Hopes for subsea cable boom in Scotland

- Published

Developers are hoping to install high-voltage cables connected to offshore wind turbines

Two very large factories are being planned for the north of Scotland and Ayrshire, with hugely ambitious plans to roll out thousands of miles of high-voltage subsea cable each year.

The plan for Hunterston involves construction of the highest free-standing tower in the country, as high as the former chimney at Longannet.

The key to making these plans reality will be in getting the sequencing right, across the energy industry, governments and finance.

At last, after numerous false dawns, the renewable energy boom is about to generate manufacturing jobs at scale. Not one, but two big plants for making subsea power cables are in Scotland's planning system.

Sumitomo Electric, part of a Japanese engineering giant with serious pedigree in this sector, has announced it will build one in the Highlands.

It is not yet saying precisely where, what the scale will be, how many jobs will be required, and how much it intends to invest. But all these numbers are likely to be large. Such plants only stack up if they're on a very big scale.

And it seems that by no coincidence at all, the owner and operator of the Nigg industrial site in Easter Ross, Global Energy, has lodged a detailed plan for precisely that type of factory to be built on 15 hectares of farmland next to the existing fabrication yard.

That's an area equivalent to 20 football pitches. The buildings would take up nearly half of that, and two of them will be up to 44m (144ft) high - the same height as the spire of St Giles Cathedral in Edinburgh.

Nigg lies within the boundaries of the green freeport designation, won in January by bidders for the Cromarty Firth and Inverness. It means tax breaks for investors, though the details of how the incentives will work are some months off.

ScotWind

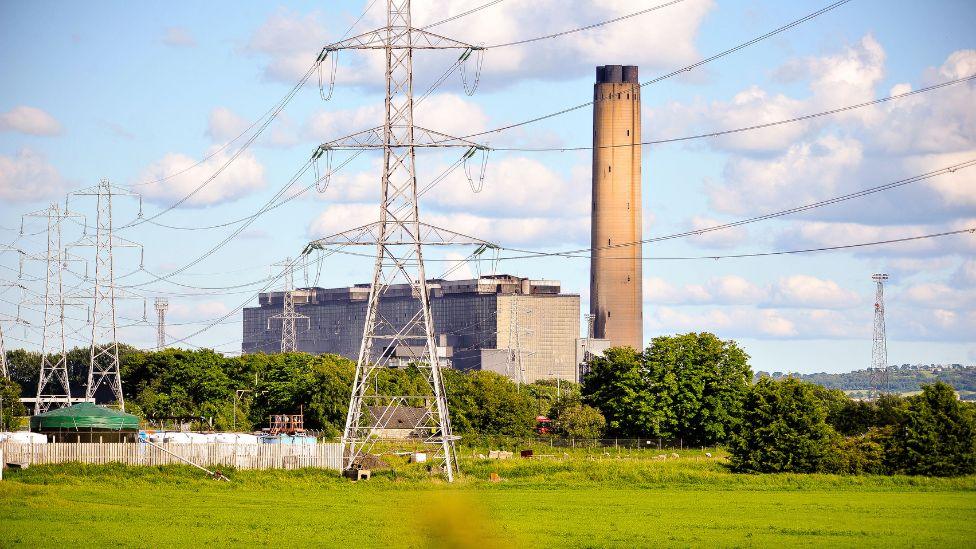

A new subsea cabling project is being planned at Hunterston power station

The Nigg plan is for high-voltage cable to be fed under the public road and onto large cable-laying ships berthed close to the Sutors of Cromarty - the two headlands that guard the entrance to the immense harbour of the Cromarty Firth.

From there, they will be shipped out to sea, and laid between hundreds of wind turbines due to be located around the shores of Scotland as part of the ScotWind project.

That next generation of offshore developments began to take shape 15 months ago, when winners were announced in the bidding competition to develop 20 large sea areas around Scotland, paying £755 million for the rights to do so.

If all those plans come to fruition - a big if, and I shall return to that - there could be nearly £29bn invested in these projects.

Of that, developers have pledged to spend more than £20bn in the Scottish supply chain. It is less likely that will be in the most obvious part of manufacturing - the towers and turbines that are central to offshore wind power.

But there is a lot more that goes into the industry than steel fabrication and blades. So if Scotland can secure the necessary investment, factories for cabling begin to make financial sense to the industry.

This is heavy and quite dirty stuff, involving 38 processes before it leaves the factory, including coatings with bitumen and lead. And it requires extensive testing, to ensure there are no flaws to interrupt the smooth flow of power.

In the clean waters around Scotland there will be demands that heavy industry does not harm the environment.

Plugged in

A plan of the factory at Hunterston

A similar factory plan is further down the planning track at another well-established coastal industrial site, and not without its controversies. It has a price tag of roughly £2bn.

At Hunterston, a company called XLCC has planning permission in principle for a very large factory to make very large quantities of DC (direct current) subsea cable for transferring power over long distances.

Its order book starts with an ambitious plan to link England with Morocco, bringing solar and wind power from the north African desert, along the coasts of France and Spain.

Xlinks is the company that spun off XLCC, both backed by wealthy investors' finance. Its plan is for a 2400-mile (3860km) subsea cable, providing more than 7% of Britain's power needs.

Since being energised in 2019, such a subsea cable already surfaces at Hunterston, and provides flexibility for Britain's electricity grid by linking Ayrshire with North Wales.

That takes excess wind power from Scotland into the national grid and population centres of England. And when the wind drops, it brings power north from gas and nuclear power stations in the south.

More subsea connectors are planned for Britain's east coast, to be laid south from Peterhead, adding capacity to the transmission wires on pylons marching across the England-Scotland border.

XLCC has made the case for building on the vast former coal storage yard at Hunterston with the prospect of 900 jobs. No such figure has been given by Sumitomo or Global Energy, but the Highland plant could easily be in that ballpark.

Local concern has focussed on the noise from the factory and from ships, partly because shipping already causes them some annoyance in the village of Fairlie.

XLCC says it is about to order a large cable-laying vessel to serve its Ayrshire factory, and to be available for charter elsewhere, which will dock on electric power and remain plugged in while alongside, with its engine off.

Drying time

The chimney at Longannet power station was demolished in 2021

The really distinctive element of the Ayrshire plan is a colossally large grey concrete tower. It will be 60m (197ft) by 40m (131ft) in length and breadth, and 185m (607ft) high. That will make it the highest free-standing building in Scotland - the same height as the now demolished chimney at Longannet power station in Fife.

The current highest building in Scotland is the Science Centre tower next to BBC Scotland headquarters, which is merely 127 metres off the Pacific Quayside.

The Hunterston tower will not be a chimney, but a drying tower for cable as plastic coating is applied to it.

To ensure the cable, in section, is precisely round, plastic has to dry evenly around it without gravity leading one side to have better protection than the other.

Cable moves through the factory at approximately one metre per minute. As drying takes three hours, it requires 180m (591ft) of drop. And as there will be six production lines, it needs a lot of bulky tower.

Production on that scale will allow the Hunterston plant to produce a staggering 2600km (1600 miles) of cable each year. That is nowhere close to the demand that is coming the way of cable-makers, so the company is planning another plant on Teesside in north-east England.

That would start at half the scale, but with space to double it, up to Hunterston's level of output.

As ever, the planning process has brought its frustrations for developers, just as locals with concerns about noise and visual impact have so far lost the argument.

Further appeals could stall the process, but as things now stand, the intention is to start construction early next year, with complex installation of production lines and testing of cable quality taking until 2027 for full production and load-out to begin.

Incentives

All this may sound too good for the economy to be true, and by transporting green energy, it would be not bad for the environment as well.

The key that unlocks all this is in sequencing. The billions of pounds required have to be committed before the developers can sign up to orders.

They are committed to spending a large share of the investment in Scotland, but they do not yet see the capacity in place to do so. They are alarmed at the bottlenecks in supply, as the rest of the world moves swiftly into offshore wind power and chases the same manufacturing capacity.

That pushes up prices and challenges the economics of the industry. And some of these same developers are eyeing the incentives to manufacture and to invest in the US, in the European Union and, recently announced, in Canada, while the UK leaves uncertainty on what it will offer.

There are, so far, Memorandums of Understanding. We have seen them before.

This time, it will take co-ordination of many moving parts, controlled by governments, finance and the energy industry, to transform them into firm orders.

Related topics

- Published24 March 2023

- Published13 March 2023