Holyrood 2016: The tax battle lines

- Published

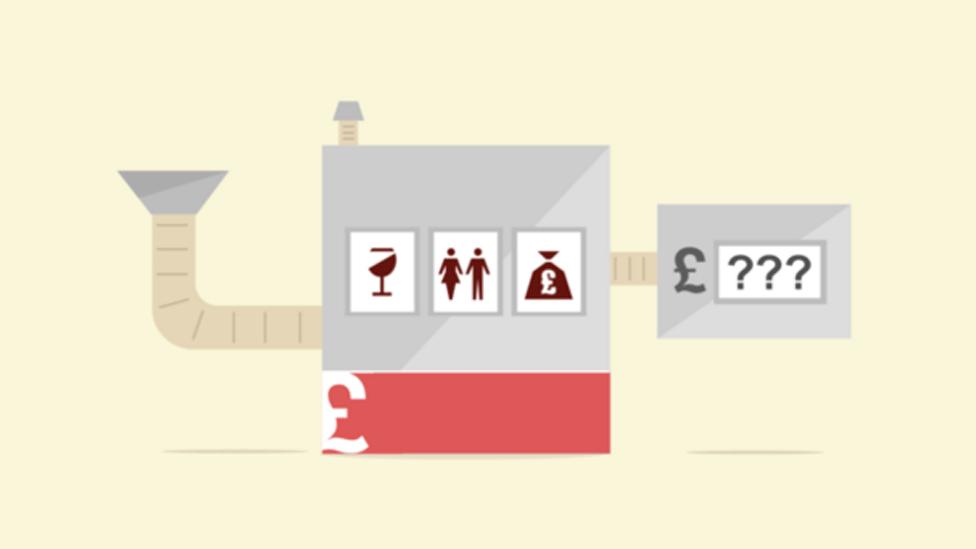

Scotland's political parties are setting out their approach to using new tax powers

Now we know the more important tax choices being set out by political leaders ahead of the Holyrood election.

Nicola Sturgeon and John Swinney have long argued that they need the levers of power at Holyrood. And having got powers over income tax, it seems they're barely going to touch them.

Council tax goes reformed - a bit, but not that much.

The SNP leaders' calculation appears to be a safety-first, cautious appeal to the part of the electorate that pays taxes, as well as those looking to the state for public services.

From the SNP's position of electoral and polling strength, some - such as the Scottish Trades Union Congress - argue there's no better time to be courageous.

Is doing nothing a sign of courage?

The brothers and sisters of the STUC argue that the SNP should follow through on its rhetoric, and do some serious re-distribution through the income tax system. If there's no courage now, they ask, then will we ever see some?

But perhaps that position of leadership strength is the time to be just as courageous in choosing not to do much. That's also a choice, and one that could mean standing up to the party membership.

Nicola Sturgeon addressed party members at their spring conference in Glasgow

The SNP conference was offered up the red meat of a renewed campaign for independence, starting this summer.

But it came with at least one sting in the tail - that the case for independence is going to have to be re-worked, because quite a lot of it didn't convince voters. (And the oil-dependent bit of it certainly won't in future.)

Half billion gap

The second sting is that winning the election requires further compromise with the electorate.

We're being told from all sides that this election is going to be a landmark one, shifting Holyrood from arguments over the distribution of a spending budget, to decisions about how to raise tax.

And as the Institute for Fiscal Studies has just set out in some detail, political leaders should be very cautious about tax increases that could hamper economic growth.

Improving growth in Scotland is a key aim of the future

With lower growth than the UK, there would soon be a lot less tax revenue than Holyrood would have had under the block grant system that's being replaced.

In other words - get Scotland's growth rate a bit wrong, and you'll have to explain to the electorate in five years time why there appears to be a half billion pound gap in Holyrood's takings.

So the Sturgeon-Swinney combo, astride the centre left and centre right aisles of the SNP's very broad church, have opted for a tax policy that risks the minimum amount of harm, by having the minimum difference with Westminster.

It has a modest progressive element. It eschews George Osborne's tax cut for higher earners in which he is raising the 40% threshold faster than inflation.

And it's pragmatic. Though it may be tempting to raise the 45% rate of tax on those earning more than £150,000, that is a choice that would be more symbolic than useful in raising revenue, and it stands a reasonable chance of backfiring.

The evidence is sketchy, but there's a significant risk of the highest earners taking their pay elsewhere, and that the signal of Scotland becoming a high tax regime would put off those with the potential for inbound investment.

Budget 2016 - What it means for you

Labour is using that highest rate decision to portray the SNP as too chummy with the highest paid 17,000 people in the country.

It is also pushing the case for using these much-hyped levers of power to raise basic rate tax by 1 penny in the pound. Likewise Liberal Democrats.

And Labour's Kezia Dugdale has just announced a property-based replacement for council tax that is, again, redistributive - skewing bills towards those in the more valuable houses.

When she says 80% of people will be no worse off, you can be sure she ain't pitching for the votes of the other 20%.

Tax investigators

Tories are, and they "aspire" to cut such tax rates. But the inside intell is that focus groups heard the words "Tory cuts" and associated them with austerity.

So for this manifesto at least, Conservative tax reductions look set to remain merely "aspirational".

On the more radically redistributive end of things, the left alliance known as RISE also wants to differentiate itself; the top 10% of earners paying 45% tax, with a 60% tax on earnings over £150,000.

And if you think you can hire a smart accountant to keep your earnings from the clutches of a RISE administration at Holyrood, be warned - they plan a shakedown squadron of crack tax investigators to go after elite evaders.

Where do Scotland's political parties stand on tax?

SNP - Against the 40p threshold change

Scottish Labour - Against the 40p threshold change

Scottish Lib Dems - Against the 40p threshold change

Scottish Conservatives - For the 40p threshold change

Scottish Greens - Against the 40p threshold change

One perhaps confusing element of these tax plans which might need explanation is the starting threshold for basic rate tax. George Osborne aims to put that up from £11,000 to £12,500 by 2020.

Nicola Sturgeon says she wants to put it up to £12,750 by the following year.

But it is a threshold controlled by Westminster. It's still "reserved". How can the SNP, Labour or anyone else claim to be able to set it at Holyrood?

The answer seems to be a zero rate band. That is, if the Chancellor at Westminster has a starting level at £12,500, and the Holyrood administration wants a higher starting level, it could set the first, say, £250 of tax at a zero rate, and nothing is paid on it.

Similarly, food, newspapers and children's clothes are brought within the VAT net, but they are zero rated for it.

However, as such a move on income tax might appear to challenge the spirit, if not the letter, of the Scotland Act, it could be open to challenge. No doubt some MSPs, and lawyers, would quite like that.

How does the tax question set battle lines for the Holyrood campaign?

Party leaders - Kezia Dugdale (Labour); Ruth Davidson (Scottish Conservatives) and Nicola Sturgeon (SNP)

It appears to leave the SNP as broadly camped across the middle ground of Scottish politics as it could ever wish to be.

Its polling position, its leader's standing, and the absence of much internal dissent, mean that it can almost certainly live until early May's election with the tensions and inconsistencies of talking radical and redistributive on one hand, while acting safely centrist on the other.

Labour's Kezia Dugdale can claim to have a more consistent position of wishing to use these new powers to re-distribute and protect public services.

And perhaps she will succeed. But the pitch Labour is making looks like one aimed at its traditional core - a narrower appeal to a chunk of the more radical left. That's in the hope it can be peeled away from its recent adherence to the SNP.

Narrowly-focussed or broadly-based, if this election campaign is to move Scottish politics towards a grown-up argument over the best balance of taxation and spending, we now have a spread of ideas and choices.

We'll hear much more about them when my colleague, Glenn Campbell, starts a six-way leaders' televised debate on Thursday evening.

But there is a risk in this fifth Scottish Parliament campaign, and not one you might have predicted. It is that the taxation choices draw so much attention that questions of priorities for spending are overlooked, along with the challenge to spend that scarce, hard-won cash more effectively.