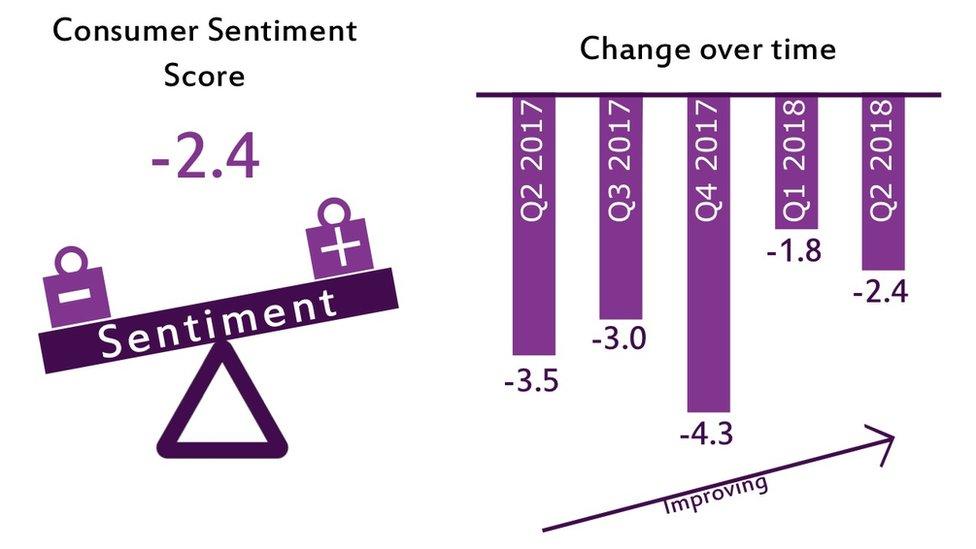

Yet another measure that tells us something about the state of the economy is the relatively new measure, commissioned by the Scottish government, of consumer sentiment.

Comparing positive outlooks with negative, the balance has been to the gloomy downside in each quarter since the Brexit referendum. With households so downbeat, and with pay still barely growing, consumer demand is not strong.

So what is being done about this? While the Downing Street cabinet seems to be debating whether the economic and business impact of Brexit is worth bothering about (Boris Johnson is reported to have put it a lot more bluntly), Scotland has a new economic secretary, and one with a lot more on his plate than Keith Brown.

Derek Mackay has quite a fiefdom, across income tax powers to business rates reform, council tax and the economy brief.

He may take some time to learn new parts of the brief. So it's probable that he signed off the same wording in response to the 0.2% first quarter growth that we might have heard from Keith Brown.

"Scotland's economy is strong..." it began.

No harm in talking it up, of course. But if the new cabinet secretary with responsibility for boosting growth can't grasp that the figures are actually weak, then this week's reshuffle and "refresh" won't have achieved much on the economic front.