Menzies Aviation faces £560m takeover by Kuwaiti rival

- Published

Menzies Aviation, one of Scotland's largest firms, is likely to be taken over by a Kuwait-based rival.

The Edinburgh-based ground services company, formerly bookseller John Menzies, works in 37 countries.

Three previous offers from National Aviation Services, which works in Africa, Asia and the Middle East, had been rejected.

A fourth offer of £560m has now been recommended to shareholders in a statement from company directors.

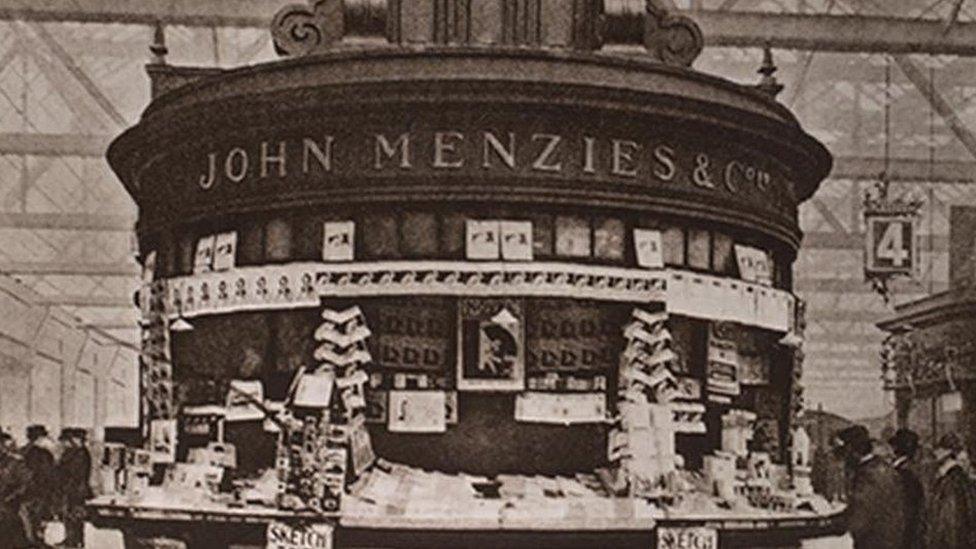

The firm started in 1833 selling Charles Dickens books and The Scotsman newspaper, and became a high street name across the UK.

It became one of Britain's biggest newspaper distributors, expanding into air freight from 1987.

The company cut more than 17,500 jobs worldwide in March 2020 because of the downturn in air travel due to the pandemic, but remained one of Scotland's biggest businesses.

National Aviation Services, external (NAS) is a subsidiary of the Kuwait-based logistics conglomerate Agility.

NAS has expanded across emerging markets in recent years and now owns a 19% stake in Menzies Aviation after purchasing millions of pounds worth of shares in the past month.

Its final offer of 608p per share follows previous bids of 460p, 510p and 605p.

"The board has considered the final proposal and indicated to NAS that it would be willing unanimously to recommend an offer at the financial terms of the final proposal to Menzies shareholders," the board said in a statement.

"Accordingly, the board is in discussions with NAS in relation to these terms and will be providing NAS with access to management and due diligence information."

It added that NAS had confirmed to the board that "the financial terms of the final proposal are final and will not be increased," although this could change if someone else tried to take over Menzies Aviation.

Philipp Joeinig, Menzies Aviation's chairman and chief executive, described previous offers as "unsolicited and highly opportunistic" which did not reflect the company's true value.

Menzies Aviation has 25,000 employees in 37 countries, providing passenger, baggage and aircraft handling services.

Every board of directors has its price, and after some "highly opportunistic" attempts at locating it, a Kuwaiti rival has settled on 608 pence per John Menzies share.

That's a long way from the 460 pence, and then 510 pence which were dismissed by Menzies' directors as "highly opportunistic".

It's also a long way from the price in January, which averaged precisely half the level on which buyer and target company have now agreed.

The directors' agreement is unanimously to recommend the offer to shareholders. The rest is usually a formality.

And so goes another Scottish headquarters, and a company worth more than half a billion pounds - its independence a victim of the consolidation in airport ground handling services. Starting 35 years ago, John Menzies has built up a world-class company in handling cargo and fuelling aircraft.

Its roots go back to 1833, in bookselling and publishing, and it became best known in its home country as a distributor and retailer of newspapers, by the 1960s running more than 350 railway station kiosks and 161 other shops.

It is 60 years since it floated shares, handing a fifth of them to employees.

But the short-termism of the market is what left it vulnerable to a longer-term Kuwaiti investor and rival, with the deep pockets to keep consolidating.

Menzies Aviation shed its distribution business in 2018 to focus on aviation, having got the knack of expansion through "acquisition, innovation and stellar contract wins".

So having expanded at least partly through acquisition, in the Netherlands, USA, Australia, Norway, Sweden and South Africa, then buying the world's largest aircraft-fuelling business, it's hard to criticise when it is itself acquired.

It had to move swiftly to adapt, first, to the collapse in cargo trade with the financial crunch of 2008, and drastically to cut staffing when the global aviation industry tanked due to Covid lockdowns. Uncertainty over the pace of the sector's recovery left it vulnerable.

The sale highlights the Scottish economy's lack of a healthy pipeline of similar companies. It is also a blow to its local supply chain when Scotland loses the benefits of hosting a large corporate headquarters.

Related topics

- Published21 February 2022

- Published9 February 2022

- Published2 August 2020

- Published17 June 2020

- Published27 March 2020

- Published5 September 2018