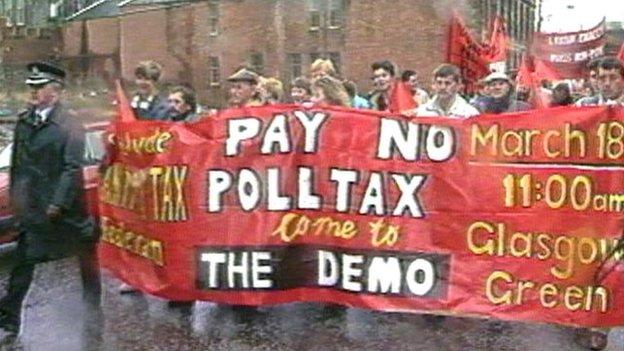

Scottish council tax arrears 'highest in UK'

- Published

Scots have the highest level of council tax arrears and payday loan debts in the UK, according to a new report.

Debt charity StepChange found that 39% of Scots who approached it for help in the first six months of this year were in arrears on their council tax bills.

On average, those who had fallen behind owed £1,534 - almost double the UK figure of £798.

StepChange's Scotland in the Red report also indicated payday loan debts were still a problem north of the border.

The average debt in the six months to June was £1,438 - the largest of the UK nations, and £129 more than the UK client average.

The report also indicated an increasing number of people falling behind on essential household bills.

In the first six months of 2014, clients north of the border had on average the highest electricity arrears (£616) of all the UK nations.

Last year, they also had the largest amount of gas bill arrears (£539).

However, the report also found that the average debt level dropped to £12,359 - the lowest of the UK nations and £634 lower than the UK client average.

'Stark reminder'

Sharon Bell, head of StepChange Scotland, said: "The rise in people struggling to pay their priority bills is a stark reminder of just how difficult day-to-day living has become for many Scottish households.

"Keeping a roof over your head and heating your home are basic needs, yet for too many Scottish families these are constant worries in the run-up to Christmas.

"Even where families are not in debt, many live on a financial knife-edge with small setbacks enough to tip them over the edge into problem debt."

Ms Bell added: "We continue to see worrying levels of payday loan debt which are making a bad situation worse for too many Scots.

"Toxic high-cost credit is being used as an emergency safety net and we need to find more sustainable ways to help people cope."

- Published4 December 2014

- Published3 December 2014