SNP will not adopt UK Chancellor's 40p tax threshold change

- Published

Wider powers over income tax will be handed to the Scottish Parliament next year

The SNP said it would not adopt UK government plans to raise the starting point at which workers in Scotland pay the 40p tax rate.

Leader Nicola Sturgeon, who is also the country's first minister, believed the move was wrong.

However, she said that if her party won the 5 May election then "no taxpayer" would see their income tax bill rise.

In April 2017, Holyrood will receive new powers to set bands and rates which apply to Scotland alone.

That will allow the Scottish government not to follow Chancellor George Osborne's plans, announced in his Budget last week, to increase the threshold for 40p tax payers to £45,000 next year.

Ms Sturgeon made clear that although she was rejecting the UK government's plan, the 40p threshold would still rise by the CPI inflation rate, taking it from £43,000 to £43,387.

She said: "That increase will prevent higher rate taxpayers from receiving a real terms cut in their tax bills, but nor will they see their bills increase."

In addition, the SNP is not proposing to increase the additional rate - for those earning £150,000 or more - from its current 45p level.

Scotland's 40p tax payers

372,000

Approximate total number

10%

Working population

-

£190m Value of 40p tax cut plan

-

14,000 Workers removed if cut adopted in Scotland

Who pays 45p income tax?

332,000

Approximate total for the UK

17,000

Approximate total for Scotland

The party's plan also includes:

freezing the basic rate of tax for the duration of the next parliament

setting a zero tax rate rate which will ensure that, by 2021/22 no one pays tax on the first £12,750 of their income

no planned increases to the basic (20p), higher (40p) or additional rate (45p)

the exact level of the higher rate threshold will be set out each year by the Scottish government

Ms Sturgeon said she believed the approach "balanced the need to invest in and support our public services".

She added: "By adopting a different path to the UK government we could generate more than £1bn of additional revenues, enabling us to protect the public services we all rely on. We believe that this proposal is reasonable, it is balanced and it is fair."

ANALYSIS

By BBC Scotland's business and economy editor Douglas Fraser

One perhaps confusing element of these tax plans which might need explanation is the starting threshold for basic rate tax. George Osborne aims to put that up from £11,000 to £12,500 by 2020.

Nicola Sturgeon says she wants to put it up to £12,750 by the following year.

But it is a threshold controlled by Westminster. It's still "reserved". How can the SNP, Labour or anyone else claim to be able to set it at Holyrood?

The answer seems to be a zero rate band. That is, if the Chancellor at Westminster has a starting level at £12,500, and the Holyrood administration wants a higher starting level, it could set the first, say, £250 of tax at a zero rate, and nothing is paid on it.

Similarly, food, newspapers and children's clothes are brought within the VAT net, but they are zero rated for it.

However, as such a move on income tax might appear to challenge the spirit, if not the letter, of the Scotland Act, it could be open to challenge. No doubt some MSPs, and lawyers, would quite like that.

What are the other main Scottish parties saying?

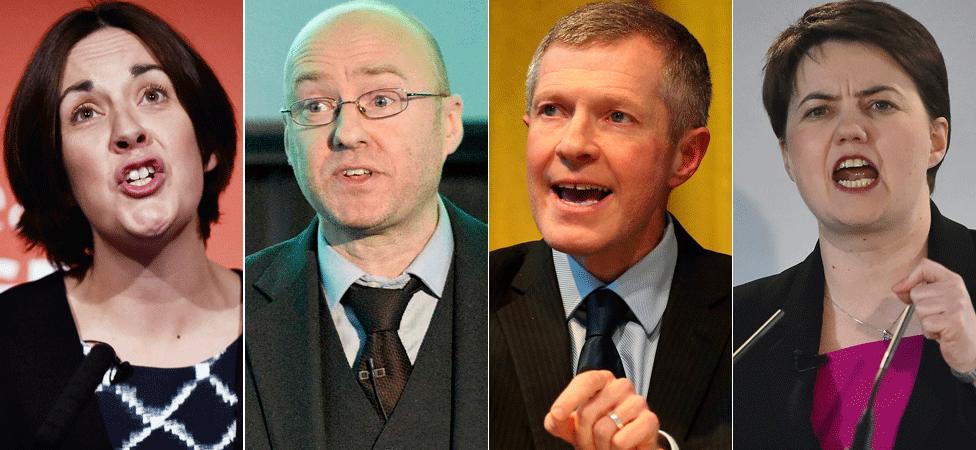

Kezia Dugdale (Scottish Labour); Patrick Harvie (Scottish Greens); Willie Rennie (Scottish Lib Dems) and Ruth Davidson (Scottish Conservatives)

Scottish Labour - Leader Kezia Dugdale said: "Nicola Sturgeon had the chance to be bold, but instead what's clear is that the SNP will make no significant changes to income tax. A year ago, the SNP said they would support a 50p tax rate on people earning more than £150,000 a year - the top 1% of earners. Even on this change - which would see the most well off bear more of the burden - the SNP have bottled it." (Against the 40p threshold change.)

Scottish Conservatives - Leader Ruth Davidson: "Nicola Sturgeon has confirmed today that she wants to make Scotland the highest taxed part of the UK. In the last five years alone, 140,000 Scots have been dragged into paying the higher rate of income tax, including public sector servants such as nurses, teachers and policemen and women. Nicola Sturgeon could have chosen to support them today but instead she has decided not to. That is bad for the Scottish economy and bad for Scottish jobs." (For the 40p threshold change.)

Scottish Greens - Co-convenor Patrick Harvie said: "In the independence referendum, and in the Smith Commission, the Scottish Greens argued alongside Nicola Sturgeon and John Swinney that Scotland needed the power to build a fairer, more equal society and an economy that protects our vital public services and invests in our young people's future. To finally win these powers and then not use them is extraordinary." (Against the 40p threshold change.)

Scottish Lib Dems - Leader Willie Rennie said: "The SNP's proposals are pathetically timid. This plan raises no extra money, not a single pound more, for public services desperately in need of investment. This is a missed opportunity; the SNP are refusing to use the full set of new tax powers coming to us at Holyrood. The Liberal Democrats' penny on income tax for education would make a transformational investment in education. £475m a year for nurseries, schools and colleges." (Against the 40p threshold change. )

What's happening with Scotland's taxes?

April 2016

of the 20p now being paid from £1 of basic rate income, 10p of that is going to be levied by the Scottish Parliament

and that 10p amount could be varied up or down

however, Holyrood has voted not to vary the figures for the 2016/17 tax year

April 2017

under the Scotland Bill proposals, Holyrood would receive the power to alter income tax rates and bands

this would allow the Scottish government to create new tax bands

it would also be able to raise the rate of tax paid by higher earners without also raising it for lower-paid workers

in addition Holyrood will be given half the share of the country's VAT receipts

and control over Air Passenger Duty at Scottish airports would be handed to the Edinburgh parliament

- Published22 March 2016

- Published2 February 2016