Poll tax debt deadline is set for February

- Published

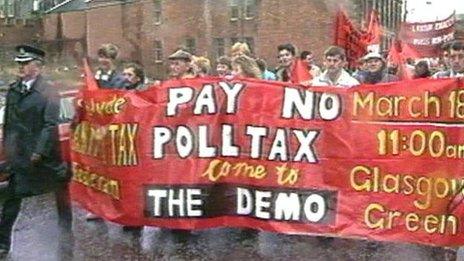

The debts date back to the introduction of the poll tax in Scotland in 1989

Collection of poll tax debts will end on 1 February next year.

The deadline is contained in the Community Charge Debt bill, external to stop local authorities pursuing arrears.

The independence referendum led to an increase in numbers of people registering to vote. Expanded electoral rolls were used to identify those who had debts.

The Scottish government said local authorities would be compensated.

The poll tax, or community charge, was abolished more than 20 years ago in 1993 after only four years in operation in Scotland.

The unpopular poll tax, which replaced the rates system, was introduced by the Conservative Thatcher government in Scotland in 1989 before the rest of the country, sparking protests on the streets.

'Consigned to history'

The amount of poll tax arrears collected by local authorities across Scotland has fallen in recent years to less than £350,000 in 2013-14.

Some local authorities have ceased recovery of debts altogether.

Deputy First Minister John Swinney said: "The poll tax was a hated levy which caused misery in hard-working communities across Scotland and was widely discredited as an unworkable tax, opposed across all sections of Scottish society.

"It is therefore entirely correct that at a time of record democratic engagement in Scotland, we legislate to ensure that people aren't dissuaded from registering to vote because they fear being chased for decades-old debts."

Mr Swinney said the legislation would mean that collections would cease and the poll tax would be "consigned to history for once and for all".

He added: "And while it is not contained as part of the bill, the Scottish government has committed to covering the cost of debts that councils would have expected to recover in the lifetime of existing recovery arrangements."

- Published2 October 2014

- Published2 October 2014