Scottish independence: What have businesses been saying?

- Published

March is the end of the financial year in the UK, when businesses announce their annual results and outline plans for the future.

With the Scottish independence referendum just months away, many big businesses have used their announcements to explain what independence would mean for them.

The economy is widely regarded as the key campaign battleground in the build up to the referendum which takes place on 18 September. Voters in Scotland will be asked the "Yes/No" question: "Should Scotland be an independent country?"

So, what have some businesses said so far?

Property investors

Property investors are split over whether independence would be good for Scotland

Caledonian Trust Plc, the Edinburgh-based property investment holding and development company, said in its interim results that the economic prospects for an independent Scotland "are not favourable".

Chairman Ian Douglas Lowe said the costs of independence would be "very high" for businesses, particularly Scotland's financial sector.

However, Dan Macdonald, chief executive of Edinburgh-based property investor Macdonald Estates, disagreed with this assessment, saying independence would create growth.

He added: "Full fiscal autonomy can equip the Scottish Parliament with the financial tools it needs to tailor policy and priorities to Scotland's particular needs, to secure investment and stimulate growth in the economy, and to create jobs."

SSE

SSE is the UK's second largest energy supplier

A single UK energy market would be "likely" if Scotland becomes independent, according to SSE.

The company, which is the UK's second largest energy supplier, issued a statement which said "a single energy market in Great Britain would be the most likely outcome in the event of a 'Yes' vote".

The statement also recognised that post-independence negotiations between the Scottish and UK governments could be "complex" and might result in changes to the existing market.

It added: "SSE has already put in place arrangements to ensure that it takes account of this uncertainty in its decision-making and is undertaking work to ensure that it has a clear view of the issues that would arise should there be a 'Yes' vote, and is in a good position to engage constructively with the Scottish and UK governments in the event of Scotland ceasing to be part of the UK."

Jupiter Fund Management

Maarten Slendebroak said he saw "significant long term business opportunity" in Scotland

Chief Executive Maarten Slendebroek said the investment firm's Scottish business would prosper regardless of the outcome of September's vote.

Mr Slendebroek said: "While the uncertainty regarding Scotland's future is a concern for business in the short term, we see a significant long term business opportunity for Jupiter in Scotland.

"It has a vibrant financial services sector and is home to many of the wealth management clients we are targeting. That will not change, regardless of the outcome of a referendum."

BlackRock

Blackrock sent its assessment on Scottish independence to its clients

The world's biggest investment fund manager has said Scottish independence would bring "major uncertainties, costs and risks".

Blackrock's assessment was that those risks would be "mostly for Scotland, but also for the remaining UK".

The New York based company, which manages trillions in financial assets, believed a currency union between an independent Scotland and the rest of the UK "looks infeasible" and would "bring risks to both countries".

It added that "best of the few choices" Scotland had would be to launch its own currency.

Thomas Cook

Thomas Cook's chief executive said the Scottish government's pledge to reduce air passenger duty was a "relatively small part" of the independence debate

Travel giant Thomas Cook told online news service the Huffington Post, external that two referendums - the Scottish independence vote and the potential UK referendum on EU membership - were creating "massive uncertainty" for business.

Chief executive Harriet Green said both votes were unsettling for companies looking to create jobs and attract investment.

Ms Green also dismissed British Airways boss Willie Walsh's suggestion that independence could be a "positive development", due to the Scottish government's pledge to cut and eventually scrap air passenger duty.

She said air passenger duty was a "relatively small part of that debate".

Next

The Next chief executive was asked about independence after the company announced increased profits

The chief executive of clothes and homeware retailer Next said Scottish independence would have no effect on how the company was managed.

According to The Herald, external, Lord Wolfson said: "I don't think it would make any difference. We manage our business in Eire how we manage in the UK.

"We do not see Scottish independence as a business issue."

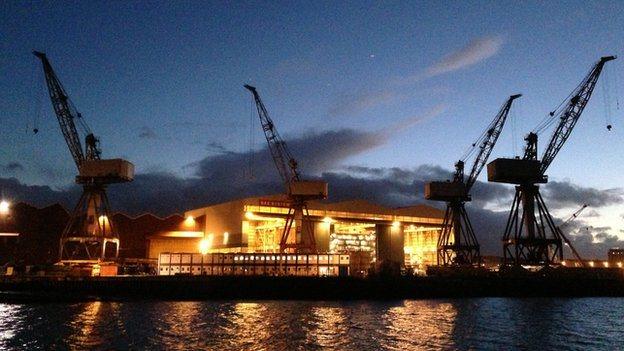

BAE

BAE employs about 3,000 workers on the Clyde

BAE Systems said continued union between Scotland and the rest of the UK offers "greater certainty and stability" for its business.

The company employs about 3000 workers on the Clyde and is helping to construct two new Royal Navy aircraft carriers.

Chief executive Ian King said: "BAE Systems has significant interests and employees in Scotland, and it is clear that continued union offers greater certainty and stability for our business.

"In the event that Scotland voted to become independent, we would need to discuss the way forward with the Ministry of Defence and UK government, and work with them to deliver the best solution in those circumstances."

Ineos

The Grangemouth oil refinery, which is owned by Ineos, employs more than 1,300 people

Jim Ratcliffe, whose company Ineos operates the Grangemouth oil refinery near Falkirk, said the vote will not make a difference to the future of the plant.

He told the BBC: "[Grangemouth] will survive in both scenarios. I don't think the Scottish vote will make any difference to Grangemouth one way or the other."

British Chambers of Commerce

The BCC represents about 92,000 businesses across the UK

The British Chambers of Commerce said its members are not saying "Yes" or "No" to Scottish independence, but they're looking for clarity on four issues.

Head of policy, Adam Marshall, told the BBC: "[Members] want to know what's going to happen on currency, they want to know what's going to happen on tax, they want to know what's going to happen on pensions, and they want to know what's going to happen on Europe.

"What they aren't saying to us is yes or no, what they're saying to us is we want to know what's going to happen on these particular issues because otherwise we are being asked to make a prediction based upon something we as a business would never do."

Alliance Trust

Chief executive, Katherine Garrett-Cox, has announced contingency plans for independence

Investment firm Alliance Trust has said it is setting up companies registered in England ahead of the referendum.

The Dundee-based company said it had to remain focused on services in the UK and beyond.

Chief executive Katherine Garrett-Cox said: "The referendum in September is creating uncertainty for our customers and our business, which we have a responsibility to address.

"Regardless of the outcome it is critical that we are able to provide continuity of service and protection for their investments and savings.

"To give them full confidence, we have started work to establish additional companies registered in England, in order to provide operational flexibility and to complement our existing business in Scotland."

Aviva

Chief executive Mark Wilson wants Aviva to stay neutral in the debate

The boss of insurance giant Aviva, Marks Wilson, has stressed that he is neutral in the independence debate, saying that it is a decision for the Scottish people.

He said: "Obviously we are looking with interest at what's going on, but I really think that's an issue for the Scottish people.

"We operate all around the world and we operate in many jurisdictions and in many places so I really think that's not an issue for us to focus on."

Aggreko

Aggreko is the world's largest temporary power company

The temporary power firm, Aggreko, said that independence would make doing business more complex, but that it would find a way to deal with it.

The Glasgow based enterprise said: "If Scotland were to leave the United Kingdom and become an independent country, it would likely burden our UK business with added operating complexity and cost.

"There is also a risk that the outcome of the issues of currency and membership of the EU will not be helpful to our business.

"At the very least, if Scotland votes for independence we will face some years of uncertainty and hiatus."

Aggreko stressed, however, that it would "find ways to manage around this challenge if it arises".

Standard Life

David Nish, chief executive of Standard Life, said plans have been made for independence

Standard Life has had its headquarters in Scotland for 189 years. However, its annual report stated that it would consider moving parts of it business elsewhere in the event of Scottish independence.

The report said Scotland had been a great base for the company, but added: "If anything were to threaten this, we will take whatever action we consider necessary - including transferring parts of our operations from Scotland - in order to ensure continuity and to protect the interests of our stakeholders."

British Airways

Willie Walsh, chief executive of BA's owners, was positive about independence

Willie Walsh, the chief executive of British Airways' owner company, IAG, was positive about independence due to what he believed would be more favourable tax rates.

He told the BBC: "If anything, [Scottish independence] might be marginally positive because I suspect the Scottish government will abolish air passenger duty, because they recognise the huge impact that that tax has on their economy.

"So, it's probably going to be a positive development - if it does happen - for British Airways."

Lloyds

Lloyds assessed the risk of independence in their annual report

Lloyds - which is Britain's biggest bank - said that uncertainty surrounds what would happen in the event of a "yes" vote in the referendum.

Its annual report stated: "The impact of a yes vote in favour of Scottish independence is uncertain.

"The outcome could have a material impact on compliance costs, the tax position and cost of funding for the group."

Ryanair

Michael O'Leary said independence might boost Scottish tourism

Michael O'Leary, chief executive of Ryanair, said he supported the position of the Scottish government in relation to the abolition of air passenger duty in an independent Scotland.

He explained: "There's no doubt that most airlines would support the position of the Scottish government in relation to the abolition of the APD (air passenger duty), which does untold damage to Scottish tourism."

"If the air travel tax were repealed by the UK government or an independent Scottish government, you'd see visitors to Scotland double over a five to 10 year period."

BP

The head of BP urged Scotland to stay in the UK

Bob Dudley, BP boss, said that the prospect of Scottish independence created "a big question mark" which will create concern for all businesses.

He said: "We have a lot of people in Scotland, we've got a lot of investments in Scotland. There's much debate about what would happen with the currency and of course whether there would be connections with Europe or not.

"These are quite big uncertainties for us. At the moment we're continuing to invest at the (same) pace because these projects are under way.

"But it's a question mark. I think all businesses have a concern. My personal view is Great Britain is great and it ought to stay together."

Shell

Ben van Beurden urged Scotland to stay in the UK, and the UK to stay in the EU

The chief executive of the oil company, Shell, wants Scotland to remain in the UK for the sake of "continuity and stability".

Ben van Beurden said: "We're used to operating in uncertain political and economic environments. But, given a choice, we want to know as accurately as possible what investment conditions will look like 10 or 20 years from now.

"As a global business with feet planted firmly on both sides of the Channel, we also believe that the UK's national interests are best served by a close relationship with Europe.

"It's for similar reasons that we'd like to see Scotland remain part of the United Kingdom.

"Shell has a long history of involvement in the North Sea - and therefore in Scotland - and we continue to invest more than a billion pounds there every year."

RBS

RBS has been based in Scotland for nearly 300 years

RBS chairman Philip Hampton told shareholders at the bank's annual meeting on 25 June that the state-backed lender was considering its options should Scotland vote for independence in September.

He said the bank would continue to maintain a "neutral position" but warned that the issue had created "a great deal of uncertainty" and would have implications for the bank's credit rating, tax and regulation.

He added: "We are having to consider the possible business implications of a 'Yes' vote and our response.

"We maintain a continuous dialogue with the Bank of England, UKFI (UK Financial Investments) and the UK government and the Scottish government on these matters."

Several months ago, RBS chief executive Ross McEwan said the bank could adapt to independence if it had to.

He said: "It's really important that the Scottish people get the opportunity to vote, and then if I need to adapt my business to serve England, Scotland, Wales and both the Republic of Ireland and Northern Ireland, then I will."