Scots independence: Shock tactics

- Published

Short, sharp shock therapy can have a bracing, positive effect on countries when they hit crisis point. Ten years after the bank crisis, there are lessons to be learned from the pace at which different countries responded.

A new take on the new economic case for Scottish independence recommends a similar short sharp shock, by closing the gap between spending and taxation in year one.

Is a referendum the way to bring people together for such a common endeavour - particularly one after Brexit?

Never waste a good crisis: the advice may be glib at a time when people are feeling the pain, but that doesn't make it bad advice.

A sudden shock to the body corporate or politic can drive people together in common cause to see a collective way through.

It's the point at which leaders can ask more readily for sacrifice. It's also the time when organisations or countries can make a radical shift of direction. Long-time logjams can be cleared.

With the strengthened sense of a collective effort, there can be buy-in to the new project. And the rewards of taking that new direction can come much faster than evolution and gradualism.

Coming out of war can be such a stimulus. That accounts for some of Japan's post-1945 success story.

More recently, closer neighbours were given a sharp jolt and came out of the experience in much better shape.

In Finland, it was the collapse of its dominant trading partner, the Soviet Union.

In Sweden, it was a banking crisis.

In Ireland, it was a full-blown economic and political crisis in the mid-1980s.

Widespread repossession

We're coming up to the 10th anniversary of the American and British banking meltdown. It's a good time to ask how the different approaches have worked out, so far.

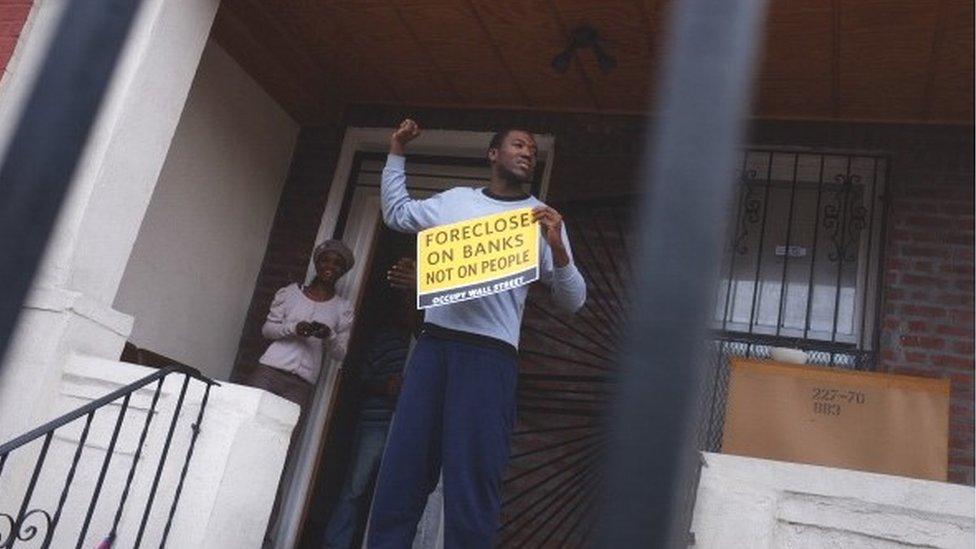

The US took a lot of pain quickly. It let banks fail. It let the property market bomb, and foreclosures abounded. It took a heavy toll in soaring unemployment.

The UK chose measures that would minimise the pain and protracted the recovery. The property market was protected from widespread repossession.

Prices fell in some areas, but not by much overall. Business was put on emergency measures of extremely low interest rates. Unemployment got nowhere close to the levels people feared.

Ten years on from bank crisis and the recession that had preceded it, the US economy is in a happier place than the UK one, with growth, and a faster return to interest rate normality.

In both countries, eight years on, voters chose different but very radical forms of punishment to the ruling elites, and we're a long way from seeing how the Trump and Brexit experiments are going to work out.

Those ruling elites are better placed for the impacts than the voters who chose those paths.

Migrants and currencies

There are questions there for the coming weeks of reflection on the 10-year anniversary. The lessons from different circumstances in Ireland and Iceland would be worth adding to the mix.

But what got me thinking about this now is closer to home - a new take on the Sustainable Growth Commission.

This was the group, led by former SNP MSP turned businessman Andrew Wilson, which was given the task by Nicola Sturgeon of finding a new route to economic growth for Scotland (importantly, on the condition that the answer involved independence for Scotland).

Sustainable Growth Commission was led by former SNP MSP Andrew Wilson

The latest response has come from John McLaren, an economist with expertise in fiscal accounts who was a special adviser to Donald Dewar nearly 20 years ago. He's not noted for sympathy for the independence cause, but nor does his work - through the Scottish Trends website - seek to promote alternative political narratives.

He praises the Growth Commission for its emphasis on opening up immigration, pumping oil revenues into a windfall storage facility rather than depending on it to pay the bills, on accepting the case for an inherited UK debt obligation, and on widening the debate on currency options.

'Unprotected' budgets

His view of its weaknesses includes a lack of clarity of what that debt obligation might require, and how to handle Scotland's economic need for continued easy access into markets in the rest of the UK.

McLaren's main concern is with the spending implications of growing demographic demand for services, when Andrew Wilson's report has accepted the evidence of a large gap between Scottish tax revenue reckonings and outgoings (that's to be updated for 2017-18 soon).

If health and associated commitments are to be funded, the other half of the budget would have to take a 15% real terms cut in the decade after independence. "This scenario seems unsustainable given the cuts already imposed on many of these 'unprotected' budgets," says the economist.

Where the Growth Commission avoided discussion of specifics, this response is not so shy; reduced public spending on items now well above the UK level per capita, such as economic support.

On the tax side, he suggests an increase in income tax and the removal of VAT exemptions (on food, domestic fuel, books, newspapers and so on), while deploying the kind of service user charges levied in other countries.

Shock treatment

None of that looks politically easy. And putting up tax while cutting spending is very likely, by any economic orthodoxy, to put a big dampener on growth.

But then there's the toughest message - John McLaren takes the view that this should all be done at the point of achieving independence. Get it over and done with, he says, rather than putting Scotland through 10 years of squeezed budgets such as we've just seen.

"Upfront savings need to be made rather than relying on an extended period of change which simply delays and prolongs the necessary fiscal adjustment," he says.

In other words, shock treatment.

It's just one man's view, of course. And there will be many other views to be heard at three SNP assemblies - in Ayr, Aviemore and Edinburgh - to discuss the Sustainable Growth Commission report ahead of the party's autumn conference.

I'm told there isn't a huge groundswell of intra-party dispute over Andrew Wilson's findings, though his proposal to use the pound sterling for at least 10 years has not gone down well with some party activists.

Among activists in other non-SNP parts of the pro-independence movement and some SNP leftists who were far from impressed by Andrew Wilson's economic orthodoxy, a further gathering to denounce it is planned for mid-September.

The choice of policies for an independent Scotland are the big substantial issues, but the timing and sequencing are probably as important. Get it right, and you could argue it will be the making of Scotland: a spur to its lacklustre growth path: bringing together that sense of a collective endeavour to dig out of difficulty. Get it wrong, and... well, you can make up your own Project Fear.

The further catch is that getting to such a point would involve another referendum. And what we've learned from two recent referendums is that they can do little or nothing to bring people together. Experience tells us they deepen divisions, and drive people apart.

That much is clear from Brexit. The process of removing the UK from the European Union may not be short, but it looks like becoming an interesting and bracing test of the sharp shock theory.

Short, sharp shock therapy can have a bracing, positive effect on countries when they hit crisis point. Ten years after the bank crisis, there are lessons to be learned from the pace at which different countries responded.