Property tax revamp under review by Scottish government

- Published

Scottish ministers announced plans to replace stamp duty with a new property tax

Planned new tax rates for property purchases are to be reviewed as part of the Budget process, the Scottish government has confirmed.

It follows calls to revise bands and rates of the Land and Buildings Transaction Tax (LBTT) set out in October's draft 2015-16 Budget.

The tax bands will replace stamp duty in Scotland from April.

The Tories have criticised the move for imposing higher rates on properties at the top end of the market.

Mr Swinney's initial plans raised the threshold for paying tax on a home from £125,000 under stamp duty to £135,000, with then rates ranging from 2% up to 12% on the portion of any price above £1m.

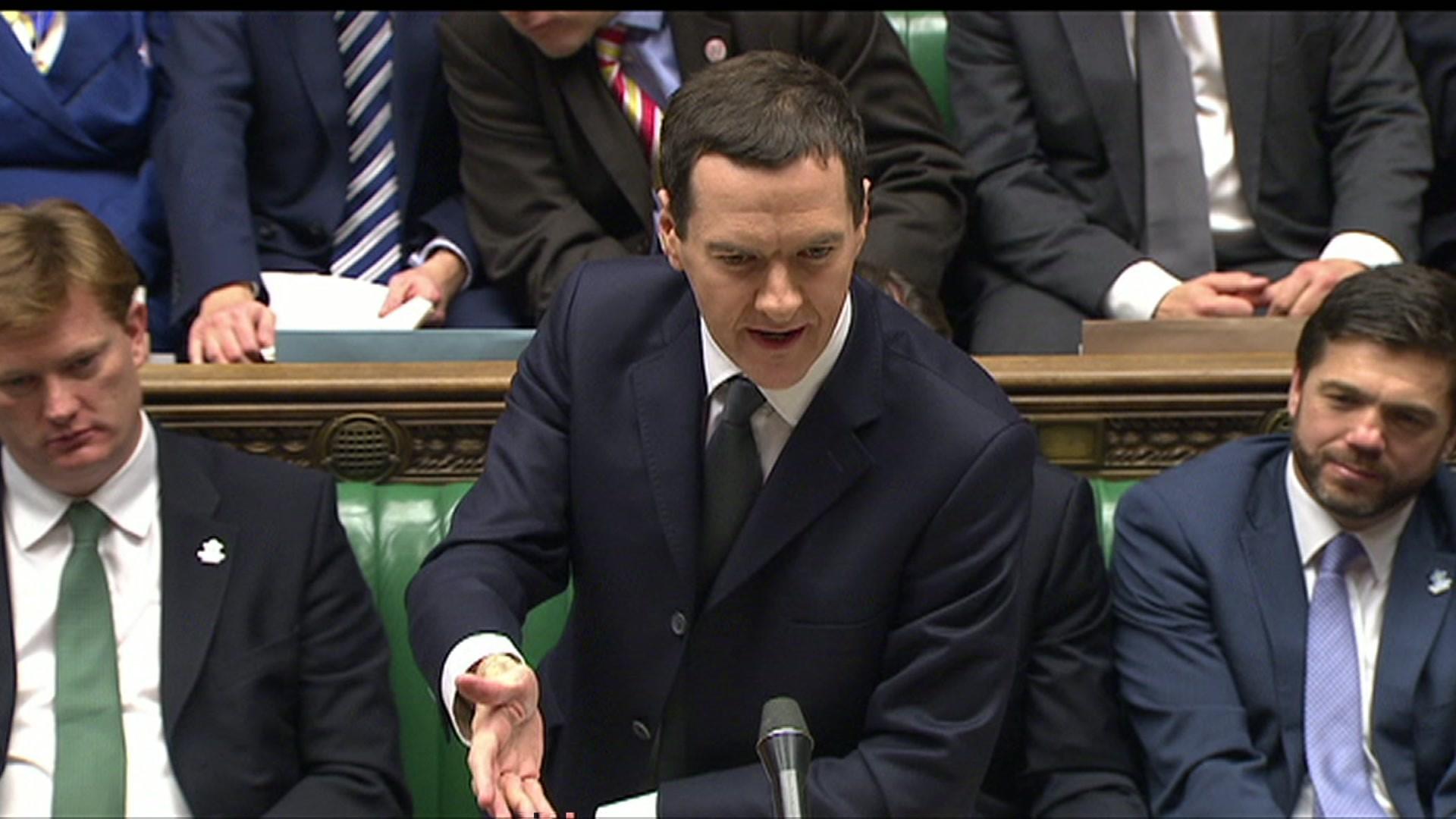

The new review of planned rates follows an overhaul of the UK stamp duty system announced by Chancellor George Osborne in his Autumn Statement.

Imitation claim

Mr Osborne replaced stamp duty bands with a graduated rate in December, which applied immediately and operate in Scotland until 1 April, when the LBTT replaces stamp duty.

The chancellor's new bands mean some purchasers benefit more under the stamp duty system.

The finance secretary said: "At the time of the UK Chancellor's Autumn Statement I said his imitation of my Scottish tax plans was the sincerest form of flattery.

"On the first occasion I've had to design a tax system for Scotland, the UK government copied it instantaneously and applied it across the UK."

'Right rates'

Mr Swinney said his proposals were designed for the Scottish market, not London house prices, with 90% of homebuyers better or no worse off and 5,000 homes would be taken out of taxation all together.

But he added: "The Chancellor's decision to introduce a new stamp duty system overnight, without warning and consultation, means that while 80% of homeowners continue to pay less tax or no tax at all under the Scottish system we now have the opportunity to review the rates and ensure they are right for Scotland."

Mr Swinney will announce his conclusions to the Scottish Parliament on Wednesday when MSPs are due to debate the Scottish Budget Bill.

The Conservatives have proposed that no tax be levied on house sales under £140,000, and that the 10% tax on homes between £250,000 and £500,000 be halved.

Finance spokesman Gavin Brown MSP said: "The eye-watering 10% tax rate has caused concern in many parts of Scotland and is having a distortion on the housing market."

- Published18 December 2014

- Published3 December 2014

- Published9 October 2014