'Deeply worrying' economic divergence

- Published

The key committee on Holyrood's budget has joined those raising alarm at evidence of Scotland's under-performance.

They say that is now threatening to undermine the ability of Scotland to retain levels of public spending and social welfare support, at a time when expectations on them are rising.

Their report, ahead of two events at Holyrood this week that bring MSPs' focus back to the budget process, puts renewed pressure on ministers to step up their planning for deep-seated economic challenges as well as post-Covid recovery.

Evidence of Scotland's economic under-performance is "deeply worrying".

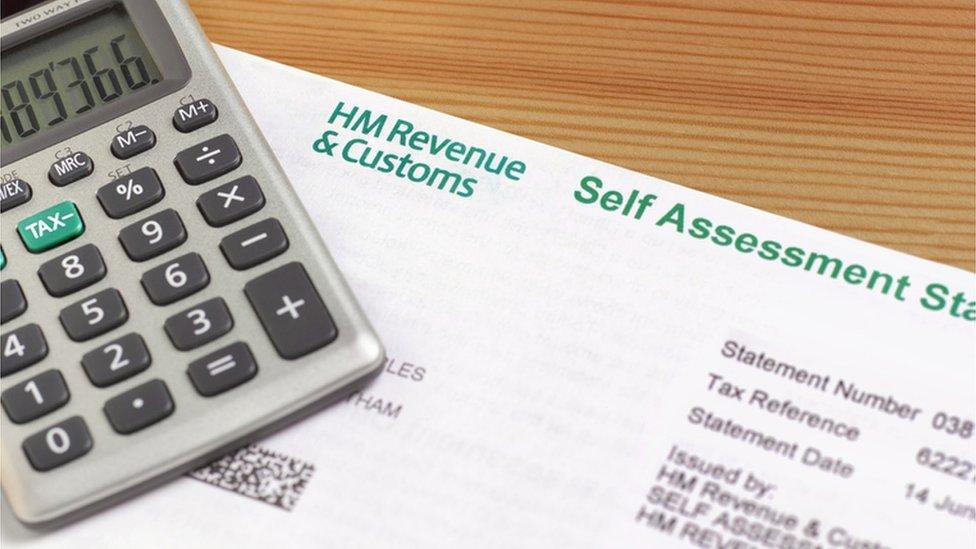

The official forecast for the impact of low wages, poor productivity and changing demographics on income tax receipts could "if they come to pass, put Scotland's fiscal sustainability at risk".

It's not the habitual doom-mongers saying this (amongst whom, I admit, I can sometimes be found).

This is the finance and public administration committee of the Scottish Parliament, convened by an MSP from the governing party, Kenny Gibson, with Ross Greer of the Scottish Greens effectively assuring the government a majority.

While journalists write and talk of parliamentary committees being "powerful", mainly to big up their stories, this grouping is just that - or ought to be - and particularly in scrutinising budgets.

It's been reflecting on the budget plans for the year starting in April this year.

It has published its findings. They go to a debate of the Parliament on Wednesday afternoon this week, and a vote on Thursday at stage one of the Budget Bill.

Finance secretary Kate Forbes has no worries this year about getting a majority. That's what two Greens are in ministerial offices to guarantee.

Muddling through

She has much more to worry her in the content of the committee's report, feeding through from an alarming set of forecasts from the Scottish Fiscal Commission.

To jog your memory, that's the official body that provides ministers with the forecasts for tax revenue on which they must base their arithmetic. As I wrote when the draft budget was published last month, that has been downgraded. And some.

This year means a continuing squeeze on councils, once they take on board the additional requirements placed on them by central government.

Beyond that, it'll be another year of muddling through and making ends meet, with some pain and a lot of inflating prices and wages, along with an uncertain trajectory for the health budget depending on the Covid-19 virus.

It's the longer term that has MSPs most worried. The finance committee's report reflects on advice that Scotland suffers from low productivity feeding lower earnings, poor business investment, and more adults both young and old who are not working and paying income tax.

That means declining income tax revenue and growing expectations of newly-devolved welfare payments.

Difficult decisions

These expectations and hopes will have become further raised by two reports this week highlighting the mountain to be climbed if Scotland is to hit its statutory target on ending child poverty.

One was from the Fraser of Allander Institute, demonstrating a number of factors in tackling child poverty, the most obvious being its complexity. "Difficult decisions" lie ahead, it concluded.

A more generous offer of childcare could be aimed at getting more parents into the workforce, but at a high cost. And that is modelled as having a lower impact than a big boost to the new Scottish Child Payment. That is due to be raised from £10 weekly to £20, and extended to a wider age range by the end of the year.

But the modelling from these Strathclyde economists suggests a weekly payment of £160 is the level at which a big impact on child poverty can be seen.

It went on to say that putting more money into family budgets would boost the economy by 2% to 4%, as they go out and spend that money.

But when you factor in the tax required to fund it, sucking funds out of the economy (and such assumptions are highly uncertain), the net effect is a decline in economic output of 2% to 3%.

Population taskforce

I digress. This is just one example of the expectations being loaded on to the Scottish budget in the medium to long term without thinking through the costs of big ambitions.

And where the finance committee is "deeply worried" is in the falling tax revenue from income tax.

Having had that devolved, it provided an incentive for the Scottish government to boost economic growth and draw in more revenue, with which to meet those ambitions for more generous social provision.

However, it also brought the risk of lower tax revenue. And what the Scottish Fiscal Commission showed us is a medium term future in which higher take from income tax, loaded on to higher earners, with a lower threshold for starting to pay the 41% rate, is not providing more revenue than the Scottish government would have had if income tax had not been devolved.

In other words: more tax powers and higher tax rates are bringing Holyrood lower revenues.

The net gap next financial year is forecast at £190m, rising to a shortfall of £417m in 2026-27.

The trends become clearer still when Holyrood's more generous welfare benefits are factored in.

Expert evidence to the committee offered little reassurance about the economic and fiscal trends. The demographics are pointing in the wrong direction. Productivity feeding lower wage growth and lower income tax receipts is a long-running problem, to which there's no easy answer.

The committee report points to talk, within government, of a 'demographic commission' or the less grand 'population taskforce'.

It reminds ministers that they promised a ten-year plan for 'economic transformation', drawing on yet another panel of expert advice, but its publication is now behind schedule.

Their work on revisiting the fiscal framework that determines how money is allocated to take account of devolved taxes is also well behind schedule.

Streamline strategies

The answers MSPs got from Kate Forbes were of initiatives that are at an early stage, to address problems that have been seen a long time off.

And such initiatives as are under way are seen by MSPs, and by academic commentators with an inside track from having recently been in government, as being overly complex.

"We called on the Scottish government to outline how it could streamline and link up its various strategies and plans," the MSPs on the finance committee said of their pre-budget report, noting that their call had been ignored. They still want it answered.

It is on economic performance and fiscal viability that they have their sternest warning from ministers, which will be hard to ignore:

"We consider that evidence showing that Scotland is lagging behind almost all other areas of the rest of the UK in key indicators of economic performance is deeply worrying.

"We are particularly concerned to note the latest Scottish Fiscal Commission forecasts showing Scotland's income tax receipts falling behind the Block Grant Adjustment (the deduction by the Treasury in lieu of Scottish income tax powers), which we consider could, if they come to pass, put Scotland's future fiscal sustainability at risk."

That's the challenge laid down by MSPs to Kate Forbes. Now, over to the cabinet secretary.

- Published9 December 2021

- Published9 December 2021