Is it time to rethink the tax system?

- Published

As government spending soars, there are inevitable questions about how much that will push up tax, but also about what gets taxed, and how? That debate is picking up pace

There's constant tinkering with the UK tax system, making it complex, and with some sources of revenue reducing. Is it time to re-think the tax base, and go after wealth?

Scotland has tax powers, but there's often more discussion of what it cannot do than the elements it could reform, starting with council tax

Tax: it's the only certainty other than death, according to Benjamin Franklin. But is it inevitable the tax system stays, at least roughly, the way it is?

It's always in flux - a machine that nobody would have designed from scratch, and which requires endless tinkering to keep it operational.

But it's now more challenged than ever. More tax revenue will be needed to fund the borrowing and enhanced public services we seem to want after the Covid-19 crisis, particularly for health and social care. Reform is long overdue, and this could be an opportune moment for a big reboot.

This week, the Treasury began consulting on more digital collection and reviewing English business rates.

The Commons finance committee has just launched a wide-ranging review of the tax system. The Institute of Fiscal Studies, and in Scotland, the David Hume Institute, have begun detailed discussions of wealth tax.

Tax breaks

The Public Accounts Committee (PAC), Westminster's spending watchdog, last week set out big, difficult questions about tax breaks.

"They're not freebies," said Meg Hillier, the PAC chair. "They cost the public purse hundreds of billions of pounds in lost income."

That includes £38 billion of giveaways to pension savers. Does it change behaviour and draw in more savings, or merely add to funds that people would be saving anyway? If the latter, it's badly targeted.

A further £15 billion is given away on VAT, charged at 5% on household fuel and zero on food, children's clothes, books and newspapers. At the IFS, they say that would be better targeted at people on low income if VAT were 20% on everything, with compensation through benefits.

The complexity of reforming tax is partly because it's intended to achieve different outcomes. Much of it is to raise revenue, to fund public services. The big three elements are income tax, national insurance and Value Added Tax.

Income Tax

Income tax is diverging between Scotland and England, and tax on employment is inconsistent across employed, self-employed and (typically high earners with) one-person service companies.

But a lot of it, in piecemeal form, is to change behaviour: stop smoking, drink and gamble in moderation, reduce carbon emissions and landfill, shift to an electric car and get married.

The risk with that is that it's too successful. Push people away from using diesel and petrol, towards electric battery cars, and the government creates a very large hole in its revenue.

It introduced a sugary soft drinks tax, with a lead time for manufacturers to cut sugar content. They did so, it succeeded on health grounds, but brought in less revenue than expected.

By tipping income tax away from low earners to high, by raising the starting threshold to £12,500, makes it fairer. But it also makes revenue highly dependent on small numbers of very high earners.

They're internationally mobile, they have clever accountants, and the system is vulnerable to sudden moves of their income from one tax jurisdiction to another.

Apple and Amazon are two of the world's biggest tech giants but pay very little tax in the UK

That competitive element of tax at the upper end is also a feature of corporation tax. Ireland set the pace with a 12.5% tax rate, which was vital to transforming its economic performance. The UK has since fallen from 30% to 19%, as other countries have also cut to avoid loss of foreign investment.

Capturing the internationally mobile tax base is also a big challenge with the digital economy. Apple, Amazon, Microsoft and Google are huge players in the economy but pay very little tax in large countries, because they say their software and algorithms are to be found in low-tax jurisdictions.

The UK is one of several European countries that wants to tax that activity. France is to the fore in doing so. But an attempt by the OECD richer country club to co-ordinate digital taxes has been fatally undermined by the Trump administration pulling out of the project. The taxes are seen as anti-American, and US trade tariffs are threatened against countries that introduce a tax unilaterally.

Wealth tax

As some sources of tax ebb away, such as fuel duty and digital commerce, the search is for a more reliable future tax base. Wealth is one obvious place to look.

Much of the nation's wealth is held in pensions, yet - as the PAC noted - we give huge tax breaks to those who build up wealth to fund their retirement.

Property is another widely-spread form of wealth-holding. That's already taxed, with transaction tax, under similar systems in Scotland, Wales, and England with Northern Ireland.

Apart from raising revenue, that makes no sense at all. It penalises those who have to move, for instance for a job, it's an extra charge on growing families who need a bigger home, and it's an incentive for older people with big houses not to downsize and make way for larger families.

Homes are also subject to council tax. Lower-income households pay a larger share of that income on council tax than higher-income ones.

The Scottish system has tinkered with that, but only at the margins. It continues to share with England the increasingly absurd valuation base of 1991 prices. No government is willing to revalue, because losers complain loudly and winners take their gains for granted.

If those who could gain by revaluation realised how much they're missing out, they'd be complaining loudly already.

There is a case for abolishing both council tax and transactions tax, and rolling them into a annual property tax based directly on valuation. But that, too, would mean some people getting much bigger bills

Tax on the wealthy

For financial wealth, such as share-holdings, that is much more focussed in high net worth households, and the Treasury is looking at changes to Capital Gains Tax.

Land could be taxed more efficiently. There are problems there: a lot of Scottish land doesn't generate much income, and the more productive land is heavily subsidised.

Government could also put more of a burden on to inheritance tax, but it knows there is a fierce backlash awaiting them among traditional Tory voters and their cheerleading newspapers.

One idea for exceptional times is for a one-off wealth tax, to pay the one-off costs of the current crisis and set government debt back to more manageable levels - say, 2% of everything you own, above a certain threshold.

Theoretically, it makes some sense. Practically, it would be a nightmare - identifying wealth, ensuring it's not hidden, turning physical assets into cash for payment. Politically, that looks tougher still.

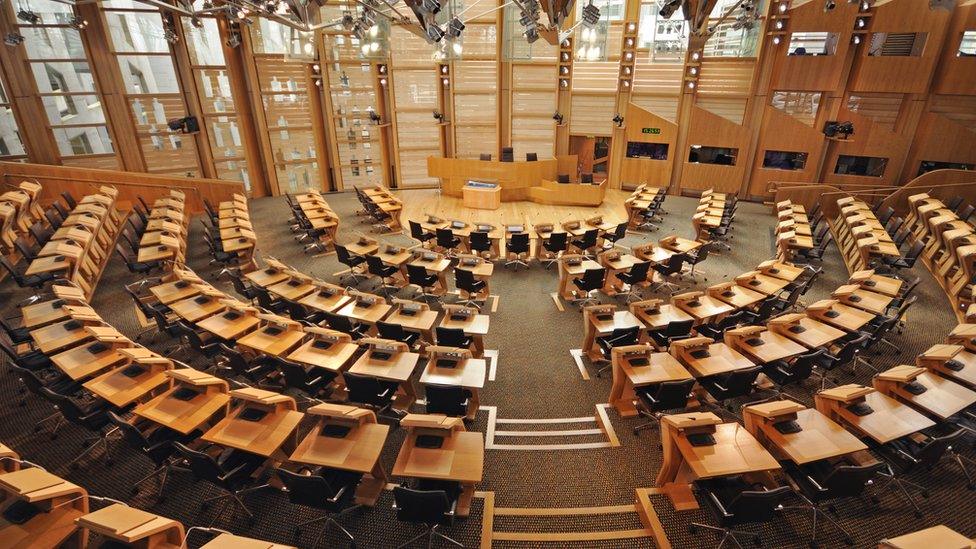

Tax at Holyrood

Could Holyrood make much of this tax reform? It hasn't done the borrowing to tackle the health and economic crisis, but it will surely suffer the effect of cost cutting when the bills come in, so flexibility on tax raising would be handy.

MSPs are limited on many fronts, particularly where reserved powers over benefits, national insurance and unearned income tax (on dividends) don't mesh with its newish income tax powers.

But rather than focus on what it can't do, there are things it could tackle. Business rates are now a target for Whitehall reform. There's a risk that Scotland gets left behind with an out-dated system, punishing already traumatised retailers, and could be forced to adjust and match English reforms.

Council tax and business rates could have been reformed since the Parliament first sat in 1999. But SNP, Labour and Liberal Democrats all failed to live up to their rhetoric on council tax, and on it goes.

Holyrood can diverge on air passenger duty, but it's choosing not to do so. It has given powers to councils to introduce tourist taxes and workplace parking charges, but ministers don't sound keen on seeing those powers used.

Next to require decisions could be tax on sugary, salty and fatty foods. The prime minister is a new convert to government "nanny"-ism and in recent days, he seems to be setting the pace.