The rollercoaster ride of Scotland's first gold mine

- Published

After 35 years of highs and lows, production is finally under way at Scotland's first commercial gold mine. The journey has been fraught with difficulty for prospectors - but it looks like their investment may be about to pay off.

Extracting gold from Cononish, near Tyndrum, in the west of Scotland was never going to be an easy proposition.

The technical challenges - and costs - of accessing the precious metal from halfway up a mountain were a daunting prospect for those willing to try.

But try they did.

Early attempts from the mid-1980s saw prospectors come and go, as they struggled - and failed - to raise sufficient cash for what was always going to be a capital-intensive project.

Their efforts to attract backers were also undermined by the volatility of the precious metals market, which often saw gold prices slump.

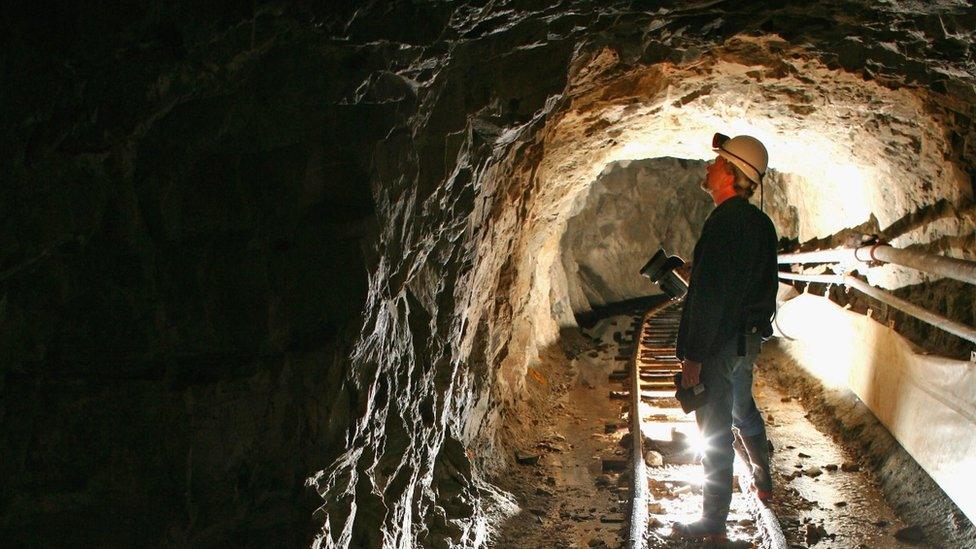

Cononish during the preparation works for the mine

By 2006, the mine had changed hands several times and was up for sale once more.

That seemed to spell the end of Cononish and Scotland's hopes of producing its own gold for the first time.

However, in 2007, Australian-listed firm Scotgold Resources entered the scene and revived the mine.

It has been a rollercoaster ride ever since.

By 2013, Scotgold had obtained planning permission and put a funding plan in place, only for the gold price to collapse, making the project less palatable for potential investors.

Costs were also spiralling, as the mine had fallen by that point within the boundaries of the Loch Lomond and Trossachs National Park, which meant much more stringent planning and environmental conditions. An earlier application had been turned down due to conservation concerns.

The problems were compounded by the fact that Scotgold couldn't raise money from traditional banking sources, given its small-scale nature.

That seemed to be that - until Edinburgh-born businessman Nat le Roux arrived on the scene and recapitalised the company in 2014.

Since then, he has pumped in millions of pounds of his own money to keep the project alive.

Mr le Roux, who is a former independent director of the London Metal Exchange, said there was "a certain romance" about the idea of a Scottish gold mine.

"But when the mine was brought to my attention seven years ago, it seemed to me to have interesting investment potential.

"When I came into it, the problem was one of finance.

"By world standards, this is a very small mine. At full production, we will be producing about 2,000 ounces of gold a month.

"At the same time, the amounts of money needed to finance the operation have been quite substantial."

Scotgold anticipates that over the expected nine-year life of the mine it will cost about £25m in capital expenditure and a further £81m in operating costs.

That's a whopping sum - but the owners still stand to make millions if all goes according to plan.

The first gold was poured at the new plant this week

Gold prices have soared from as low as £700 an ounce in 2015 to more than £1,300 today.

Scotgold believes it can recover 175,000 ounces in total from Cononish, worth £236m at current prices.

Repeated feasibility studies have also shown gold deposits at Cononish to be high-grade - and its rarity as "authentic Scottish gold" has already attracted a premium from buyers.

In 2016, the company auctioned off 10 limited edition 1oz fine Scottish gold rounds formed from initial extractions from the mine.

They raised an average of more than £4,550 per ounce - a premium of 378% over the then spot price of about £950.

Richard Gray says staff with expertise will be needed

Scotgold chief executive Richard Gray has steered the company through turbulent times in recent years, but describes the team working on the project as "inherent optimists".

"There are always issues and problems to overcome but we have this belief that we will overcome them and the mine will be very profitable," he says.

"I have always been confident in the merits of the project.

"However, without the support of Scotgold's shareholders to stay the course, there was always a risk in the worst case scenario that the company would be forced to sell the asset to someone who would develop it and subsequently reap the rewards."

There are still challenges ahead.

These include the impact of Covid-19, which forced Scotgold to delay production of first gold earlier this year.

The company is looking to increase its workforce from 25 to 70 as production ramps up, but finding the people to handle the highly technical aspects of gold extraction has also proven a problem.

Mr Gray explains: "Expertise is needed and you obviously can't find all the people already existing in the area. Some people will have to come from further afield and hopefully settle nearer by."

Scotgold expects to produce 10,000oz of gold next year before ramping up production to an average of 23,500oz a year for the rest of the mine's life.

Cononish may yet prove to be the start of a golden era for prospectors in Scotland.

Scotgold remains optimistic that it will discover extensions to Cononish, which would lengthen the life of the mine.

And it has identified potentially significant gold deposits in other areas of Scotland where it holds option agreements with Crown Estates Scotland.

Mr le Roux says: "It is not like Cononish is one fortuitous discovery in the middle of an otherwise barren landscape.

"My view, and that of others, is that we will end up with a number of gold mines in the west of Scotland, either on the same scale as Cononish or perhaps a little bit bigger, assuming the gold price holds up."