Scotland should create new income tax band, says Conservative commission

- Published

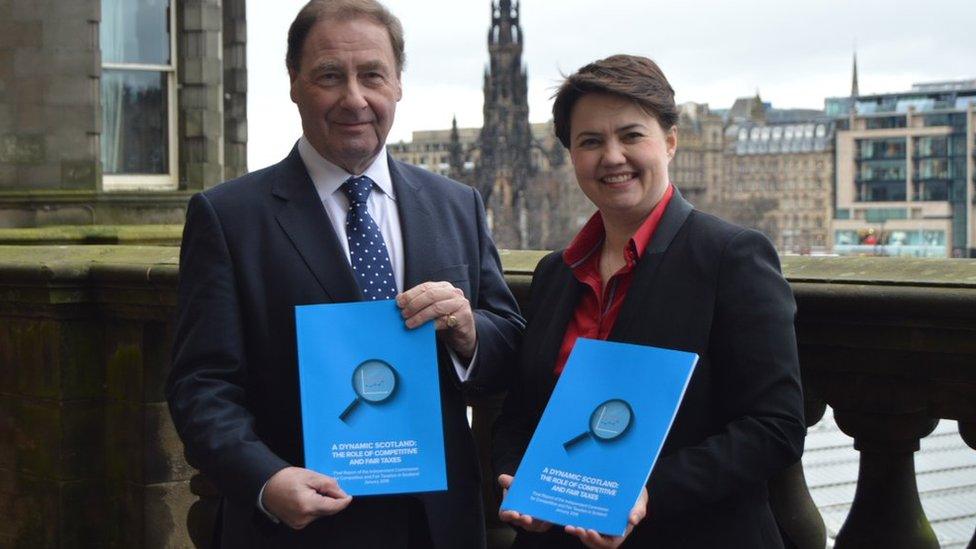

The commission was set up by Scottish Conservative leader Ruth Davidson and chaired by Sir Iain McMillan

Scotland should create a new middle income tax band after greater powers are devolved to Holyrood next year, a commission set up by the Scottish Conservatives has suggested.

The commission said the move would prevent many "aspirational families" being drawn into the higher tax rate.

It suggested the new rate should be between the current 20% and 40% bands.

Its report also said taxes in Scotland should be lower than the rest of the UK "when affordable".

And it called for the council tax to be reformed to make it fairer.

'Wealth creators'

The commission was headed by former CBI Scotland head Sir Iain McMillan, and was tasked with looking at how the Scottish Parliament could use new and existing powers to boost economic growth.

Its report recommended that the new "middle band" of income tax should be set at about 30%, and warned politicians against raising the upper rate of tax, which it said could "drive out wealth creators".

UK Tax Rates

30%

Proposed Scottish 'middle band'

-

20% Basic rate | Up to £31,785

-

40% Higher rate | Up to £150,000

-

45% Additional rate | £150,000 +

The SNP said it favoured introducing a "more progressive" income tax regime when the Scottish Parliament is given greater flexibility in setting income tax rates from next year.

Scottish Labour has a firm commitment to raising the top rate from 45% to 50%, with the party saying the additional revenue would go towards tackling education inequality.

The Scottish Conservatives hope the issue of tax will help put clear water between itself and the other parties as they aim to replace Labour as the main opposition in the Scottish Parliament when voters go to the polls on 5 May.

'Competitive edge'

The commission's report said that the "significant" new tax powers coming to the Scottish Parliament next year presented both "risks and opportunities" to the country.

Its key recommendations included:

in order to ensure Scotland "retains a competitive edge", the overall tax burden should not be any higher than in any other part of the United Kingdom, and lower when affordable.

on income tax, it backs the creation of a new "middle band" at about 30%

it backs a freeze in business rates for the course of the next Scottish Parliament, to offset the 42% increase in rates since 2007.

it supports a "reformed, fairer" council tax, with greater help offered to low income households across the bands.

the report concludes that the new Land and Buildings Transaction tax is "unfair" and - over the longer term - should be abolished.

and on Air Passenger Duty, the report backs its replacement with a new competitive Departure Tax, with a more progressive structure linked to travel distance.

Writing in the foreword to the report, Sir Iain said the Scottish Parliament had so far been largely "sheltered" by the Barnett Formula from the "tough political decisions that are necessary to balance the imposition of taxes on Scottish taxpayers on the one hand with public spending on the electorate's behalf on the other".

He added: "These days will come to an end in April 2017. From now on the debate in Scotland needs to include tax as well as matters concerned with spending."

Sir Iain said he hoped the report would "stimulate a rigorous debate on Scotland's international competitiveness and the contribution that competitive and fair taxes can make to improving Scotland's economy."

Analysis by Brian Taylor, BBC Scotland political editor

For now, Ruth Davidson says she agrees with the underlying thinking - that Scotland already faces disadvantages such as remoteness from big markets and should not add to those with higher tax. For detail, we will have to hold fire for now.

The Liberal Democrats will similarly set out their thinking although Willie Rennie has talked of the need to invest in education. The Greens say improved public services in Scotland cannot be funded without higher impositions, potentially affecting both income tax and council tax.

Labour has set out some early thinking, including a restored 50p upper rate for those earning more than £150,000 a year.

The SNP are looking at that but I hear one or two concerned questions behind the scenes. Would such a tax raise significant sums? What if, within a continuing UK, top earners registered elsewhere to sidestep the Scottish rate? What signal does it send about Scotland being open for business?

It is a conundrum for the SNP. As the governing party - and quite possibly the continuing governing party - they want nothing that jeopardises the economy of Scotland, particularly as future public services will be more dependent than ever on the buoyancy of that economy, given the new tax powers.

Equally, though, they want to match - more than match - the anti-austerity, pro-public services rhetoric of their Labour opponents.

Scottish Conservative leader Ruth Davidson said the party would examine the commission's recommendations before setting out its plans ahead of the election.

She added: "The commission's central recommendation is that the tax burden should be no higher in Scotland than in the rest of the UK, and lower when affordable - and I back that 100%.

"We need to show that Scotland is open for business, so I and my team will do everything we can to ensure that the SNP does not use the new tax powers to take more money from the paypackets of hardworking Scots."

The committee's other members were business journalist Bill Jamieson, former PwC tax partner Rhona Irving, former Scottish Enterprise chief Jack Perry, ex-Barr Ltd chairman Anthony Rush, economist Dr Andrew Lilico and former UK government special adviser Paul Sinclair.

Responding to the report, Scottish Lib Dem leader Willie Rennie said: "The Tories haven't really changed. They still favour tax cuts for the better off no matter what the consequences.

"Their plans on spending will have a devastating effect on education, the NHS, the police and other public services."

'Unfunded plan'

SNP MSP Kenneth Gibson said: "It is hugely hypocritical of the Tories to try to position themselves as being against tax rises - when the reality is they want to hike household bills by reintroducing taxes on the sick and on higher education, and a Tory council wants to hike council tax by an eye-watering 18%."

Scottish Labour reckoned the Tory plan was "unfunded and straight out of the 1980s".

MSP Jackie Baillie said: "With the SNP already planning half a billion pounds worth of cuts to local budgets for schools and childcare, these unfunded Tory plans will only pile on more cuts affecting our young people.

"The SNP and Labour are both committed to breaking Tory austerity, but only Scottish Labour has been bold enough to say what we would actually do differently. We would ask those earning more than £150,000 a year to pay a little bit more so we can invest in future generations"

- Published25 January 2016