Scottish devolution: Smith Commission to recommend tax powers

- Published

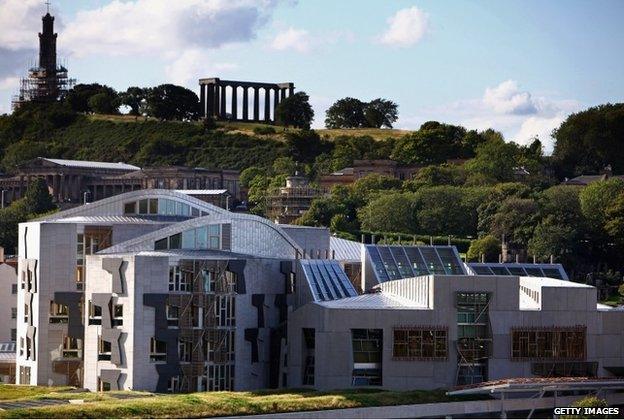

The Smith Commission is setting out plans to increase the powers of the Scottish Parliament

The commission on devolving powers to the Scottish Parliament is to recommend it has full control over income tax rates and bands, the BBC understands.

But the report is not expected to call for personal allowances - the threshold at which tax is paid - to be devolved.

The Smith Commission, which was set up after the "No" vote in the independence referendum, reached an agreement at its final meeting in Edinburgh.

The full report will be published on Thursday morning.

'Suffer the wrath'

The UK government, which set up the commission, has promised to use its conclusions to boost devolution.

It is thought the Smith Commission will also recommend "a substantial package of welfare powers".

Sources close to the talks said it would also recommend the devolution of Air Passenger Duty.

However, sources have told the BBC that other taxes such as VAT would not be devolved.

Analysis

By Douglas Fraser, BBC Scotland economy editor

The Scottish Parliament has had 15 years of spending power with very little taxation accountability.

That's about to change, a lot, if the Smith Commission "heads of agreement" translate into workable new devolution legislation.

There is a political case for such radical changes.

The mood of the electorate at the time of the independence referendum, we're told, was that it wanted more change and more powers at Holyrood.

The SNP, despite having lost that vote, is even more firmly in the driving seat of Scottish politics. And after "The Vow" from pro-union parties, pledging extensive new powers, the Scottish government is "holding their feet to the fire".

For those political reasons, unionist parties, despite winning the referendum, don't want to stand in the way of devolving many more powers.

Speaking earlier, Scottish First Minister Nicola Sturgeon said it would "suffer the wrath" of voters if it failed to deliver.

The recommendations of the commission, chaired by Lord Smith of Kelvin, are to form the basis of UK government legislation on more Scottish powers, although they would not be delivered until after the Westminster election, in May 2015.

Scottish Secretary Alistair Carmichael said the commitment to further devolution was made in good faith and that the timetable previously outlined would be adhered to.

Ms Sturgeon said she had high hopes for the commission's report, but told the BBC: "If those high hopes are not delivered on, it won't be me the unionist parties have to worry about - it will be the wrath of the Scottish people."

The first minister said devolution of income tax without control over the personal allowance - which she said was needed to tackle poverty - would be a "serious failure".

She added: "How can anybody argue that anything less than controlling half of your own tax base adds up to meaningful home rule?"

Analysis

By Norman Smith, BBC Assistant Political Editor

Although publicly today's deal will be welcomed at Westminster - in private there will be a good deal of anguish.

For Labour, the package represents a significant retreat - having previously strenuously opposed devolving income tax.

Aware that such a stance was at odds with Scottish opinion and could have led to a further c of their support to the SNP - they backed down.

The fear now however is that it will create renewed momentum for barring Scottish MPs from voting on English laws - a move which could cripple any future Labour govt.

For David Cameron, there will also be anger among some of his MPs that, once again, Scotland appears to have been given more power and allowed to retain the generous Barnett funding formula.

And for Unionists, generally there will be unease that today marks merely another staging post on the road to full independence.

The commission's recommendations are expected to include:

The full devolution of income tax rates and bands, with the personal allowance (the threshold above which tax is paid) continuing to be set by the UK government.

Assigning a proportion of the VAT revenues raised in Scotland to the Scottish budget.

Giving Holyrood control of air passenger duty and - eventually - the aggregates tax.

Devolving welfare measures including attendance allowance, carers' allowance and some cold weather payments.

Retaining UK control of all the benefits being merged into universal credit, while introducing some devolved flexibility over aspects such as the frequency of payments.

Devolving the work programme.

Putting Holyrood in charge of its own elections, which could allow MSPs to give 16 and 17 year olds a vote in the 2016 Scottish Parliament election.