Scotland's national investment bank launches

- Published

Scotland's new investment bank has opened for business with a mission to foster innovation and help meet climate change targets.

The Scottish National Investment Bank (SNIB) will be backed by £2bn of Scottish government funding over the next decade.

Officials have announced the bank's first investment - a Glasgow-based laser technology firm called M Squared.

MSPs unanimously passed plans for the bank in January.

First Minister Nicola Sturgeon described the bank as "one of the most significant developments in the lifetime of this parliament".

In its first decade, it will invest in businesses and projects that help Scotland meet its 2045 net zero target, tackle inequality and foster innovation in the country's businesses.

SNIB chairman Willie Watt said he hoped the bank would eventually become a national, non-political institution.

He said: "I want it to become a trusted institution that is seen as being owned by the whole of Scotland.

"A non-political, cornerstone institution in the investment landscape in Scotland.

"I want it to have a list of really good investments against each of those three missions so we can look back and say that we actually invested against these missions."

Funding will be provided in multiple forms, according to Mr Watt, including through loans and equity purchases.

The idea is well established in other countries, and it's not new to Scotland. Enterprise agencies have been lending and investing in growth companies for many years.

The SNIB is different and important now because it steps up scale and ambition for what can be achieved.

It does so when there is less negativity about the role of the state in trying to "pick winners", and a growing appreciation that such investments can bring big dividends for the economy, society and technology.

The "moonshot" language used by Boris Johnson about Covid-19 testing reflects a belief that the state can set strategic goals and draw together the resources to achieve them, as the USA did with its 1969 moon landing. His former chief adviser, Dominic Cummings, is a passionate advocate of America's way of supporting technology firms with government action.

And the power of government procurement and support for private medical research through the pandemic is leading others to review the way they think about the other big global challenge, of tackling climate change.

Whether the SNIB works depends on the quality of its foresight and decision-making, not only in getting returns but in drawing in private sector partners. It requires scale, and plans so far are not huge.

The trickiest bit can be getting the right level of autonomy - an arm's length from government interference, and denying ministers the easy option of bailouts when important employers are in financial distress.

Only two days before the SNIB was launched, a Scottish government policy paper was calling for it to bail out defaulting companies: "We should consider scrapping interest charges on Covid-19 related loans, or converting these loans to equity, managed by public policy banks such as the Scottish National Investment Bank".

There are positive examples, including Scottish Water. But the Scottish government portfolio of Ferguson shipyard, BiFab fabrication yards and Prestwick Airport so far does little to reassure taxpayers that their money is being put behind winning investments.

Profit targets for the bank will be set in the coming months but the chairman said he does not expect money to be flowing back into the bank for the first few years.

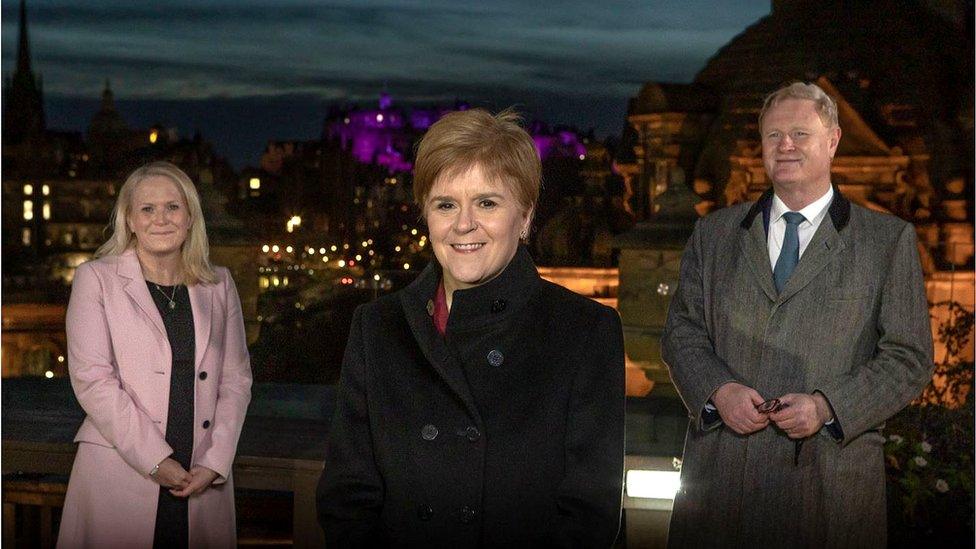

Scottish National Investment Bank CEO Eilidh Mactaggart, First Minister Nicola Sturgeon, and bank chairman Willie Watt launched the national bank

Ms Sturgeon said: "The Scottish National Investment Bank will help to tackle some of the biggest challenges we face now and in the years to come, delivering economic, social and environmental returns.

"It is hitting the ground running with its first major investment in M Squared - a great example of the ambitious and innovative companies we have here in Scotland that will be key to our economic recovery and future prosperity.

"The launch of the bank is one of the most significant developments in the lifetime of this parliament, with the potential for it to transform, grow and decarbonise Scotland's economy."

M Squared is based in Glasgow and specialises in quantum technology

Dr Graeme Malcolm, the founder of M Squared, said: "Science and advanced technologies have a major role to play in Scotland's future economic prosperity.

"By increasing investment in research and development with a mission-based approach, Scotland has a real opportunity to actively tackle climate change and benefit from the coming quantum revolution.

"We are delighted that the Scottish National Investment Bank has invested in M Squared as its very first business - our shared commitments to society and the environment makes this an ideal partnership that will enable accelerated growth and progress in frontier technologies."

- Published21 January 2020

- Published16 April 2020