Stewart Milne: The rise and fall of a housebuilding giant

- Published

Stewart Milne says he is "struggling to accept" the collapse of his firm

The collapse of the Stewart Milne Group has cost hundreds of jobs and left families across the country facing uncertainty over their new homes.

It is a miserable situation for the housebuilding firm and its boss Stewart Milne - who was once hailed as a Scottish business success story.

Starting out as a young electrician - with a love of football - Milne went on to dominate the construction business in the north east and serve as chairman of Aberdeen FC.

The 73-year-old said he was "devastated" by the collapse of the company he founded in 1975 and was "struggling to accept it".

Milne had postponed retirement in an attempt to secure a future for the firm that he poured his working life into.

Raised in Alford, Aberdeenshire, he was the youngest of five boys. His father was a farm worker and his mother was an auxiliary nurse.

"It was a tough upbringing," Milne said in a 2004 interview with the Sunday Times.

"We lived in a tiny cottage with just three rooms and no electricity until I was 14."

Stewart Milne Group was hit hard when work was forced to stop during the pandemic

Milne said he had little interest in studying at school but sport was his passion. He trained as an electrician and gained a City & Guilds qualification in 1971.

In partnership with a plumber, Milne got his foothold in the industry by renovating flats in Aberdeen.

He found he had no shortage of work in the 1970s as the city's tenement housing stock needed extensive modernisation.

By 1975 he had set up himself as a housebuilder employing 30 people.

His company pioneered rapid timber frame construction that gave them an advantage over his competitors at the time.

Milne boasted that his teams could complete jobs in weeks that would take rival firms months.

After the oil price slump hit the north east economy in the late-1980s, Milne expanded into central Scotland and it became his biggest area of operation.

Stewart Milne Group eventually had offices in Aberdeen, Edinburgh, Glasgow and Manchester and a workforce of more than 1,000 people.

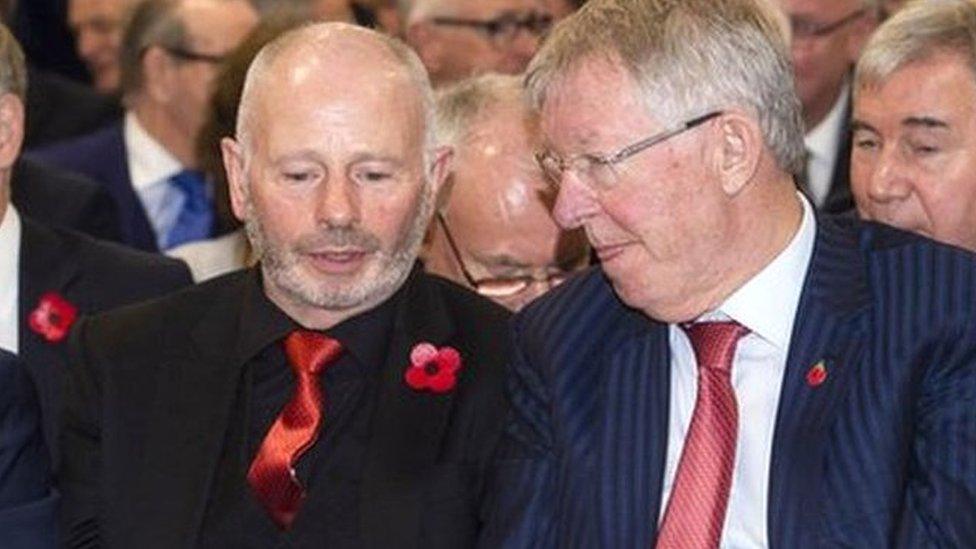

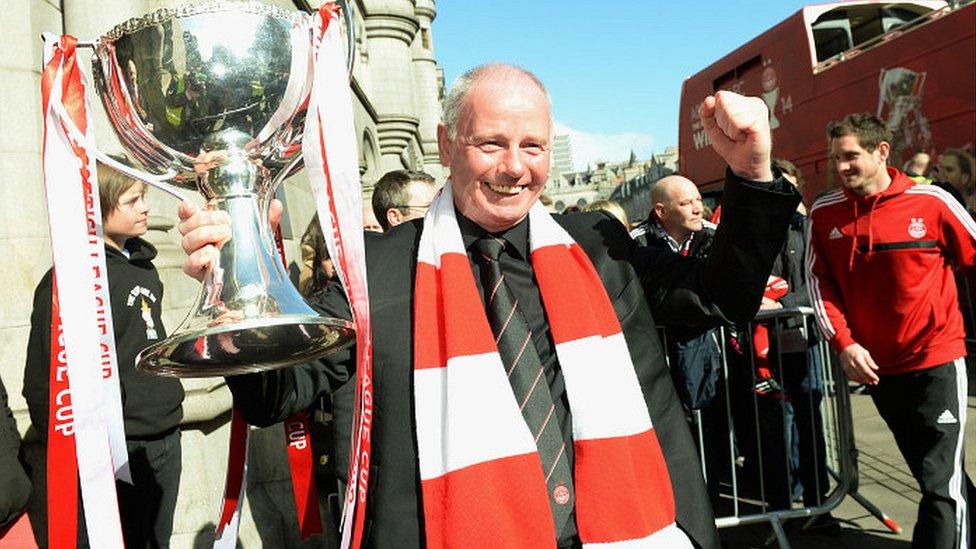

Milne was chairman of Aberdeen FC for 22 years

Milne also became a major shareholder in Aberdeen FC. He joined the Pittodrie club's board of directors in 1994 and became chairman in 1998.

He announced he was stepping down as chairman in 2019 but remains on the board.

His departure from the club came just weeks after former manager Sir Alex Ferguson opened Cormack Park, a new £12m training facility.

Aberdeen FC has confirmed that it has not been affected by the collapse of the Stewart Milne Group.

Milne's career was recognised with a CBE for services to construction in 2008.

He received honorary doctorates from Robert Gordon University, Napier University and Heriot-Watt University as well as a lifetime achievement award from industry body Homes for Scotland.

Jane Wood, chief executive of Homes for Scotland, said she was "surprised and saddened" by the company's collapse.

Stewart Milne Group was put up for sale in April 2022 after Milne announced his retirement, which he later postponed in a bid to secure the firm's future.

He said at the time: "After considerable soul-searching, I have decided that the time is right to step back from the business I founded to prioritise my time for family, friends and other ventures."

His company was hit hard by the Covid pandemic, which saw construction firms forced to down tools for months.

Stewart Milne says that two bids were made to buy the firm but these were rejected by bankers

In the year to October 2020 Stewart Milne Group recorded a pre-tax loss of £71.5m on turnover of £269.7m.

In December 2021, the firm sold its timber frame business to focus on housebuilding in its core markets in Scotland and north west England.

By October 2022 it had recorded annual pre-tax profits of £16.5m.

However, turnover fell to £172.4m as its house sales fell by nearly 30% to 583.

The initial sale was suspended due to "economic uncertainty". It was relisted in July 2023, but failed to attract a viable buyer.

It has now entered administration with the immediate loss of more than 200 jobs, with hundreds of other sub-contractors expected to be impacted.

Lloyds Banking Group said it had attempted to find a solution that would place the business on a "sounder financial footing" and avoid insolvency.

Milne said that two bids were made to buy his firm after "significant interest", but Lloyds did not accept them and withdrew funding.

"I believe one of the bids could have delivered a comparable, financial return to administration and, crucially, allowed the business to continue to operate, safeguarding hundreds of jobs and protecting livelihoods," he added.

"I tried everything I could to find a way to achieve a better outcome for the business and the people who depend on it."

Related topics

- Published8 January 2024

- Published28 July 2023

- Published21 April 2022