Stewart Milne: Aberdeen and Dundee meetings to help workers

- Published

Stewart Milne Group went into administration last week

Meetings to offer legal support to workers who lost their jobs after Stewart Milne Group collapsed are being held.

The construction firm went into administration last week with the loss of more than 200 jobs.

Administrator Teneo said 217 jobs would be directly affected but it is feared hundreds of other sub-contractor roles will also be impacted.

The Unite union said meetings were being held in Dundee and then Aberdeen.

The union is exploring possible legal action over what it described as a lack of consultation in advance of redundancies.

Meanwhile, speaking in Aberdeen, First Minister Humza Yousaf said: "We want to do what we can to support the workers".

He recognised people who had bought homes or were awaiting repairs would be in "absolute shock".

Mr Yousaf said he could understand "anger and frustration" in the wake of what had happened.

The collapse has left families across the country facing uncertainty over their new homes.

Unite said it represents more than 60 workers at the company in locations including Aberdeen, Dundee, Edinburgh and Glasgow.

Unite industrial officer John Clark said: "Unite will be stepping up our efforts to provide legal support for the Stewart Milne Group workers by hosting these meetings in Aberdeen and Dundee."

The first meeting was held in Dundee's Apex Hotel on Monday morning, and was being followed by a second at Aberdeen's Beach Ballroom in the afternoon.

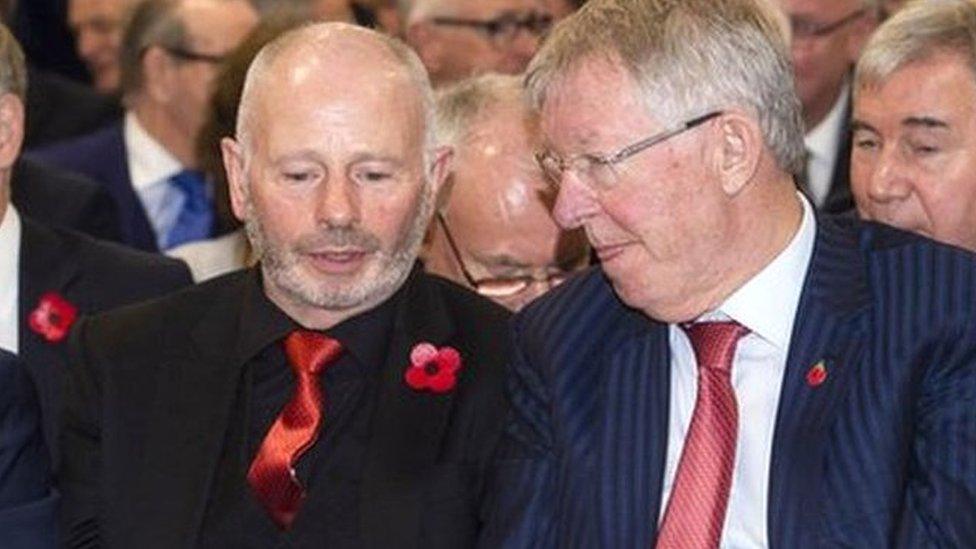

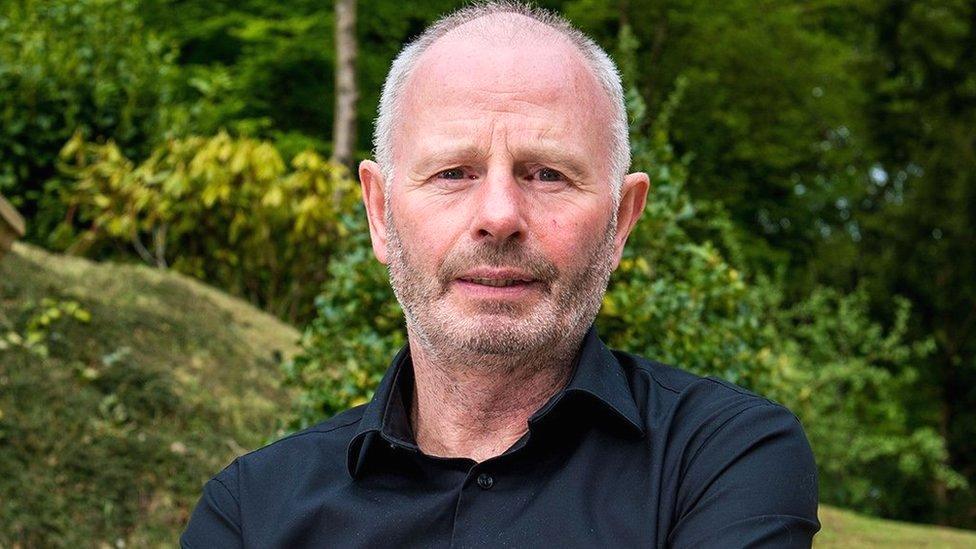

Stewart Milne said he was struggling to accept the collapse

Stewart Milne Group was put up for sale in April 2022 after Mr Milne announced his retirement, which he later postponed in a bid to secure the firm's future.

His company was hit hard by the Covid pandemic, which saw construction firms forced to down tools for months.

Lloyds Banking Group said it had attempted to find a solution that would place the business on a "sounder financial footing" and avoid insolvency.

Mr Milne said that two bids were made to buy his firm after "significant interest", but Lloyds did not accept them and withdrew funding.

The 73-year-old said he was "devastated" by the collapse of the company he founded in 1975 and was "struggling to accept it".

Related topics

- Published10 January 2024

- Published8 January 2024

- Published28 July 2023

- Published21 April 2022