Mini-budget: How is Scottish business reacting?

- Published

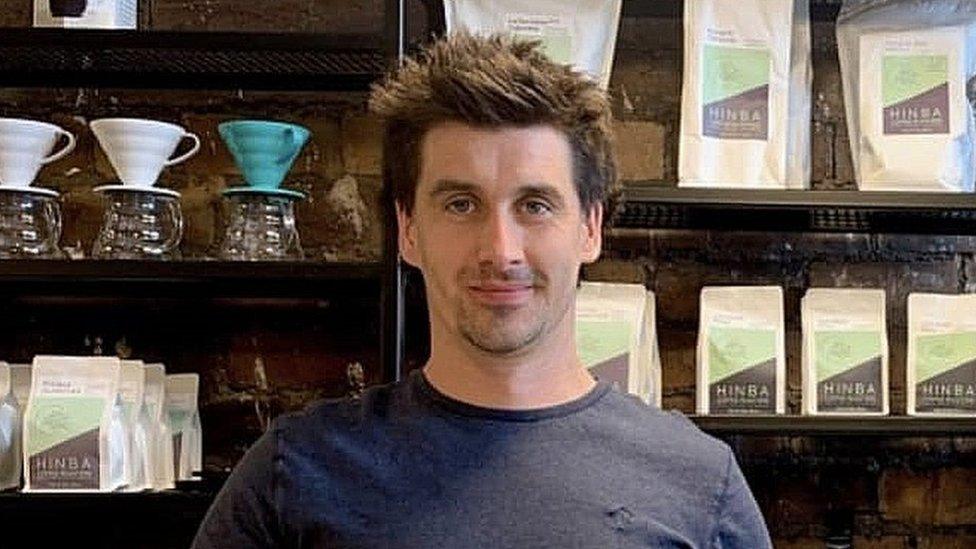

Coffee shop owner Fergus McCoss says the mini-budget puts his firm's growth plans "back on the table"

Scottish business has given a mixed reaction to the chancellor's mini-budget, with praise from some quarters but disappointment from others.

Fergus McCoss is breathing a sigh of relief after the chancellor laid out a major shake-up of the UK's finances.

The businessman, who runs Hinba Coffee Roasters in Glasgow and Oban, said the decision to scrap the planned raise in the corporation tax and reverse the national insurance rise had "really helped".

He told BBC Radio Scotland's Lunchtime Live: "It comes as a relief. It's been a really tough time in the hospitality sector so we are really pleased to get this sort of support at the moment.

"We are hoping for continued support. That then opens the opportunity to expand again.

"We are an ambitious small business and we want to grow, we want more shops, we want to do more things.

"This puts this back on the table because we were thinking that we'd have to have a quiet year or two, just to consolidate again."

The Scotch whisky industry has also raised a toast to the chancellor, after he announced that planned increases in the duty rates for beer, cider, wine and spirits had been cancelled.

The Scotch Whisky Association (SWA) said the move would not only support the sector, but the hospitality industry and the wider economy.

Chief executive Mark Kent said: "This will save consumers £1.35 on the average priced bottle of Scotch Whisky and help the industry as it deals with the dual challenge of rising energy costs and supply chain pressures."

Meanwhile, small business representatives said it was "a real relief" to see the reversal of the 1.25% "damaging hike" in national insurance contributions.

Chancellor Kwasi Kwarteng says tax cuts and economic measures will boost growth

Andrew McRae, from the Federation of Small Businesses (FSB), said: "Scrapping the hike will save businesses money every month at a time when purse strings are already tight and will remove a barrier to creating new jobs.

"Other common sense measures will help small businesses too - by keeping corporation tax rates at their current level more companies will have breathing space in the midst of this cost-of-doing business crisis."

"Of course, many of the more eye-catching announcements - on everything from income tax to investment zones to planning reform - are either wholly devolved to Scotland or at least involve co-operation between our various governments.

"It will be interesting to see how the Scottish government decides to proceed in light of these moves and, indeed, how it chooses to spend any consequentials."

But there was less enthusiasm for the mini-budget from the hospitality sector.

'Left out in the cold'

The Night Time Industries Association Scotland said it was "extremely disappointed" with the announcement.

In a statement, it said: "It will be seen as a missed opportunity to support businesses that have been hardest hit during this crisis, causing considerable anxiety, anger, and frustration across the sector as once again they feel that many will have been left out in the cold.

"We have been extremely clear with the government that the Energy Bill Relief Scheme, even with the announcement of the limited tax cuts on National Insurance, corporation tax and duty, is unlikely to be enough to ensure businesses have the financial headroom to survive the winter, especially with yesterday's announcement of the rise in interest rates from the Bank of England."

The Scottish Licensed Trade Association says its pleas for support have "simply been ignored"

Colin Wilkinson, managing director of the Scottish Licensed Trade Association, said the mini-budget was "more about what was left out rather than what was included".

He explained: "The sector has been pushing for a permanent reduction in VAT, similar to those introduced during the pandemic, and to bring us in line with our European competitors.

"Also, we were looking for industry support to be given through rates relief or the cancellation of rates for the next year.

"Both of these pleas have simply been ignored so from our point of view, there's not much to cheer about from the chancellor's mini-budget statement."

The Scottish Retail Consortium welcomed parts of the mini-budget but warned that "many of the announcements" would only have a limited impact on Scottish consumers and businesses.

The industry body also argued that the chancellor had "provided no insight" on what decisions might be made on business rates, with Scottish retailers facing a £60m uplift in their rates bills next April.

Director David Lonsdale said retailers would welcome the government's decision to scrap planned increases in national insurance contributions.

He also described the government's move to drop plans to scrap tax-free shopping for international visitors to Scotland and the UK as "most welcome".

Mr Lonsdale said: "Tax-free shopping and visits by international visitors generates much needed jobs and revenues in the retail, tourism, and hospitality sectors in Scotland and this move should provide a cheer in high street destinations."

He added: "However, many of the announcements today will only have a limited impact on Scottish consumers and businesses.

"With the UK government accelerating its planned reduction in the headline rate of income tax, bringing it forward to next April, Scottish ministers should ensure workers on low or modest earnings here in Scotland benefit similarly to boost household incomes and encourage discretionary spending."

'Bold start'

Scottish Chambers of Commerce said the string of policy announcements from the chancellor signalled "a bold start".

Director and chief executive Liz Cameron said: "The chancellor's commitment to pro-growth and pro-enterprise policies will be eagerly welcomed by businesses.

"The specifics on reducing business costs, cutting red tape and boosting infrastructure development are exactly the levers the UK government should be pulling to support economic growth."

She added: "As firms continue to navigate unprecedented challenges in the economy, consistent collaboration and partnership will be essential between both governments and the business community if we are to move from survival to growth.

"As we look ahead to the Scottish government's emergency budget, businesses and households now play the waiting game to see if the Scottish government opts to take similar moves.

"With control of powers such as income tax and land and buildings transaction tax devolved to Scotland, the expectation will be for Scottish government to deliver parity with the rest of the UK."

- Published23 September 2022

- Published23 September 2022