Highest council tax bands 'to pay more' says Nicola Sturgeon

- Published

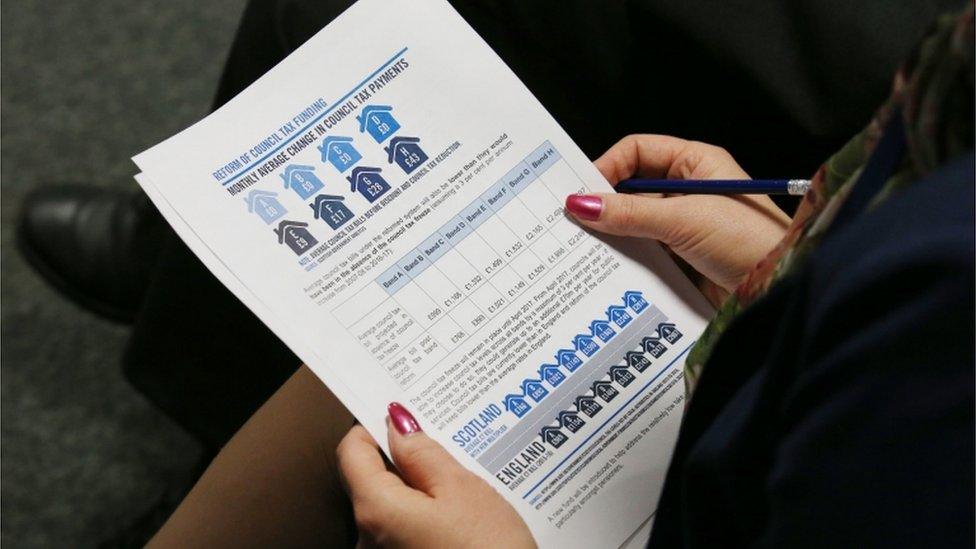

Ms Sturgeon unveiled the proposals at an event at Lasswade High School in Midlothian

People in Scotland's four highest council tax bands are to pay more under new Scottish government proposals.

The plans would see the average band E household pay about £2 per week more, and the average household in the highest band about £10 a week more.

First Minister Nicola Sturgeon said the move would raise £100m a year for education.

The council tax freeze will also end in 2017, with councils then able to increase the tax by up to 3% a year.

Ms Sturgeon said this would potentially allow local authorities to raise up to £70m to help fund local services across Scotland.

The 75% of Scottish households that live in bands A to D would be unaffected by the changes, which will be introduced if the SNP is re-elected in the Holyrood election on 5 May.

Opposition politicians - some of whom want the council tax to be scrapped altogether - have said the proposals do not go far enough, with Ms Sturgeon being accused of "tinkering round the edges" rather than delivering genuine reform.

They also said the first minister had reneged on SNP manifesto promises in 2007 and 2011 to abolish the council tax.

And local government body Cosla said it was "astounded" that the government had "missed an opportunity which could have had benefits for millions of people".

The average annual increase in council tax as a result of the band adjustments announced by Ms Sturgeon will be:

band E - £105

band F - £207

band G - £335

band H - £517

Ms Sturgeon said 54,000 households living in bands E to H on low incomes - more than one third of which are pensioner households - would be entitled to an exemption from the changes through the council tax reduction scheme.

The reforms would also provide additional support to families on low incomes across all council tax bands.

This would be by extending the relief available to households with children, which the Scottish government said would benefit 77,000 low income families by an average of £173 per year and support an estimated 140,000 children.

Council Tax Plans

A - D

No change for these tax bands

E - H

Will pay £2 to £10 more per week

-

£100m for education each year

-

54,000 people on low incomes in bands E to H will be exempt

-

3% increase in local taxes available to councils from 2017

Ms Sturgeon said the changes would ensure bills in every band were lower than they would have been had the freeze not been in place.

Across Scotland, average rates in all bands will remain lower than the average in England, she added.

Ms Sturgeon also said there were no plans for a revaluation of properties.

Scotland's 32 councils currently raise about 15p of every pound they spend from council tax, with many local authorities arguing the freeze that has been in place since 2007 was threatening jobs and local services.

'Balanced way'

Speaking at an event at Lasswade High School in Midlothian, Ms Sturgeon said the council tax reforms would "protect household incomes, support investment in our schools, make local taxation fairer and ensure local authorities continue to be properly funded while becoming more accountable".

She added: "The Commission on Local Tax Reform made clear that the present system could be made fairer. We are choosing to do this in a reasonable and balanced way that will also generate £100m of additional revenue to invest in schools.

"These reforms to council tax bands will mean no change for three out of every four Scottish households, with those in lower banded properties paying no more than they do now."

Analysis by Glenn Campbell, BBC Scotland political correspondent

There was a time when the SNP argued that council tax was not reformable. In 2007, they were elected to government promising to abolish it and replace it with a local income tax.

They went off that idea and opted instead for a nine year council tax freeze. If they win this year's Holyrood election, that freeze will end in 2017, but council tax rises will be capped at 3%.

The existing eight bands will be revised to make those in bands E-H pay a bit more. There'll also be extra help for those on low incomes.

Nicola Sturgeon says her proposals will make the council tax fairer. At the moment, those in the top band pay three times more than those in the bottom.

In future, those in the top band will pay nearer four times as much. It is a relatively modest proposal from a party that was once radical on local taxation.

There will also be a consultation on whether a fixed proportion of income tax receipts should be distributed to councils, and on whether councils should be able to levy a tax on vacant and derelict land.

The cross-party Commission on Local Tax Reform concluded in December that the current system was in need of change.

Ms Sturgeon had said that her plans would "build on the findings" of the commission's report.

But Cosla's finance spokesman, Kevin Keenan, said there was "nothing radical" in the first minister's announcement.

He added: "Unsurprisingly the only opportunity the government did take was to further control and centralise.

"For a government that has criticised the council tax system since coming into power in 2007 and then went to the trouble of setting up a commission to look at an alternative it is bizarre that this is the best that they could come up with."

The Scottish government proposals will be introduced if the SNP wins the forthcoming Scottish Parliament election

Scotland's other political parties are expected to set out their proposals for local taxation soon.

Scottish Labour accused Ms Sturgeon of breaking an SNP promise to abolish council tax.

The party's public services spokeswoman, Jackie Baillie, said: "The SNP promised to abolish council tax back in 2007 and attacked Labour's proposals to change the way banding worked, yet that is exactly what the SNP government has announced today.

"It has taken the SNP a decade to deliver tinkering round the edges rather than real reform."

Scottish Liberal Democrat leader Willie Rennie said the SNP could have put in place similar policies nine years ago, but had failed to act.

He added: "If they had acted sooner, they could have stopped the heartache and cuts in Scottish education.

"Half a generation of young people have missed out on skills and life chances because of the timid SNP."

Analysis by BBC Scotland political editor Brian Taylor

Perhaps they could compose a pipe tune. "The SNP's Retreat from Local Income Tax." Maybe they could play it at the Tattoo.

In truth, it has been a long, slow retreat. In 2007, the SNP manifesto was explicit. The "unfair" council tax would be scrapped, with a local income tax set at 3p.

By 2011, the approach was more nuanced. The SNP promised to "consult with others to produce a fairer system based on ability to pay to replace the council tax and we will put this to the people at the next election, by which time Scotland will have more powers over income tax."

Opponents, naturally, seize upon that word "replace" in describing today's announcement as a broken promise.

By no stretch, they argue, can Nicola Sturgeon's plan be said to "replace" council tax. Supporters of the SNP say the reforms will be "a fairer system based on ability to pay".

Scottish Conservative leader Ruth Davidson claimed the "hypocrisy" of the SNP was "incredible", and said Ms Sturgeon had adopted the recommendations made by a tax commission that was set up by the Tories, external.

She said: "It called for a reformed council tax, a more progressive multiplier, protection for low-income households and an end to the freeze but with a cap on any tax rises. All of these recommendations have been adopted by the SNP today."

Ms Davidson added: "After spending years flirting with a local income tax, calling the council tax 'hated' and making endless complaints about it, Nicola Sturgeon has now decided to keep the formula intact, but just put in a few tweaks."

The Scottish Greens also said the proposals outlined by the first minister did not go far enough, with the party's local government spokesman, Andy Wightman, saying council tax was "discredited and must be scrapped".

He added: "The Scottish government has endorsed a regressive tax structure in clear contradiction to their claims to want to be progressive with tax powers."

The Royal Institute of Chartered Surveyors (Rics) said Ms Sturgeon's announcement was a "missed opportunity to introduce a more progressive and fairer approach to local taxation of domestic properties in Scotland."

And the Unison union said it had "expected more than tinkering with the present system" and that the proposals "will not ensure that local government is properly funded, nor will it ensure a fair funding for local government."

Bob Fraser, senior property partner at estate agents Aberdein Considine, said the proposals would make it harder to sell homes at the top end of the property market, particularly in areas such as Aberdeen, Aberdeenshire and Edinburgh.

But he said there appeared to be "positive elements", such as the exemptions for some pensioners.

- Published14 December 2015

- Published23 November 2015

- Published21 August 2015

- Published7 August 2015

- Published30 June 2015