Irn-Bru founder's great-grandson to step down after six decades

- Published

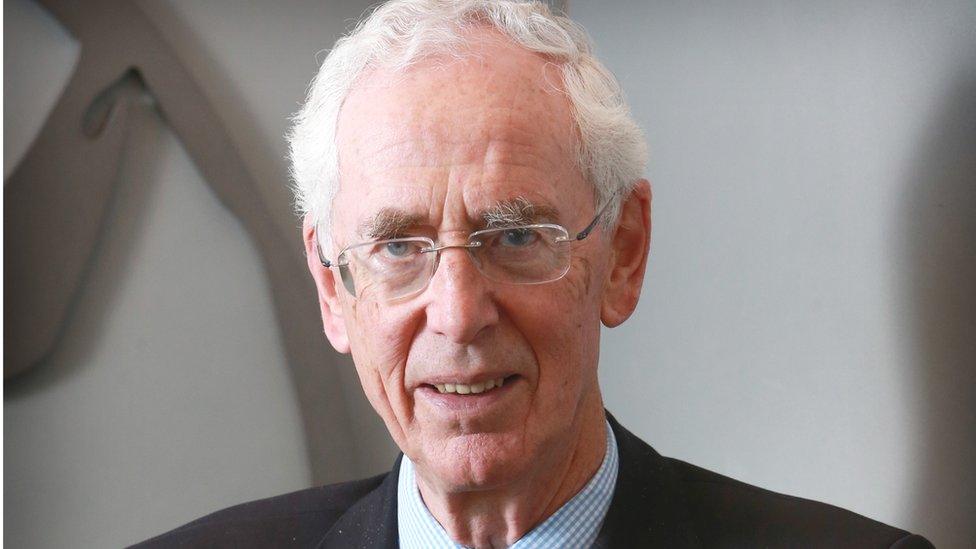

Robin Barr spent more than 30 years as chairman of AG Barr

Robin Barr is to step down from the board of soft drinks giant AG Barr after six decades with the firm.

Mr Barr, who is the great-grandson of company founder Robert Barr, has announced he will not seek re-election at next month's annual general meeting.

The 85-year-old held the post of chairman for 31 years before stepping down in 2009.

He has remained a non-executive director of the Cumbernauld-based firm until now.

Mr Barr's great-grandfather founded the business in 1875, producing and selling "aerated waters", as soft drinks were then called.

AG Barr's portfolio of products now includes Irn-Bru, Rubicon, Funkin and Boost.

The Barr family's links to the company are likely to continue after Mr Barr's departure.

His daughter Julie, who is AG Barr's company secretary, will stand for election as a non-executive director at May's AGM.

She has been with the company for 19 years and is a qualified corporate lawyer.

Chairman Mark Allen said: "We are hugely indebted to Robin for all his years of service, not to mention the balanced and insightful guidance he has provided to the board as the business has developed across the last 60 years or so."

'Investment phase'

In a separate development, AG Barr said it was now in "an investment phase" after reporting strong results for the year to 29 January.

Revenue increased by 18.2% to £317.6m, while adjusted pre-tax profit was up by 13.3%, at £43.5m .

The company reported strong revenue growth across its core drinks brands.

During the financial year, Barr bought energy drinks brand Boost in a deal worth up to £32m.

Chief executive Roger White said: "Our strategy to build and develop a multi-beverage portfolio capable of significant long-term growth is progressing well.

"We are now in an investment phase, designed to capitalise on the strategic growth opportunities ahead.

"We do anticipate a short-term impact on operating margins, as a result of the combination of this investment, ongoing inflationary cost pressures, and the initial dilutive impact from the Boost acquisition."

Related topics

- Published5 December 2022

- Published6 December 2021