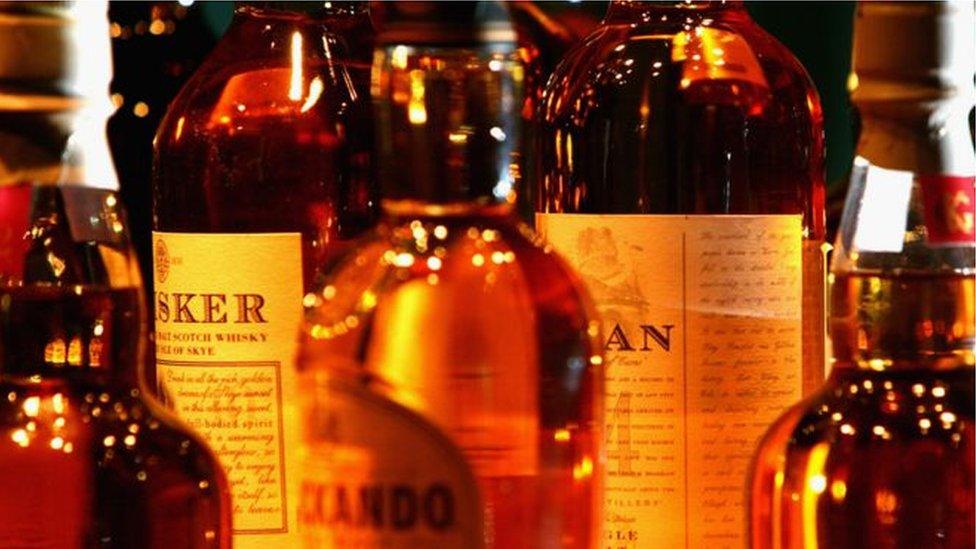

Whisky sour and lockdown tumbleweed

- Published

When prices go up, so do sales - at least for some premium Scotch whisky exports, defying the laws of economic gravity.

Diageo is not suffering too badly from US punitive tariffs, but the closure of pubs, restaurants, festivals and events has meant a big blow to its Scotch whisky exports worldwide.

It moved swiftly to adapt to the opportunities of lockdown, and is continuing to invest in its biggest brand, Johnnie Walker, as he turns 200.

Meet Sir Robert Giffen. Born in Strathaven, Lanarkshire in 1837, he worked in a lawyer's office while taking classes at Glasgow University, striding out on an inky career path with a job on the Stirling Journal.

It was the grounding for a distinguished career in financial journalism in London, in the early days of The Economist. He went on to become one of Britain's foremost statisticians.

By the time of his death in 1910 in Fort Augustus, he had achieved quite a lot. But 110 years later, he's best remembered for having identified, or at least described, the Giffen Effect.

This defies the most basic law of economic gravity - when the price rises for a particular product, demand rises too. Because, let's say, a bottle of single malt Scotch whisky becomes more expensive, it can also be perceived as more desirable and so it fetches a higher price.

And that may be what we're seeing in the United States. It's not for sure, but something odd has happened to the single malt Scotches being exported to the USA. They've had a 25% tariff slapped on them, to do with a trade dispute over aircraft subsidies, but the latest evidence suggests they've become more attractive to Americans.

The figures come from Diageo, the London-based global giant of distilling, with around 40% of the Scotch industry and a proportionately prominent role in its global reach. Its annual results cover the year to 30 June, and they show that exports of single malt Scotch to the US increased since July last year, albeit by a meagre 1%.

Its worldwide sales of numerous spirits, beer and Guinness were down more than 8%, profits down 47%, and Scotch sales worldwide were down 17%.

Stout disposal

The first half of the company's financial year continued a rising tide of consuming spirits worldwide. In key markets, such as the US, beer and wine are in retreat for younger people, and new "recruits" to alcohol, in the marketing jargon, are choosing spirits instead, often in cocktails. Tequila has been doing particularly well in the US.

But then Covid-19 arrived. At least spirits don't go off as tumbleweed blows through America's saloons. Guinness does, though. Three-quarters of the stout drunk in Europe and Africa is in pubs, restaurants, at festivals and sports grounds. Half a million kegs have been retrieved from the licensed trade. In total, there has been a £7m cost of disposal, and the accounts note a £23m cost of replacement as the on-trade has opened up again.

Lockdown also knocked out key opportunities to flog and drink Scotch, starting with the Chinese New Year, and in airports. In countries where whisky is mainly sold in the off-trade of restaurants, pubs and clubs, the fall was very deep.

In the USA, however, 80% of Diageo's business is in selling for home consumption, and that has been doing nicely. North America is where Diageo makes half its profits - in the most recent year, down 47% to £2.1bn.

Kilmarnock bottle shop

And here's just part of the paradox. Despite that 25% tariff, Scotch malts "continued to perform well, with growth from Oban and Lagavulin, as well as Talisker and Mortlach".

Some of the tariff blow was averted by building up stocks in the US ahead of its introduction, and those helped to see it through the vital Thanksgiving and festive season.

Yet two-thirds of Scotch sold to the USA pre-tariff has been blended. With very few exceptions, it's cheaper. And without the 25% tariff, the biggest blend, Johnnie Walker, fell 11%. The momentum of recent marketing pushes has fallen away.

To some extent, the strategy is successfully encouraging Americans to trade up to more expensive brands. As chief executive Ivan Menezes told me in fluent marketing jargon: "Premiumisation trends are strong".

An 11% drop for Johnnie Walker was relatively good news for the company's biggest brand. Around the world, it fell by a whopping 22%. In the big growth markets of Latin America, it was down 33%. Brands with some history in South America, including Buchanan's and Old Parr, were also down sharply. Drinkers were trading down to lesser brands.

This was not a good start to the celebrations of the 200th anniversary of Mr Walker starting to sell whisky from his shop in Kilmarnock.

Diageo is not backing off, but stepping up its investment. It's is investing a lot in Scottish visitor attractions - more than £150m for four contrasting malt distilleries that contribute to the blend, and the conversion of Fraser's department store on Edinburgh's Princes Street into the Johnnie Walker Experience. It's due to open in the second half of next year.

Gooey cakes

Apart from making and selling a lot of alcohol, Diageo's strength is in its marketing. And it's interesting to note how it adjusted rapidly to lockdown.

Using data intelligence, it could quickly see the shift to home drinking, and to social events being held online. It noted that the number of web searches for "cocktail shaker" rose seven-fold.

In the US, without a national furlough scheme to replace wages, the company put a lot of money behind efforts to raise funds for unemployed bar-tenders, while using their downtime for extra training opportunities.

In several countries, marketing spend was rapidly hauled out of events, and used to align brands with the move into home cooking and baking - notably the contribution of Bailey's Irish whiskey liqueur to desserts and some gooey cake recipes.

Production and advertising of Guinness moved quickly to shop sales in cans. As several countries eased the online sales of alcohol, Diageo was quick to pick up the opportunity. That remains "low single digits", but it's seen as a positive trend that's worth watching.

America First

Next week, there will be a further decision from the Trump administration on those US tariffs on single malts. They extend to lots of European cheeses and meat, and in Scotland, to cashmere sweaters and shortbread. They are likely to be continued, but the distillers' fear is that they could be extended to Scotch blends, and beyond 25%.

Diageo says the tariffs are of particular concern to smaller distillers with more exposure to single malts. The figures suggest it can afford to be relaxed about them, but it joins the industry in vigorous criticism of being drawn into a dispute over airliner manufacturing. It faces the same 25% punitive tax on sales of its US whiskey into the European Union and UK, because of another trade dispute, this one over steel and aluminium.

Britain's trade secretary, Liz Truss, is reported to be making the case against the tariffs as forcefully as possible on a visit to Washington this week. Her leverage is lessened by the eagerness with which the Westminster administration needs to get some form of free trade deal with the USA as the Brexit transition ends.

Donald Trump's "America First" administration is hardly likely to be generous to foreigners with a presidential election only three months away.