TSB confirms 17 branch closures in Scotland

- Published

TSB has confirmed that it will close 17 branches in Scotland next year, following a review of its UK network.

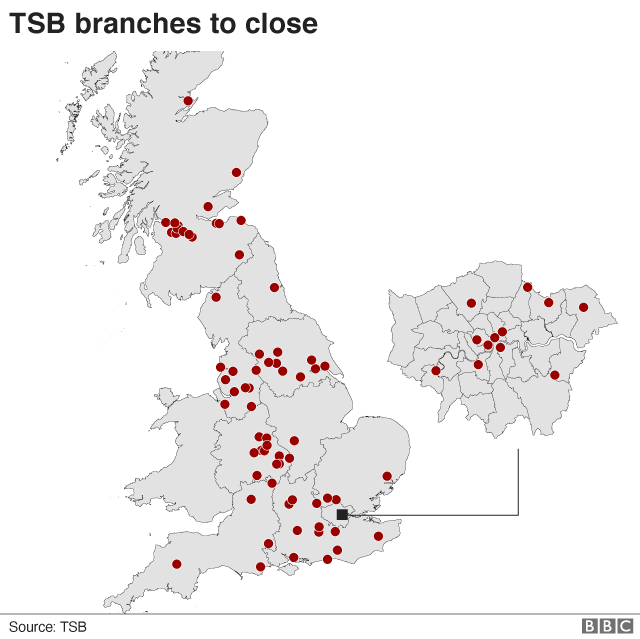

Earlier this week, the bank announced that 82 branches across the UK would close as part of a plan to make £100m of cost cuts by 2022.

The bank said it would still have a strong Scottish presence, with 134 TSB branches north of the border.

It did not reveal how many posts in Scotland were at risk as a result of the closures.

However, it said 370 positions across the UK would be hit.

The Spanish-owned bank said its closure decisions had been based in part on a branch's usage, proximity to alternative branches and the accessibility of alternative services such as free-to-use ATMs and the Post Office.

In April, TSB had already announced that 71 branches in Scotland and 22 in England would open for only two or three days a week.

List of affected Scottish branches

The branches affected, and the month of closure in 2020, are:

Barrhead (April)

Glasgow - Govan (May)

Bishopbriggs (May)

Milngavie (May)

Dunbar (May)

Portobello (May)

Jedburgh (May)

Kinross (May)

Tain (June)

Uddingston (June)

Edinburgh - Clerk Street (July)

Carluke (July)

Brechin (July)

Dumbarton (July)

Clarkston (July)

Edinburgh - Morningside (September)

Wishaw (September)

In a statement, TSB said its network had become difficult to sustain, with low customer numbers at "a significant number" of branches.

It also said that in the past two years alone, branch transactions had dropped by 17% as customers increasingly chose to bank online or by phone.

'Difficult decision'

TSB customer banking director Robin Bulloch said: "We have made the difficult decision to close some of our quieter branches and will fully support customers through this transition.

"We realise this is difficult news for our branch partners and will do everything to support those affected to redeploy as many people as we can to other roles and keep compulsory redundancies to a minimum."

TSB said it would be offering new services to support customers during the "transition".

These include "in-branch one-to-ones" for customers that regularly use the affected branches, to help them "continue to perform day-to-day banking tasks" in the local area.

TSB was created in 2013 under the instruction of the European Commission after Lloyds was bailed out by UK taxpayers in 2008.

It started with 631 branches, which included those that were branded Cheltenham & Gloucester as well as all Lloyds branches in Scotland.

At the end of 2020, TSB will have a network of 454 branches.

- Published28 November 2019

- Published25 November 2019