Scotland's economy: GERS figures shows deficit up as oil revenue falls

- Published

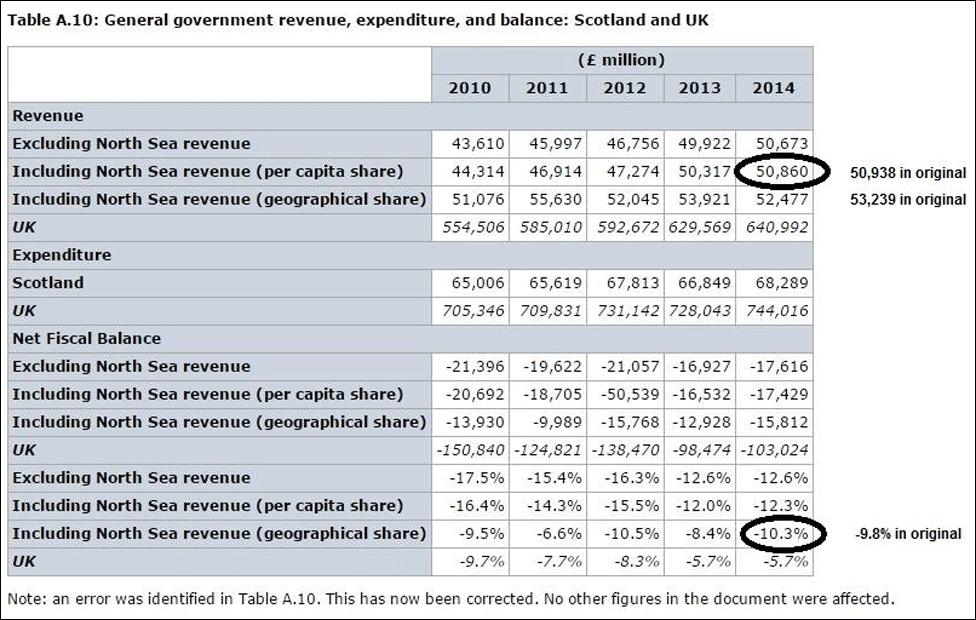

Latest Government Expenditure and Revenue Scotland figures show Scotland's public spending was almost £15bn more than its tax revenue

Scotland's public spending was almost £15bn more than its tax revenue in the last financial year, new figures show.

The amount spent per head was £1,400 per person higher than the UK figure, according to the Government Expenditure and Revenue Scotland (GERS) bulletin for 2014-15, external.

The deficit ran to almost 10% of Scotland's output - nearly double the level for the UK as a whole.

Ministers insisted the foundations of the Scottish economy remained strong.

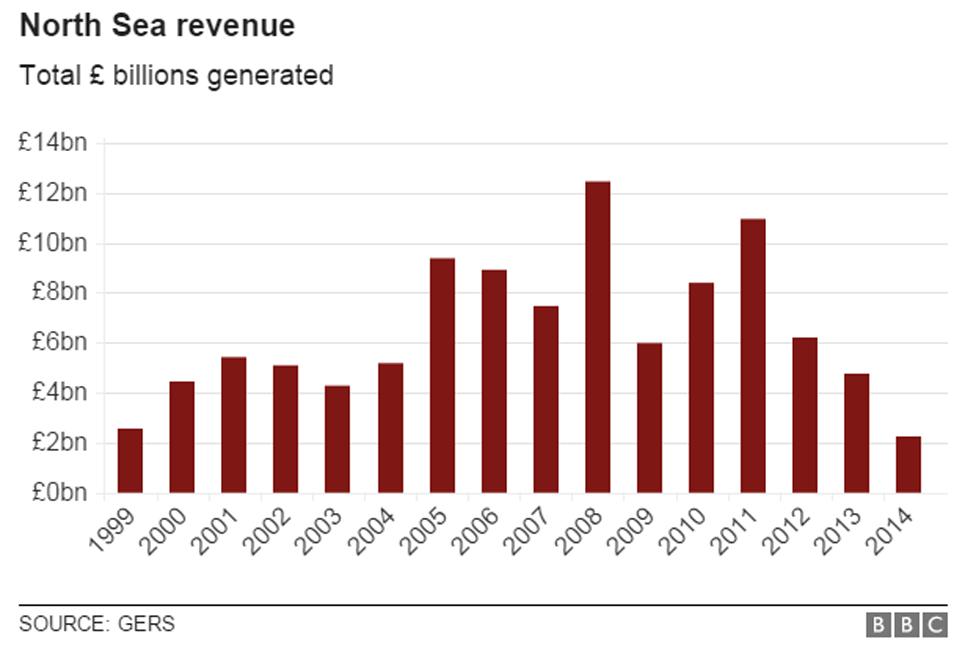

The figures reflect a sharp drop in the calculation of oil and gas tax revenues that might have been credited to Scottish government income.

First Minister Nicola Sturgeon said: "Taken in the context of the wider economic environment, which has been impacted by muted global demand, falling oil prices and more difficult conditions for manufacturers, the economy has remained resilient with record levels of employment, positive economic growth and growing exports.

"This shows the foundations of Scotland's economy are strong and that we have a strong base to build our future progress upon."

The Scotland Office Minister Andrew Dunlop said: "These figures show that Scotland is facing challenging economic times, in particular because of the drop in oil price, and demonstrate the value of the broad shoulders of the United Kingdom.

"The UK and Scottish governments both have a responsibility to work hard and support the Scottish economy in difficult global conditions, and that is exactly what we will continue to do."

Scotland's public expenditure in 2014-15

£68bn

Total expenditure

-

£11.5bn Health

-

£7.6bn Education and training

-

£2.8bn Policing

-

£2.7bn Transport

The annual GERS figures, which are produced by Scottish government economists, independently of ministers, also showed;

income from tax was £10,000 per person - that included a geographic share of oil revenue from around the Scottish coast. It represented 8.2% of revenue - slightly below the UK figure

and expenditure was £12,800 per person, or 9.3%. That was £1,400 per person more than the UK average.

The GERS figures are widely used to inform the debate about Scotland's potential for independence or for the full range of tax-raising powers.

They looked much more positive when oil and gas tax revenue was in the billions. But with the fall in the price of oil and gas, as well as high levels of investment, producer profits have plummeted, and taxes with them.

Excluding North Sea revenue, the deficit ran to £16.7bn, or 11.9% of Gross Domestic Product (GDP), which is the key measure of total economic output.

Including a geographic share of offshore tax revenue, the 2014-15 deficit was £14.9bn, or 9.7% of GDP.

For the UK, the equivalent measure was a deficit of £89bn. That was 4.9% of GDP.

ANALYSIS: How big should a deficit be?

In an economy that's growing fast, and sustainably so, governments can afford a bigger deficit.

As an indicator, the eurozone - which the UK is not a part of - says government deficits should be no more than 3% of GDP.

Several eurozone countries have driven a coach and horses through that 3% rule.

So has the UK which is running a deficit of 4.9%.

If you home in on Scotland its deficit for 2014-15 was 9.7%.

In actual money spent, Scottish revenue including a share of oil and gas tax was £53.4bn, while expenditure on all aspects of government activity in Scotland, both devolved and reserved, ran to £68.4bn.

The scale of the deficit looks less daunting when capital expenditure is removed. That is sometimes done to measure spending without the investment element that provides longer-term returns.

On that measure, the current spending deficit for 2014-15 was £11.9bn, according to GERS - or 7.8% of GDP, compared with a UK figure of 3.3%.

As a benchmark of a sustainable level of deficit, the rules for eurozone membership require deficits to be no more than 3% of GDP.

Mistake made in report

On Wednesday afternoon the Scottish government admitted it got a key figure wrong in its GERS report.

It explained that the online document was updated to rectify an overstatement of oil revenues in one calculation which had been designed for international comparison.

This change does not affect the over totals.

GERS: Extracts from Table E.2 (figures rounded to the nearest £100). The numbers listed refer to the difference compared with the rest of the UK.

How have opposition parties reacted?

Kezia Dugdale, Murdo Fraser, Willie Rennie and Patrick Harvie reacted to the GERS report

Kezia Dugdale, Scottish Labour leader, said the figures showed "the devastating impact" that leaving the UK would have had on Scotland's finances. She added: "The fact that the cuts that would have been needed after separation would have been five times more than those being imposed now by George Osborne gives a sense of the impact on our schools and hospitals. People were misled by the SNP in the run-up to the referendum and that is unforgivable."

Murdo Fraser, finance spokesman, for the Scottish Conservatives said: "These figures today illustrate the impact of the falling oil price on Scotland's balance sheet. They also shed new light on the SNP's deception before the referendum. During that referendum debate, the SNP was warned repeatedly by us that they were over-estimating the future value of oil. But instead, Nicola Sturgeon and others cited the good years to claim we would all be £500 better off, and wilfully ignored the bad years because it didn't fit with their plan."

Willie Rennie, Scottish Liberal Democrat leader, said Ms Sturgeons economic credibility had been "smashed to smithereens" by the figures. This is not good news for Scotland. These devastating GERS figures call into question her judgement on the nation's finances and the oil industry which are two critically important responsibilities for any Scottish first minister. Of course she was wildly optimistic on her projections for income from North Sea oil. Yet her fatal error of judgement was recommending that Scotland should be independent even though its finances would be based on such a volatile and unpredictable source of income."

Patrick Harvie, Scottish Greens co-convenor said: "These figures prove that Scotland is in urgent need of a bold transition plan that will secure high-quality jobs and energy production in the face of North Sea oil industry decline. Our economy and workforce have the potential to make huge gains in industries like decommissioning, food production and renewables - but we simply cannot afford to wait around timidly while more jobs are lost in the oil industry. Scotland needs bold investment and industrial policy that will make us a leader in the industries of the future."

- Published9 March 2016

- Published9 March 2016

- Published7 March 2016

- Published2 March 2016