Scottish independence: Standard Life draws up 'Yes' contingency plan

- Published

Robert Peston reports on how both local people and the business world have reacted

Standard Life's announcement that it may move operations outside Scotland in the event of independence has sparked a political row.

The company said it was putting the contingency plan in place because of uncertainty over issues like currency.

Scottish First Minister Alex Salmond said the move showed his currency union plan was the right option.

Deputy Prime Minister Nick Clegg said he was not surprised by the announcement.

The intervention came ahead of the Scottish independence referendum, on 18 September.

Meanwhile, in a separate development, credit ratings agency Standard and Poor's gave its assessment of the viability of an independent Scotland, saying "the challenge for Scotland to go it alone would be significant, but not unsurpassable".

Edinburgh-based Standard Life - which has been based in Scotland for 189 years - employs about 5,000 people north of the border out of a total headcount of 8,500.

The company's concerns came on the day of its annual results, reporting operating profits of £751m - a fall of 13% on a year earlier.

The intervention was made amid a vigorous debate over the currency of an independent Scotland.

In the event of a referendum "Yes" vote, the Scottish government wants to keep the pound as part of a formal currency union with the rest of the UK - but the three main Westminster parties - the Conservatives, Labour and the Liberal Democrats - have said they would not support such a move.

Standard Life has started work to establish additional registered companies to operate outside Scotland, into which it could transfer parts of its business.

Its annual report said Scotland had been a great base for the company, but added: "If anything were to threaten this, we will take whatever action we consider necessary - including transferring parts of our operations from Scotland - in order to ensure continuity and to protect the interests of our stakeholders."

Standard Life chief executive David Nish said a number of material issues remained unresolved in connection with independence, including currency and the shape and role of its monetary system.

Risk analysis

Scottish Finance Secretary John Swinney: 'Standard Life's position... boosts case for currency union'

He also highlighted arrangements for financial services regulation and consumer protection and the approach to individual taxation, especially around savings and pensions.

Mr Nish added: "We will continue to seek clarity on these matters, but uncertainty is likely to remain.

"In view of this, there are steps we will take based on our analysis of the risks."

Mr Nish insisted Standard Life had a "long-standing policy of strict political neutrality and at no time will we advise people on how they should vote".

Following the announcement, First Minister Alex Salmond clashed with Scottish Labour leader Johann Lamont at Holyrood during a heated First Minister's Questions.

Ms Lamont said Standard Life's comments showed a "Yes" vote would be a "disaster for Scottish jobs".

She added: "Standard Life is actively making plans to leave Scotland if the first minister gets his way.

"No amount of bluff, no amount of bluster and no amount of bullying from Alex Salmond can change that fact."

Ms Lamont accused the SNP leader of "denial, deception, delusion" on the issue, but was rebuked by Presiding Officer Tricia Marwick.

Later, she insisted: "Isn't it the case that Alex Salmond's plans would do more damage to Scotland than even Margaret Thatcher?"

But Mr Salmond argued Standard Life would "find Scotland a good place to do business".

He added: "That will happen first and foremost because of the excellence of the staff. That's its prime asset, the 5,000 people who work in Scotland - that's the strength of the company and has made it successful."

He said the second reason was "because the Scottish government puts forward the concept of a shared currency and regulatory framework, which is exactly the sort of things Standard Life have been calling for".

The first minister told Ms Lamont: "The bluff, the bluster, the bullying applies to George Osborne, who is the Tory Chancellor [Ms Lamont] is in alliance with."

Mr Salmond said Standard Life's managing director had written to employees in 1992 claiming devolution would be damaging to business and would cost jobs.

Standard Life, overseen by chief executive, David Nish, has been headquartered in Scotland for 189 years

But he said by the time of the devolution referendum in 1997 "they had changed their mind as experience showed them constitutional change could offer a secure business environment".

Liz Cameron, chief executive of Scottish Chambers of Commerce, said it was not unusual for firms to make contingency plans.

She added: "Scottish businesses plan ahead for different situations, whether it is the referendum or other economic changes, and they are obliged to report external issues which may impact on their business - this is normal practice."

Mr Clegg said the announcement was not surprising because of uncertainty over issues like currency.

He told BBC Radio 5 Live: "Because of the failure of the SNP to prepare for this moment and spell out what they mean by independence, it is no wonder that major employers are saying 'maybe we can't continue with our presence north of the border'."

'Yanked out'

Asked whether it was right for businesses to intervene in the independence debate, the Deputy Prime Minister said: "I think it's right for businesses to answer questions for themselves about their own business and address themselves to their own workforce, because there are thousands of people who work for Standard Life who want to know, 'what does it mean for my future and my ability to pay my bills if Scotland were to be yanked out of the UK?'"

Alistair Darling: "No wonder that companies like Standard Life... are starting to get worried and having to make contingency plans"

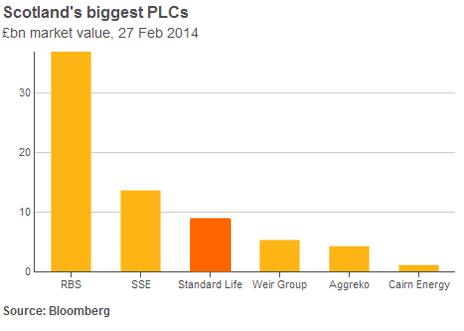

Meanwhile, the chairman of RBS - which has reported its biggest annual loss since being bailed out by the UK government - also raised issues of uncertainty.

Sir Philip Hampton said the bank was "politically neutral", adding: "Clearly there are issues we are looking at - currency, the application of financial regulation, lender of last resort, credit ratings - which could affect us.

Independence 'flexibility'

"But there is real uncertainty about how any of these matters would be settled in the event of a 'Yes' vote and the outcome would depend on negotiations between the two governments.

"Indeed, there could be a prolonged period of uncertainty over each of the issues so it really is impossible to quantify with any precision what the effects of each might be right now."

In a separate assessment, credit rating agency Standard and Poor's said an independent Scotland would benefit from "all the attributes of an investment-grade sovereign credit" due to its "wealthy" economy, skilled workforce and flexible markets.

However, the US-based agency also raised concerns over comparatively high levels of public debt, sensitivity to oil prices and "potentially limited" monetary flexibility.

It said there would be "volatility" if banks decided leave, but added: "If this were to happen, it could bring benefits in terms of reducing the size of the Scottish economy's external balance sheet, normalizing the size of its financial sector, and reducing contingent liabilities for the state.

"In short, the challenge for Scotland to go it alone would be significant, but not unsurpassable."