SSE reveals £12.5bn boost in renewables investment

- Published

Energy firm SSE has announced plans to invest £12.5bn over the next five years in a bid to accelerate its net zero plans.

The plan would see it increase renewable energy output five-fold within 10 years.

The Perth-based company said the move makes it the biggest constructor of offshore wind in the world.

The announcement, with half-year results, follows pressure from an investment fund, Elliott Management.

The fund has taken a stake in SSE.

Alistair Phillips-Davies, SSE chief executive, said: "We are constructing more offshore wind than anyone else in the world right now and expanding overseas, delivering the electricity networks needed for net zero and pioneering carbon capture, hydrogen and battery technologies to deliver system flexibility."

Mr Phillips-Davies told BBC Radio's Good Morning Scotland programme the company is looking to create "thousands of jobs" with major projects including its Berwick Bank windfarm.

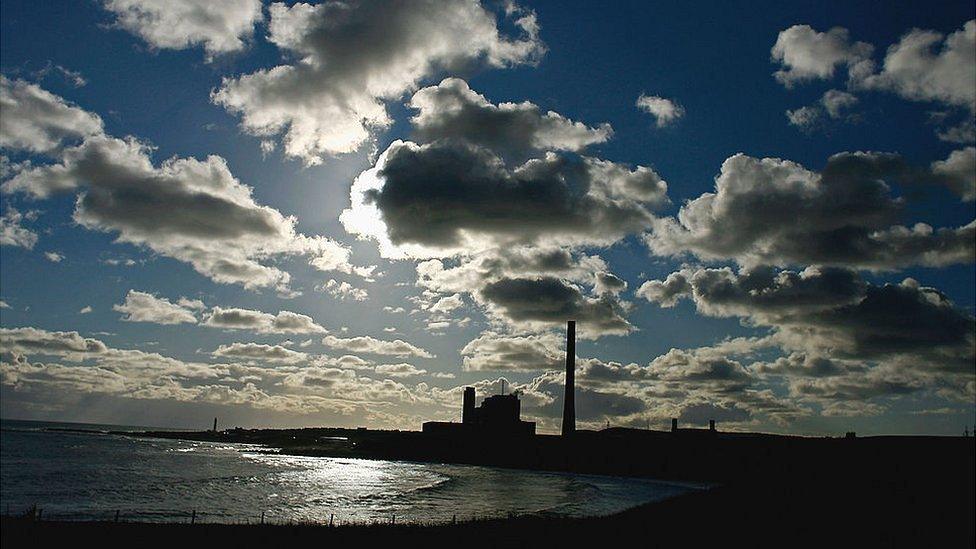

SSE owns and runs Scotland's last fossil-fuel fired power station at Peterhead, but has promised to reduce its emissions through carbon capture technology.

A major carbon project in Aberdeenshire, the Acorn project, recently failed to secure UK government backing, but Mr Phillips-Davies said it was still on the reserve list, and his firm would press for investment.

The company's revised plan - which would see an additional £1bn a year invested in renewable power generation - would increase the amount of energy produced by four gigawatts over the period.

It would mean the company delivers 25% of the UK's 40 gigawatt offshore wind target by 2030. It would also generate more than 20% of the UK's electricity network investment.

Could Scotland be a wind power super power?

The Elliott investment fund is understood to want SSE to split its renewable energy division from its electricity networks division.

SSE, which has a market valuation of more than £17bn, also owns and runs the high-voltage network in the north of Scotland.

The increase in spending on new energy generation is 65% higher than previous commitments, with the company saying it intends to take advantage of UK government tax breaks laid out earlier this year.

SSE will see 40% spent on networks, 40% on renewables and 20% on the rest of the business.

The firm revealed that pre-tax profits for the six months to September jumped 116% to £1.7bn, following soaring energy prices this year.

But the company's renewables division was hit by poor UK summer weather, with wind levels low and dry conditions impacting its hydro business.

Despite high gas prices, SSE said it would continue to dispose of its 33.3% stake in gas distribution operator Scotia Gas Networks in the financial year.

In June Extinction Rebellion protesters blocked the entrance to SSE's Peterhead power station with a washing machine to highlight what it claimed was the firm's greenwashing policies.

Related topics

- Published11 May 2021